The Kyndryl Holdings, Inc. (NYSE:KD) share price has done very well over the last month, posting an excellent gain of 27%. Looking back a bit further, it's encouraging to see the stock is up 92% in the last year.

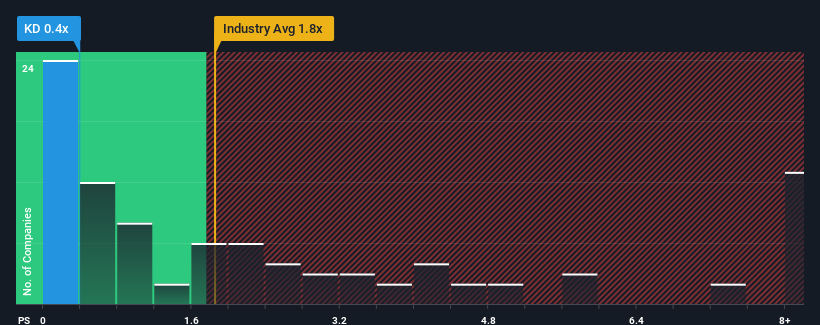

Although its price has surged higher, it would still be understandable if you think Kyndryl Holdings is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.4x, considering almost half the companies in the United States' IT industry have P/S ratios above 1.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does Kyndryl Holdings' P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, Kyndryl Holdings' revenue has gone into reverse gear, which is not great. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Kyndryl Holdings' future stacks up against the industry? In that case, our free report is a great place to start.How Is Kyndryl Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Kyndryl Holdings would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Kyndryl Holdings would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 5.7%. As a result, revenue from three years ago have also fallen 17% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 0.2% per annum during the coming three years according to the four analysts following the company. That's shaping up to be materially lower than the 12% per year growth forecast for the broader industry.

In light of this, it's understandable that Kyndryl Holdings' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Kyndryl Holdings' P/S Mean For Investors?

Kyndryl Holdings' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Kyndryl Holdings' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Kyndryl Holdings with six simple checks.

If these risks are making you reconsider your opinion on Kyndryl Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.