Consumer confidence at the University of Michigan in the US in May unexpectedly fell far short of expectations. It fell sharply from April, and fell sharply from April. The monthly decline was the biggest since August 2021. Consumer expectations for short-term inflation have risen sharply, and so have long-term inflation expectations. Confidence has plummeted as people worry about inflation and the job market.

Consumer confidence at the University of Michigan in the US unexpectedly fell far short of expectations in May, falling sharply from April and hitting a six-month low. Consumer short-term inflation expectations in the country have risen sharply, from 3.2% last month to the latest 3.5%, and long-term inflation expectations have also risen.

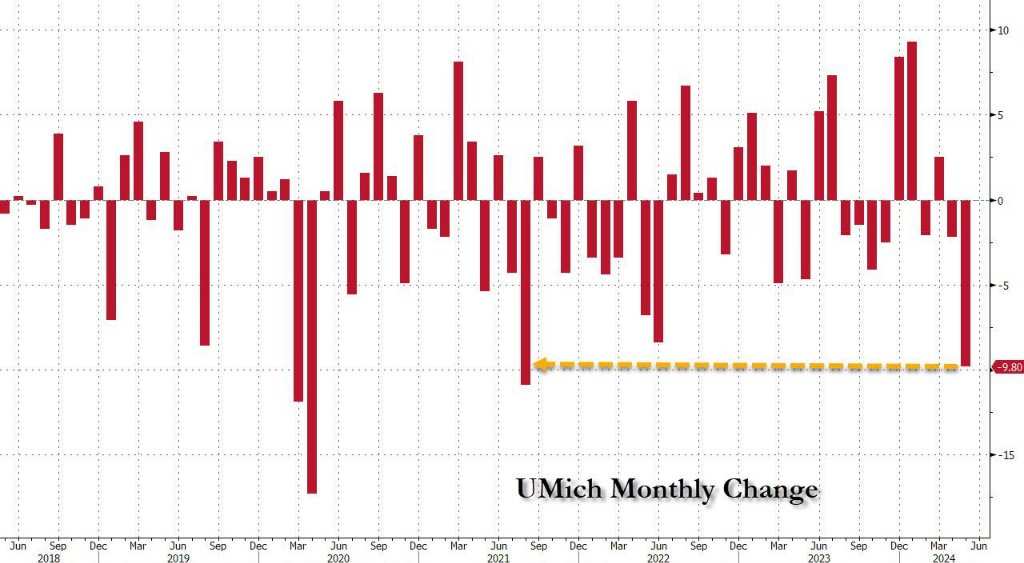

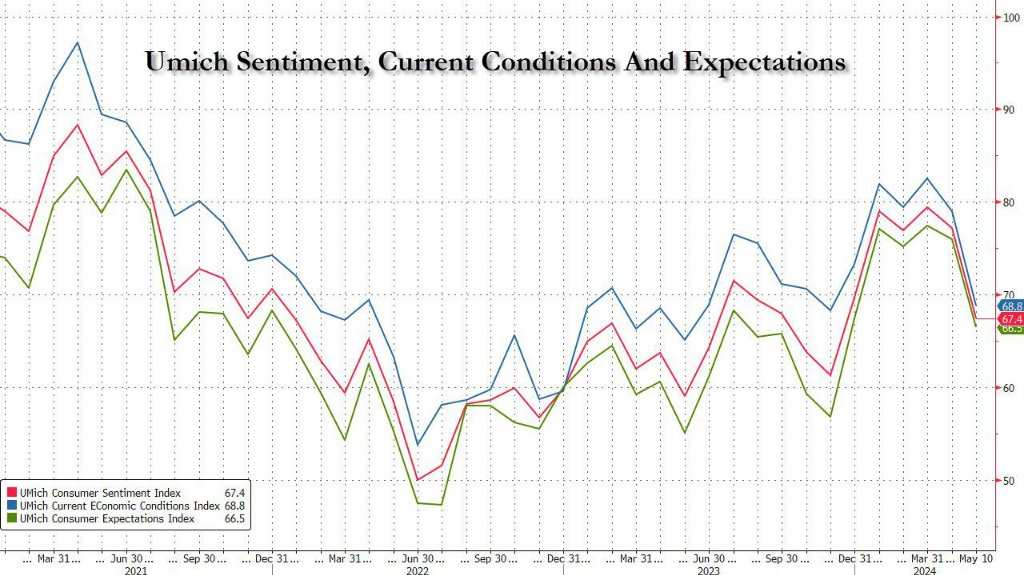

The initial value of the US Consumer Confidence Index in May was 67.4, a six-month low. It fell far short of expectations of 76.2, and far lower than the pre-April value of 77.2. This consumer confidence reading fell short of all economists' predictions in the media survey, and fell short of expectations, setting a historical record. Consumer confidence at the University of Michigan fell 9.8 points this month, the biggest drop since August 2021.

The overall sub-index fell far short of expectations: the initial value of the University of Michigan Consumer Status Index in May was 68.8, the expected value was 79, and the value before April was 79; the initial value of the expected index was 66.5, the forecast was 75, and the value before April was 76. The data for both categories were six-month lows.

In terms of inflation expectations that have received much attention in the market, the initial value of the 1-year inflation forecast is 3.5%, the highest level in six months. It is much higher than the 3.2% forecast, which was 3.2% before April; the initial value of the 5-year inflation forecast is 3.1%, which is also higher than the forecast of 3%, and the value before April was 3%.

The University of Michigan report also showed that people's assessments of the conditions for purchasing durable goods fell to their lowest point in a year. Furthermore, consumer sentiment about the financial situation and the short-term and long-term prospects of the US economy declined in May.

According to the analysis, consumer confidence declined significantly as they worried about inflation and the job market. The general decline in consumer sentiment among consumers of all ages, income, and education groups also reflects growing concerns about high interest rates. Although the US labor market boosted economic growth last year, the pessimism highlighted in the Michigan report added evidence that the US economy is slowing down.

Joanne Hsu, director of research at Michigan Consumer Confidence Data, said in a statement:

Strong household income has been the main source of support for strong consumer spending over the past few years, so weak labor market expectations are worrying, and if this situation continues, it may lead to a decline in consumer willingness to buy.

To make matters worse, consumers expect this pain to continue as interest rate expectations deteriorate sharply this month. Only a quarter of consumers expect interest rates to fall over the next year, compared to 32% in April.

Michigan data shows that America's short-term inflation expectations have risen markedly. Short-term and medium-term US bond yields have increased slightly, and US stocks have since declined:

- The increase in US two-year Treasury yields extended to 2.7 basis points, reaching a new high of 4.8445% on a new day. The three-year US Treasury yield rose 3.3 basis points to a new high of 4.6551%. The 5-year US Treasury yield reached a record high of 3.5 basis points. The seven-year US Treasury yield rose 4.2 basis points to a new high. The 10-year US Treasury yield rose 4.2 basis points to a new high. The increase in 30-year US Treasury yields widened again to more than 2.5 basis points, approaching the daily high that US stocks reached before the market.

- The S&P 500 rose more than 0.3%, the Dow rose 160 points, or 0.4%, and the NASDAQ rose 0.28%. However, since then, US stocks have taken back their gains, and the S&P 500 index and Nasdaq index have declined in the middle of the session.

- Spot gold maintained an increase of about 1% and traded at the $2,370 per ounce line. US stocks rose to a daily high of $2378.46 before the market.

Consumer confidence is affecting economic growth in the coming months. Pessimistic consumer sentiment will inhibit spending levels, thereby affecting economic recovery, while optimistic consumer sentiment will help the future economy.