The EU said that the Eurozone's soft landing is on track, inflation is falling faster than previously expected, and predicts 0.8% GDP growth in 2024.

Data released by Eurostat on Wednesday showed that after entering a slight recession in the second half of 2023, Eurozone GDP both grew month-on-month in the first quarter, and even the German economy, which had been lagging behind for a long time, exceeded expectations.

Meanwhile, the European Commission said in a report that the Eurozone's soft landing is on the right track, inflation is falling faster than previously anticipated, and economic growth will accelerate next year.

2024 started well, with GDP growing in the first quarter compared to the same period

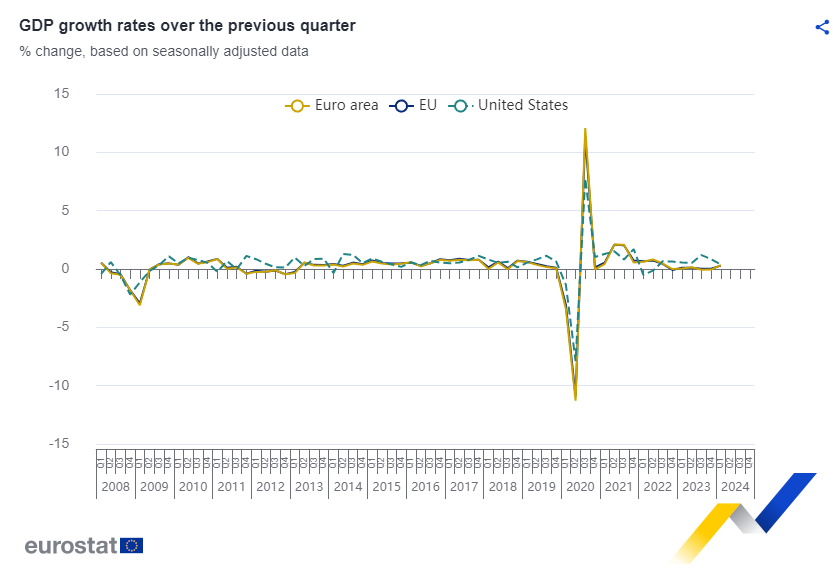

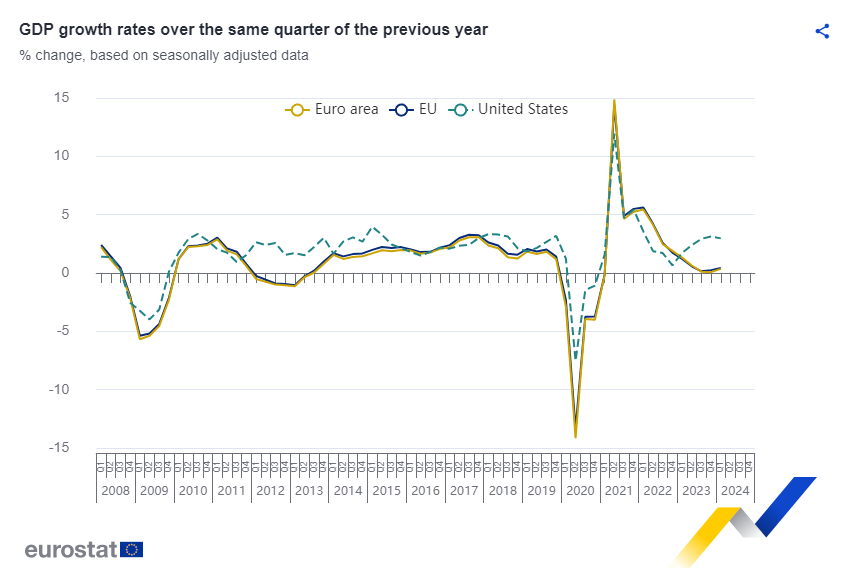

According to revised data released by Eurostat on Wednesday, in the first quarter of 2024, the Eurozone and the EU's seasonally adjusted GDP grew 0.3% month-on-month, better than previously anticipated, and the economy showed a recovery trend. Eurozone GDP fell 0.1% in the fourth quarter of 2023, and the EU remained stable.

On a year-on-year basis, both the Eurozone and the EU's seasonally adjusted GDP grew by 0.4% in the first quarter of 2024, which was also better than expected, and was significantly faster than 0.1% and 0.2% in the previous quarter.

Among the major economies in the Eurozone, the German economy is still shrinking. GDP fell 0.2% month-on-month in the first quarter, but did not expand and was better than expected; the French economy recovered at an accelerated pace, and the GDP growth rate in the first quarter rose to 1.1% from 0.8% of the previous value; Spain and Italy's GDP growth rate in the first quarter was 2.4% and 0.6% month-on-month.

The data also showed that employment continued to recover slowly. The number of employed people in the Eurozone increased 0.3% month-on-month in the first quarter of 2024, and the number of employed people in the EU increased 0.2% month-on-month.

Compared with the same period last year, employment in the Eurozone increased 1.0% year on year in the first quarter of 2024, and employment in the EU increased 0.7% year on year. In the third quarter of last year, employment in the Eurozone increased 1.2% year on year, and the EU increased 1.0% year on year.

After the data was released, the euro rose slightly against the US dollar.

At a time when inflation is falling steadily, the ECB is expected to start a cycle of cutting interest rates in June and will continue to cut interest rates in the second half of the year. The market anticipates that interest rates will be cut three times during the year.

ECB President Lagarde told the media last month that the ECB is still on the right track to cut interest rates in the near future. Inflation is slowing down as expected. If there is no major impact, the ECB will cut interest rates soon.

Is a soft landing on the right track? The deficit continues to widen

The European Commission predicts that Eurozone GDP will grow by 0.8% this year and 1.4% in 2025, with little change compared to the last set of forecasts three months ago; inflation expectations for this year and next were lowered to 2.5% and 2.1% from 2.7% and 2.2% previously.

European Economic Commissioner Paolo Gentiloni said in a statement:

We expect growth to gradually accelerate this year and next, as private consumption is supported by falling inflation, a recovery in purchasing power, and continued growth in employment.

However, he warned:

Public debt will rise slightly next year, requiring fiscal consolidation while protecting investment.

According to the EU's latest forecast, the total Eurozone budget deficit for 2024 and 2025 is 3% and 2.8%, respectively, higher than the 2.8% and 2.7% forecasts previously forecast. France and Italy are currently facing larger deficits, while Germany and Spain are expected to have smaller gaps.

The Commission said that lower borrowing costs would stimulate investment activity while reducing consumers' motivation to save and boosting consumption. The report said that by 2025, the average real wage in the EU will fully return to the level of 2021.

The Commission also said that, over time, the improvement in global commodity trade prospects should support the EU's external demand for goods, thereby helping to boost Europe's weak manufacturing prospects.