During the European session on Monday (May 13), the US dollar index turned down intraday to 105.1287, or 0.19%. The following is a technical analysis of the three currency pairs EUR/USD, GBP/USD, and AUD/USD.

EUR/USD

(EUR/USD daily chart source: eHuitong)

At last week's meeting, the Federal Reserve showed a more moderate stance than expected, as Chairman Powell made it clear that it would not raise interest rates and hinted that they are still inclined to cut interest rates. Traders will be watching the US CPI data for April, which will be released on Wednesday. According to the S&P Global Purchasing Managers' Index (S&P Global PMI), output price growth was strong in April, but it was slower than in March.

EUR/USD is hovering around the 50-day and 200-day moving averages and the medium-term downtrend line. If the price successfully breaks above levels, then it may challenge the 1.0814 resistance before the 1.0880 resistance level. If the market continues to rise, the pair could hit the 1.0940 resistance level. Conversely, the pullback could push the market down to the 20-day moving average of 1.0770 and then to 1.0647. Technical oscillators indicate a possible upward pullback.

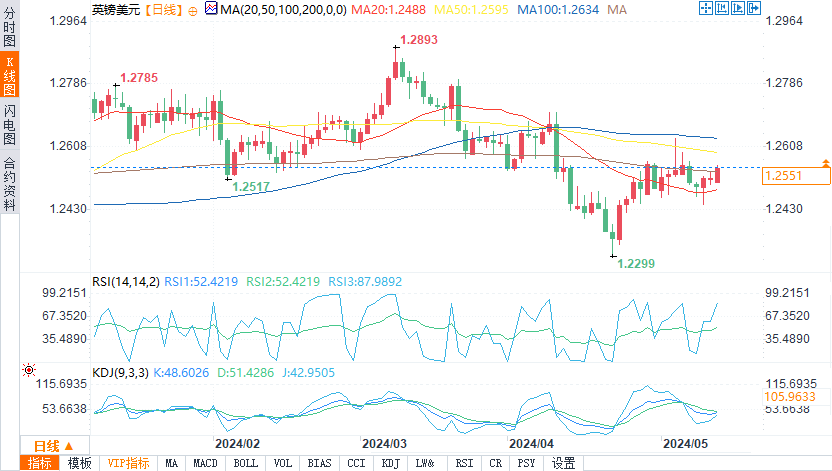

GBP/USD

(GBP/USD daily chart source: eHuitong)

On Tuesday, the UK will release employment data for March, and the unemployment rate is expected to rise to 4.3% from 4.2% previously. Investors are likely to keep a close eye on wage growth to determine if it continues to decline. As predicted by the central bank, this could lead to a slowdown in inflation. Therefore, if wage growth slows, the value of the pound may continue to fall as traders fear that the Bank of England (Bank of England) may cut interest rates in June.

On the chart, GBP/USD is struggling with the 200-day moving average around 1.2540 and is still below the short-term downtrend line. A break below the 1.2465 support level could pave the way for bears to test a five-month low of 1.2300. If the euro falls sharply below the latter level, it may support a short-term bearish structure and reach the 1.2186 level. However, as technical oscillators show some signs of upward recovery, the first resistance may come from the recent downtrend line and the 50-day moving average of 1.2590.

AUD/USD

(AUD/USD daily chart source: eHuitong)

Following the RBA's decision to maintain a neutral position, Australian traders will turn their attention to the Australian employment report released on Thursday, which is expected to rise to 3.9% from 3.8% previously. Although no possibility has been ruled out, the Reserve Bank of Australia emphasized that potential wage growth and a significant recovery in employment may increase the possibility of a September rate hike.

The AUD/USD pair has been developing in the 0.6390 - 0.6635 trading range, but is well above the short-term EMA. The direct resistance comes from the highs of 0.6635 and 0.6665. If these lines are broken, the outlook will turn more bullish and test the 0.6730 resistance level. On the other hand, if it breaks below the 0.6555 support and moving average, it could turn downward and challenge 0.6465. The MACD and RSI showed some signs of weakness.

At 20:45 Beijing time, EUR/USD was reported at 1.0797, an increase of 0.27%. GBP/USD rose 0.25% to 1.2554. AUD/USD rose 0.30% to 0.6623.