Powerlong Commercial Management Holdings Limited (HKG:9909) shares have had a really impressive month, gaining 32% after a shaky period beforehand. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

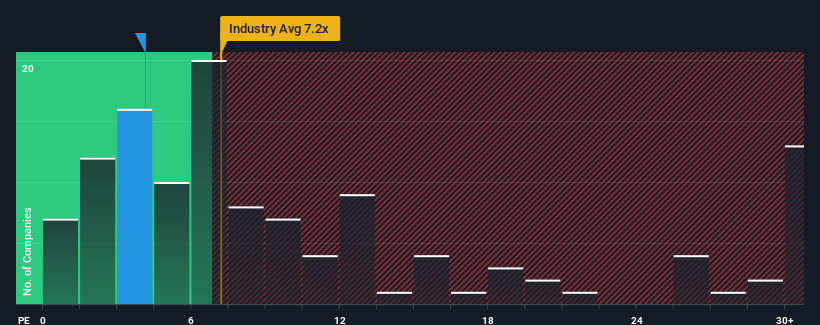

Although its price has surged higher, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 10x, you may still consider Powerlong Commercial Management Holdings as a highly attractive investment with its 4.1x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

There hasn't been much to differentiate Powerlong Commercial Management Holdings' and the market's earnings growth lately. One possibility is that the P/E is low because investors think this modest earnings performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Powerlong Commercial Management Holdings would need to produce anemic growth that's substantially trailing the market.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. Although pleasingly EPS has lifted 43% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 5.4% each year as estimated by the four analysts watching the company. That's shaping up to be materially lower than the 16% per annum growth forecast for the broader market.

In light of this, it's understandable that Powerlong Commercial Management Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Powerlong Commercial Management Holdings' P/E?

Powerlong Commercial Management Holdings' recent share price jump still sees its P/E sitting firmly flat on the ground. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Powerlong Commercial Management Holdings maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Powerlong Commercial Management Holdings with six simple checks on some of these key factors.

If you're unsure about the strength of Powerlong Commercial Management Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.