On Monday (May 13), spot gold fluctuated in a narrow range in the Asian market and is currently trading around 2362.00 US dollars/ounce. The price of gold climbed 0.6% last Friday to close at 2360.75 US dollars/ounce, recording the best weekly performance in five weeks. Due to recent weak US employment data, expectations for the Fed to cut interest rates were strengthened, driving the rise in non-yielding gold.

US futures for June delivery closed 1.5% higher last week to $2375.00 an ounce.

On Thursday, gold rose more than 1% after data showed that the number of jobless claims increased more than expected at the beginning of the week.

Phillip Streible, chief market strategist at Blue Line Futures, said that the surge in gold buying was mainly driven by technology, but was supported by last week's employment data and Thursday's initial jobless claims data.

Financial markets expect the Federal Reserve to begin an easing cycle in September.

Investors are currently looking forward to the US Producer Price Index (PPI), Consumer Price Index (CPI), and US retail sales data (commonly known as “horror data”) to be released this week, both of which could have a significant impact on the price of gold.

Meanwhile, near record domestic prices dampened demand for physical gold in India, the world's second-largest consumer of gold, during an important holiday season.

Some analysts said that after two weeks of consolidation, the price of gold is attracting the attention of some new bulls after holding the initial support level of around $2,300.

The price of gold rebounded from a low at the beginning of last week. It hit an intraday high of 2378.27 US dollars/ounce on Friday, a new high since April 22; it closed up nearly $60 last week, recording the best weekly performance in 5 weeks.

Meanwhile, the price of silver successfully rose above $28 per ounce after holding the key support level.

The University of Michigan's preliminary consumer confidence survey on Friday showed that optimism had fallen to its lowest point in five months, while inflation expectations had risen to the highest point in nearly two years.

Ole Hansen, head of commodity strategy at Saxo Bank, said that it is not surprising that gold prices have risen again because the market's bullish beliefs have not been tested during the two-week consolidation period.

He said, “Supported by signs of a cooling in the US job market, we are now seeing a technological breakthrough. As inflation is brought under control, the expected number of US interest rate cuts has increased from one to two.”

However, some analysts warned that although the market currently expects two interest rate cuts this year, these expectations are very unstable.

Naeem Aslam, chief investment director of Zaye Capital Markets, said he expects gold and silver to rebound in the near future. “Traders are not getting clear signals from the Federal Reserve about their monetary policy,” he said. “Employment data and other economic data suggest that the economy is slowing down, but the Fed is still determined to keep interest rates high for a longer period of time. All of this has strengthened the US dollar index again and caused gold to lose its luster.”

Looking at the technical side of gold, Alex Kuptsikevich, senior market analyst at FxPro, said that gold and silver regained momentum after successfully maintaining key retracement levels.

He said, “The latest upward trend made the outside world once again realize that the decline in the second half of April was a corrective correction.” However, Kuptsikevich added that despite the strong rise in gold and silver, there is still a lot of work to be done to attract new capital and push the price above recent historical highs above $2,431.

“In the face of high bond yields in developed countries, the price of gold has risen further. Many countries have huge budget deficits and need to support the economy, which makes people think that the upward potential is limited,” he said. “Until gold and silver reach new levels, we doubt whether a new round of attacks on the highs will be successful, and we think they are likely to fall again.”

Although the price of gold may continue to consolidate, famous financial analyst and market strategist Peter Granditch said that due to weakening economic activity and interest rates have peaked, there is still an upward risk for gold and silver. However, he added that investors should be patient.

“It's hard for me to imagine the price of gold falling sharply below recent lows, and the price of gold will still rise by hundreds of dollars (if not more),” he said in an interview with Kitco News. “I don't think this rise will be as difficult and rapid as it was earlier this year, but my long-term goal is $2,536, which is the easiest to achieve this year.

With renewed focus on economic fundamentals, some analysts say this week will be a critical time for gold and silver to recover and rise to record highs.

The main economic event this week will be the April Consumer Price Index (CPI). Earlier, the Federal Reserve (Fed) said that since prices are still far above the 2% target, it is not strong enough to fight inflation.

Barbara Lambrecht, a precious metals analyst at Commerzbank, said in a report on Friday, “If (consumer) prices rise strongly again, hopes for a slight interest rate cut in the near future may be thwarted again. At that time, the price of gold should fall again”.

In addition to the US CPI data, some analysts said that after disappointing consumer confidence data was released last Friday, US retail sales data (commonly known as “horror data”) will also attract some attention from the market. Traditionally, consumers who are less optimistic about the health of the economy will spend less, which will put pressure on economic activity.

“The University of Michigan Consumer Confidence Index has once again fallen to a six-month low. This is difficult to explain because gasoline prices have now fallen, the stock market has returned to a level close to an all-time high, and there is little evidence of a major decline in the labor market,” Paul Ashworth, chief North American economist at KITO Macro, said in a report. “This makes us wonder if we are ignoring something more worrying about consumers. We don't think so, but retail data for April released on May 16 will provide more information.”

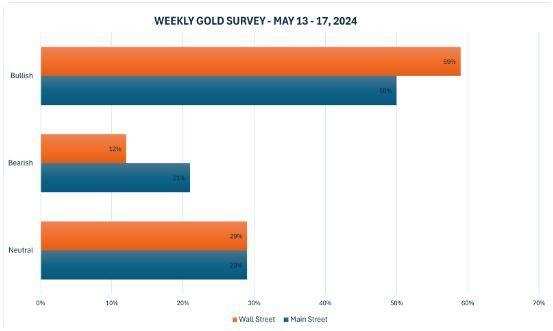

According to KITCO's survey, most analysts and retail investors tend to be bullish on the gold price trend in the coming week.

At 06:54 Beijing time, the current price of spot gold is 2361.22 US dollars/ounce.