Deep-pocketed investors have adopted a bearish approach towards Marathon Petroleum (NYSE:MPC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MPC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Marathon Petroleum. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 12% leaning bullish and 87% bearish. Among these notable options, 5 are puts, totaling $277,850, and 3 are calls, amounting to $212,252.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $220.0 for Marathon Petroleum over the last 3 months.

Volume & Open Interest Trends

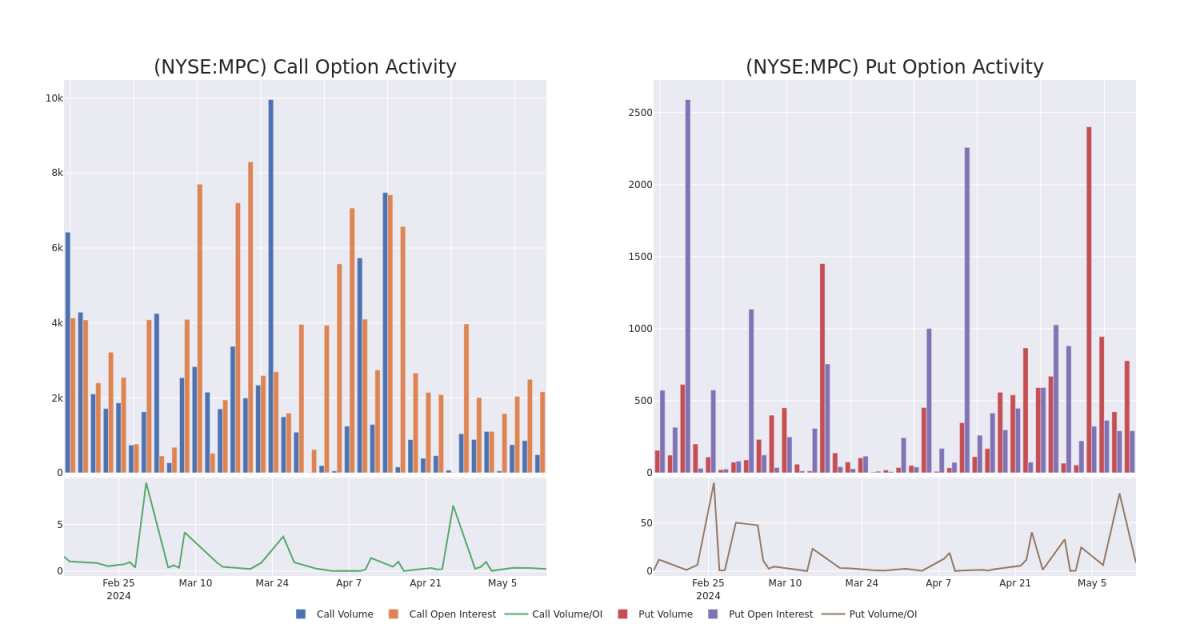

In today's trading context, the average open interest for options of Marathon Petroleum stands at 490.8, with a total volume reaching 1,262.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Marathon Petroleum, situated within the strike price corridor from $150.0 to $220.0, throughout the last 30 days.

Marathon Petroleum Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MPC | CALL | SWEEP | BEARISH | 06/21/24 | $3.0 | $2.99 | $2.99 | $185.00 | $95.7K | 862 | 339 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $12.1 | $11.8 | $12.1 | $160.00 | $67.7K | 87 | 73 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $12.1 | $11.9 | $12.1 | $160.00 | $61.7K | 87 | 164 |

| MPC | CALL | TRADE | BEARISH | 01/17/25 | $18.3 | $18.1 | $18.1 | $180.00 | $61.5K | 713 | 45 |

| MPC | PUT | SWEEP | BEARISH | 06/20/25 | $12.15 | $11.9 | $12.1 | $160.00 | $56.8K | 87 | 264 |

About Marathon Petroleum

Marathon Petroleum is an independent refiner with 13 refineries in the midcontinent, West Coast, and Gulf Coast of the United States with total throughput capacity of 3.0 million barrels per day. Its Dickinson, North Dakota, facility produces 184 million gallons a year of renewable diesel. Its Martinez, California, facility will have the ability to produce 730 million gallons a year of renewable diesel once converted. The firm also owns and operates midstream assets primarily through its listed master limited partnership, MPLX.

Present Market Standing of Marathon Petroleum

- With a trading volume of 1,670,758, the price of MPC is down by -0.98%, reaching $177.8.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 78 days from now.

What Analysts Are Saying About Marathon Petroleum

3 market experts have recently issued ratings for this stock, with a consensus target price of $199.33333333333334.

- Maintaining their stance, an analyst from Mizuho continues to hold a Neutral rating for Marathon Petroleum, targeting a price of $203.

- An analyst from Mizuho has decided to maintain their Neutral rating on Marathon Petroleum, which currently sits at a price target of $200.

- An analyst from Barclays has decided to maintain their Overweight rating on Marathon Petroleum, which currently sits at a price target of $195.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Marathon Petroleum with Benzinga Pro for real-time alerts.