Whether job vacancies are declining or private sector wage growth is slowing, there is plenty of evidence that the UK job market is cooling down.

The UK job market is cooling, which is gradually translating into lower wage growth. This is the main conclusion drawn from the latest UK labour market data, and is generally consistent with the message issued by the Bank of England last week.

It's worth noting from the outset that overall employment data — employment, unemployment, and inactivity — is still considered quite unreliable as the survey response rate continues to decline. The unemployment rate rose to 4.3%, but it's hard to say how much (probably not much) we should pay attention to this issue.

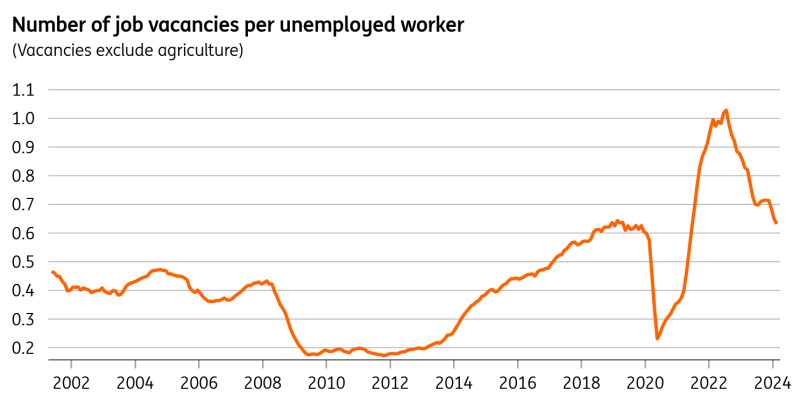

But this information was echoed elsewhere in the report. Job vacancies have declined further, and if we take a look at the ratio of these job vacancies to the number of unemployed people, now it's not much different from the 2019 average. If we use official payroll data to measure another employment indicator, then employment data has remained flat or even declined slightly so far this year.

The ratio of job vacancies to unemployment rates has returned to pre-pandemic levels

(Image credit: ING)

This easing seems to have indeed led to some gradual decline in wage growth. Admittedly, this month's overall regular pay target is slightly higher than the general consensus, but this appears to be the reason for the public sector. The Bank of England has stated that the public sector is less important to current monetary policy decisions. Wages in the private sector fell to 5.9% from 8.4% last summer.

Even here, there are concerns about reliability. After one-time living expenses were erroneously factored into permanent wage increases, wage growth in 2023 appears to have been artificially boosted. These subsidies did not reappear this winter, and now it appears that this may be exaggerating the decline in wage growth. Although the compensation data did not show a decrease in the sample size, it ended up showing the average level of workers, so questions in the labor force survey may indirectly inject some additional variability.

For these reasons, the Bank of England tells us that it is putting less emphasis on wage growth now compared to a few months ago. This means that next week's service sector inflation data will be the single most important determinant of whether the Bank of England will cut interest rates in June.On an annual basis, services CPI will fall, but we think the risk is that this decline will be slightly lower than the Bank of England's expectations. If we're right, then August is a better starting date for interest rate cuts than June. But to be honest, we think the current situation is 5 or 5.