People's 1-year inflation expectations are 3.3%, the highest since November last year, and hovered around 3% for the previous four months; expectations for longer-term inflation and housing price increases have also risen. At the same time, those surveyed had no confidence in their ability to find a new job after losing their current job, which fell to its lowest level in three years. The proportion of consumers unable to pay their minimum debt over the next three months is expected to reach its highest level since COVID-19.

According to a survey report released by the New York Federal Reserve on Monday, American consumers' expectations for inflation and housing price increases rose in April, while at the same time, their views on the labor market deteriorated, highlighting the troubling situation in terms of US household finances and living costs.

Specifically, consumers expect:

- The price level will rise at an annualized rate of 3.3% over the next year, which is the highest reading since November last year. In the four months before the April survey data was released, consumers' inflation expectations hovered around 3%.

- The three-year inflation forecast fell to 2.8%, compared to 2.9% before March.

- The five-year inflation forecast rose to 2.8%, compared to 2.6% before March.

- Expectations for the rate of increase in housing prices hit the highest rate since July 2022, at 3.3%. Previously, for seven consecutive months, this forecast was in the 3.0% line.

Prior to the release of the consumer inflation expectations mentioned above, a series of reports were published, mostly showing that US inflation is sticky and housing prices continue to rise. This week, the US will release a major inflation data for April. The market generally expects that the latest data will show that the US CPI and PPI are still rising at a steady pace, and housing has always been a factor driving up inflation.

The New York Federal Reserve's latest survey is similar to the University of Michigan consumer survey released last Friday. According to the Michigan report, the initial 1-year inflation forecast for consumers in May was 3.5%, the highest level in six months. It was significantly higher than the 3.2% forecast, which was 3.2% before April; the initial value of the 5-year inflation forecast was 3.1%, which is also higher than the forecast of 3%, and the value before April was 3%.

According to the New York Federal Reserve survey, consumers also expect the prices of gasoline, food, medical care, college education, and rent to rise more rapidly.

At the same time, perceptions of the labor market have worsened, expectations of income growth have declined, and the possibility of rising unemployment is increasing. The interviewees were also less confident about their ability to find a new job after losing their current job, which fell to its lowest level in three years.

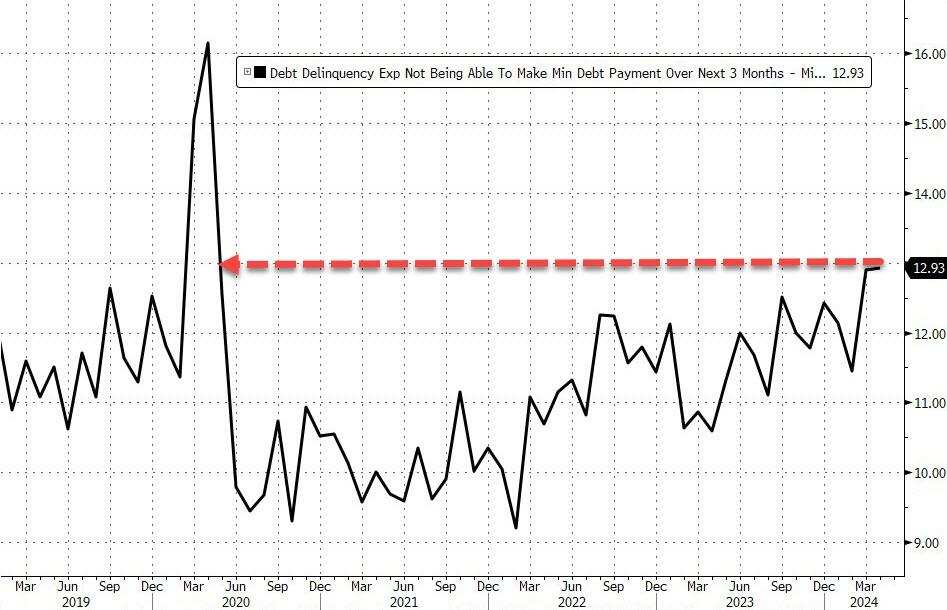

This situation has had an impact on American household finances. The proportion of consumers who are unable to pay their minimum debt over the next three months is expected to reach its highest level since the COVID-19 pandemic began.

The US inflation forecast surveyed by the Federal Reserve rose. After the data was released, the price of gold and US bonds declined in the short term:

- Spot gold fell by about $10 in the short term, and the overall decline during the day extended to about 1%, reaching as low as $2334.06 on the new day.

- The yield on US 10-year Treasury bonds rose more than 1 basis point in the short term, approaching 4.485%, narrowing the overall decline during the day to less than 1.6 basis points. Before the opening of the market, US stocks fell to a daily low of 4.457%. The two-year US Treasury yield rose by about 1 basis point in the short term, approaching 4.85%. The overall decline during the day narrowed to 1.7 basis points, and US stocks also fell to a daily low of 4.8232% before the market.

Many Federal Reserve officials said they would like to see more evidence that US inflation is continuing to move towards the Fed's 2% target before cutting interest rates. Even hawkish officials, such as Federal Reserve Governor Bowman, said on Friday that she sees no reason to cut interest rates this year. The current futures market shows that investors expect the Federal Reserve to cut interest rates once or twice before the end of the year.