Whales with a lot of money to spend have taken a noticeably bearish stance on Abbott Laboratories.

Looking at options history for Abbott Laboratories (NYSE:ABT) we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 27% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of $532,166 and 5, calls, for a total amount of $268,980.

From the overall spotted trades, 6 are puts, for a total amount of $532,166 and 5, calls, for a total amount of $268,980.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $95.0 and $130.0 for Abbott Laboratories, spanning the last three months.

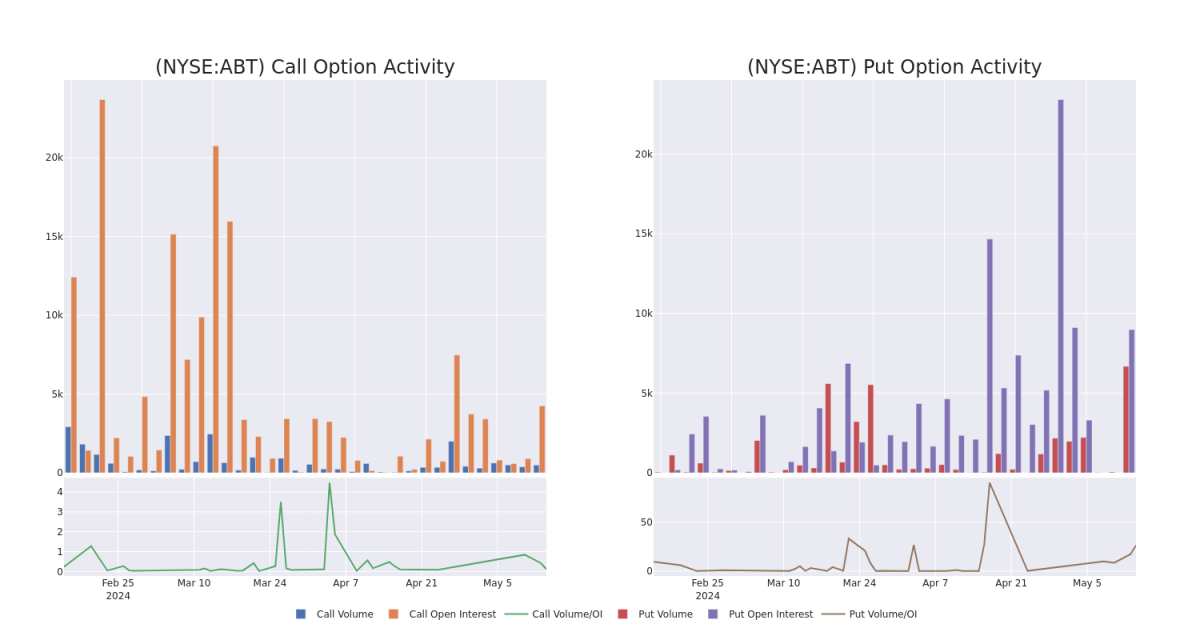

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Abbott Laboratories's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Abbott Laboratories's whale activity within a strike price range from $95.0 to $130.0 in the last 30 days.

Abbott Laboratories Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABT | PUT | TRADE | BEARISH | 05/17/24 | $0.79 | $0.54 | $0.7 | $105.00 | $255.5K | 8.0K | 5.0K |

| ABT | PUT | TRADE | BEARISH | 08/16/24 | $20.95 | $20.1 | $20.76 | $125.00 | $105.8K | 3 | 51 |

| ABT | CALL | SWEEP | BEARISH | 09/20/24 | $5.4 | $5.3 | $5.3 | $105.00 | $71.5K | 293 | 1 |

| ABT | PUT | SWEEP | BULLISH | 05/17/24 | $1.01 | $0.75 | $0.75 | $105.00 | $63.3K | 8.0K | 11 |

| ABT | CALL | TRADE | BEARISH | 01/17/25 | $3.4 | $3.3 | $3.3 | $115.00 | $61.3K | 3.6K | 200 |

About Abbott Laboratories

Abbott manufactures and markets cardiovascular and diabetes devices, adult and pediatric nutritional products, diagnostic equipment and testing kits, and branded generic drugs. Products include pacemakers, implantable cardioverter defibrillators, neuromodulation devices, coronary stents, catheters, infant formula, nutritional liquids for adults, continuous glucose monitors, and immunoassays and point-of-care diagnostic equipment. Abbott derives approximately 60% of sales outside the United States.

In light of the recent options history for Abbott Laboratories, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Abbott Laboratories

- With a trading volume of 2,794,055, the price of ABT is down by -1.25%, reaching $103.46.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 65 days from now.

What The Experts Say On Abbott Laboratories

2 market experts have recently issued ratings for this stock, with a consensus target price of $132.5.

- An analyst from RBC Capital has decided to maintain their Outperform rating on Abbott Laboratories, which currently sits at a price target of $125.

- An analyst from Barclays has decided to maintain their Overweight rating on Abbott Laboratories, which currently sits at a price target of $140.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abbott Laboratories options trades with real-time alerts from Benzinga Pro.