Shandong Sanyuan Biotechnology Co.,Ltd. (SZSE:301206) shares have continued their recent momentum with a 27% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 8.8% isn't as impressive.

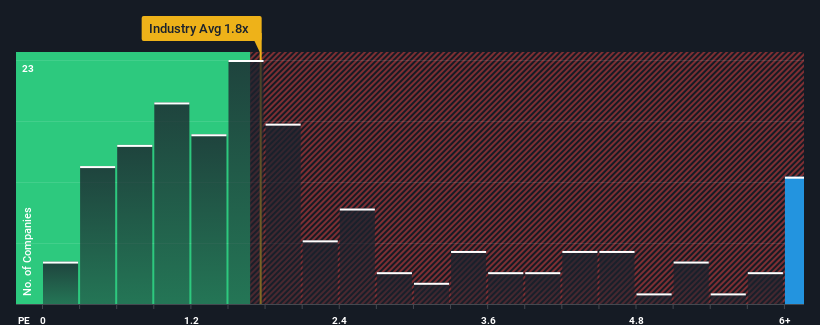

After such a large jump in price, you could be forgiven for thinking Shandong Sanyuan BiotechnologyLtd is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 11.4x, considering almost half the companies in China's Food industry have P/S ratios below 1.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Shandong Sanyuan BiotechnologyLtd Has Been Performing

There hasn't been much to differentiate Shandong Sanyuan BiotechnologyLtd's and the industry's revenue growth lately. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shandong Sanyuan BiotechnologyLtd.Is There Enough Revenue Growth Forecasted For Shandong Sanyuan BiotechnologyLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Shandong Sanyuan BiotechnologyLtd's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 11% last year. However, this wasn't enough as the latest three year period has seen an unpleasant 36% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 39% over the next year. With the industry only predicted to deliver 10%, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Shandong Sanyuan BiotechnologyLtd's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Shandong Sanyuan BiotechnologyLtd's P/S

Shares in Shandong Sanyuan BiotechnologyLtd have seen a strong upwards swing lately, which has really helped boost its P/S figure. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Shandong Sanyuan BiotechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It is also worth noting that we have found 2 warning signs for Shandong Sanyuan BiotechnologyLtd that you need to take into consideration.

If these risks are making you reconsider your opinion on Shandong Sanyuan BiotechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.