The top three net purchases were Zhongtong Bus, Nanjing Xinbai, and Coney Electromechanical

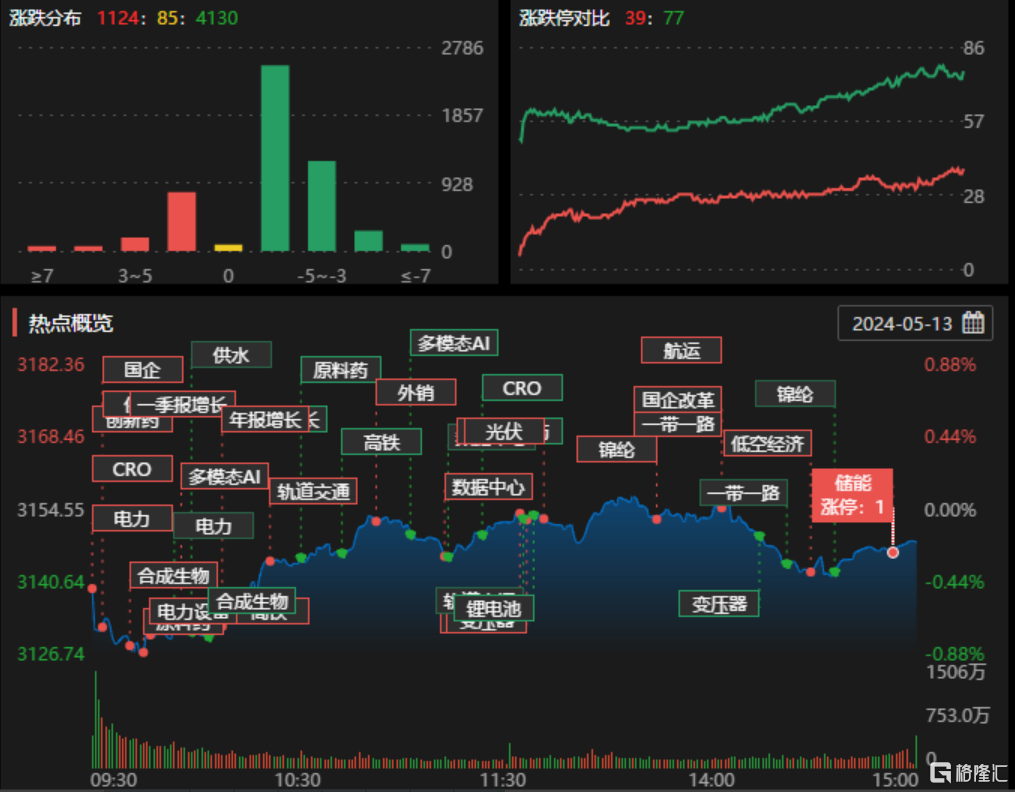

On May 13, the trend in the A-share market was weak. More than 4,100 stocks fell, 1124 stocks rose, 77 stocks fell to a halt, and 39 stocks rose and stopped.

Market hot topics focus on the electricity, gas, and water sectors, as well as the shipping and home appliances sectors related to price increases in people's livelihood.

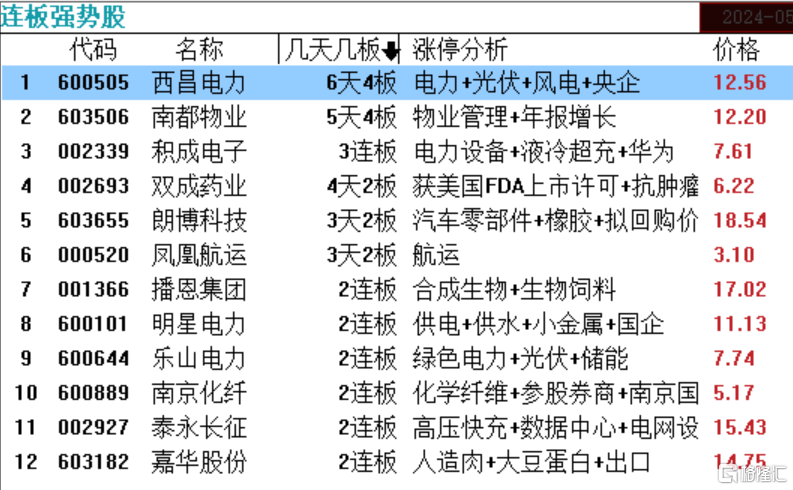

In terms of high-ranking stocks, individual electricity-related stocks are Xichang Electric Power 6-day 4-board, Jicheng Electronics 3-connected board, Star Electric, and Leshan Electric 2-board, high-voltage fast charging Taiyong Long March 2-board, property stock Nandu Property 5-day 4-board, Auto Zero Concept Rambo Technology 3-day 2-board, and shipping concept Phoenix Shipping 3-day 2-board.

Let's take a look at today's Dragon Tiger rankings:

The top three net purchases on the Dragon Tiger list today were Zhongtong Bus, Nanjing Xinbai, and Coney Electromechanical, which were 110 million yuan, 99.4978 million yuan, and 52.753 million yuan respectively.

The top three net sales figures on the Dragon Tiger list were TCL Smart Home, Xinghu Technology, and Jimin Healthcare, which were 155 million yuan, 954.159 billion yuan, and 61.3555 million yuan respectively.

Among the individual stocks involved in dedicated institutional seats in the Dragon Tiger list, the top three were Haixing Electric Power, Zhongtong Bus, and Jiangsu Huachen, which were 79.581 million yuan, 31.3981 million yuan, and 22.1374 million yuan respectively.

Among the individual stocks involved in exclusive institutional seats in the Dragon Tiger list, the top three were TCL Smart Home, Yangdian Technology, and Jicheng Electronics, which were 111 million yuan, 39.99 million yuan, and 17.0385 million yuan respectively.

The subject of some of the individual stocks on the list:

Zhongtong Bus (automobiles+state-owned enterprise reform+fuel cells)

The first board rose and stopped, with a turnover rate of 8.43% and a turnover of 507 million yuan.

The net purchase of quantitative trading was 378.048 million yuan, the net purchase of Shenzhen Stock Connect was 9.282,800 yuan, and the net purchase of the 2 institutions was 31.3981 million yuan.

1. It mainly focuses on buses and takes into account the development, manufacture and sales of component products. Currently, there are 5 fuel cell buses. Intelligent driving buses have been tested as sports cars in open road scenarios, and have reached the L4 level of intelligent driving.

2. The company sold a total of 1,090 vehicles in April, with cumulative sales volume of 3604 vehicles in January-April, an increase of 121.78% over the previous year.

Nanjing Xinbai (cellular immunotherapy+genetic testing+modern commerce)

Today's increase was 6.17%. Over the past 13 trading days, the cumulative increase was 52%, the turnover rate was 9.07%, and the turnover was 803 million yuan.

1. Nanjing Xinbai's acquisition of Dendreon was approved, and Dendreon's core product, Provenge, is the first cellular immunotherapy drug approved for marketing by the US FDA, and is currently the only cellular immunotherapy drug to treat prostate cancer.

2. Nanjing Xinbai announced that the cumulative deviation value of the closing price increase of more than 20% during the three consecutive trading days of May 7, May 8, and May 9, 2024 was an abnormal fluctuation in stock trading. According to the company's own inspection, the company's production and operation are currently normal, there have been no major adjustments or changes in production and operation, and there are no major issues affecting abnormal fluctuations in the company's stock trading price.

TCL Smart Home (Export+Home Appliances+TCL+ Quarterly Report Growth)

The first board rose and stopped, with a turnover rate of 8.92% and a turnover of 1,164 billion yuan.

Well-known travel investors from Shandong made a net purchase of 17.5435 million yuan, Shenzhen Stock Connect had a net sale of 17.6481 million yuan, and the two institutions had a net sale of 111 million yuan.

1. Mainly engaged in R&D, manufacturing and sales of refrigerators and washing machines. The company's main products are refrigerators (including freezers) and washing machines.

2. The company's net profit for the first quarter was 225 million yuan, an increase of 27.83% over the previous year. According to the 2023 annual report, the company's export sales accounted for 67.44%.

Key trading of individual stocks:

Xinghu Technology: Today's increase was 2.12%, the turnover rate was 29.08%, and the turnover was 2.34 billion yuan. Fang Xinxia made a net purchase of 41.3328 million yuan; Shandong Bangjing sold 36.378 million yuan.

Haixing Electric Power: The first board rose and stopped, with a turnover rate of 2.13% and a turnover of 529 million yuan. The net purchase of the two institutions was 79.5861 million yuan; the net purchase of Shanghai Stock Connect was 306.692 million yuan; the net sale of quantitative funds was 10.5891 million yuan.

Lukang Pharmaceutical: Today's increase was 9.18%, with a turnover rate of 36% and a turnover of 3.359 billion yuan. Fang Xinxia had a net purchase of 51.6391 million yuan; Ningbo Sangtian Road had a net purchase of 43.7542 million yuan; Ningbo Heyuan Road had a net purchase of 33.5682 million yuan; Shenzhen Stock Connect had a net sale of 51.4017 million yuan.

Jicheng Electronics: 3 connected boards, turnover rate of 24.52%, turnover of 859 million yuan. Shanghai's Liyang Road had a net purchase of 19.0849 million yuan, with a net purchase of 155.25,800 yuan; leisure fans had net sales of 21.8616 million yuan, quantitative betting net sales of 10.796 million yuan, and 2 institutions net sales of 17.0385 million yuan.

Yangdian Technology: 20CM rose and stopped, with a turnover rate of 32.37% and a turnover of 908 million yuan. The net purchase of stock trading was 408.14,800 yuan; the net sale of the 2 institutions was 39.9999 million yuan.

Covos: Today's increase was 7.3%, the turnover rate was 3.64%, and the turnover was 1,224 billion yuan. Shanghai Stock Connect had a net sale of 39.54 million yuan; the three institutions ranked in the Buy 2, Buy 3, and Buy 4 seats, with a total net purchase of 287 million yuan; the “Shanghai Super Short” market ranked in sales for 2 seats, selling 72.6045 million yuan.

In the Dragon Tiger list, there are 7 individual stocks involving exclusive seats on Shanghai Stock Connect. The net purchase of Lily was 10.8853 million yuan, and the net sale of Haixing Electric Power was 43.5699 million yuan, Xinghu Technology was 34.175 million yuan, and Ningbo Ocean was 21.7776 million yuan.

In the Dragon Tiger list, there are 5 individual stocks with exclusive seats on Shenzhen Stock Connect, with net sales of 19.223,300 yuan for Gansu Energy and 17.6481 million yuan for TCL Smart Home.

Trends in volatile capital operations:

Fang Xinxia: Net purchase of Lukang Pharmaceutical for 51.64 million yuan, Xinghu Technology for 41.33 million yuan, net sale of Subao Protein for 1.51 million yuan

Leisure group: net purchase of Xintiandi for 2005 million yuan, net sale of Jingcheng Electronics for 21.86 million yuan

Xu Liusheng: Net purchase of Reddy Smart Drive 10.91 million yuan

Master Zhang Meng: Net sale of Xiaosong shares for 17.2496 million yuan

Brother Zhao: Net purchase of Xintiandi RMB 114.617 million

Northeast Warriors: net purchase of lily flowers of 18.1976 million yuan; net sale of Haixing Electric Power for 21.4523 million yuan and Suobao protein for 136.104 million yuan