Decoding Gilead Sciences's Options Activity: What's the Big Picture?

Decoding Gilead Sciences's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bullish move on Gilead Sciences. Our analysis of options history for Gilead Sciences (NASDAQ:GILD) revealed 9 unusual trades.

金融巨頭對吉利德科學採取了明顯的看漲舉動。我們對吉利德科學(納斯達克股票代碼:GILD)期權歷史的分析顯示了9筆不尋常的交易。

Delving into the details, we found 55% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $72,059, and 7 were calls, valued at $273,450.

深入研究細節,我們發現55%的交易者看漲,而44%的交易者表現出看跌趨勢。在我們發現的所有交易中,有2筆是看跌期權,價值72,059美元,7筆是看漲期權,價值273,450美元。

Expected Price Movements

預期的價格走勢

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $60.0 to $70.0 for Gilead Sciences during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在關注吉利德科學在過去一個季度的價格範圍從60.0美元到70.0美元不等。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

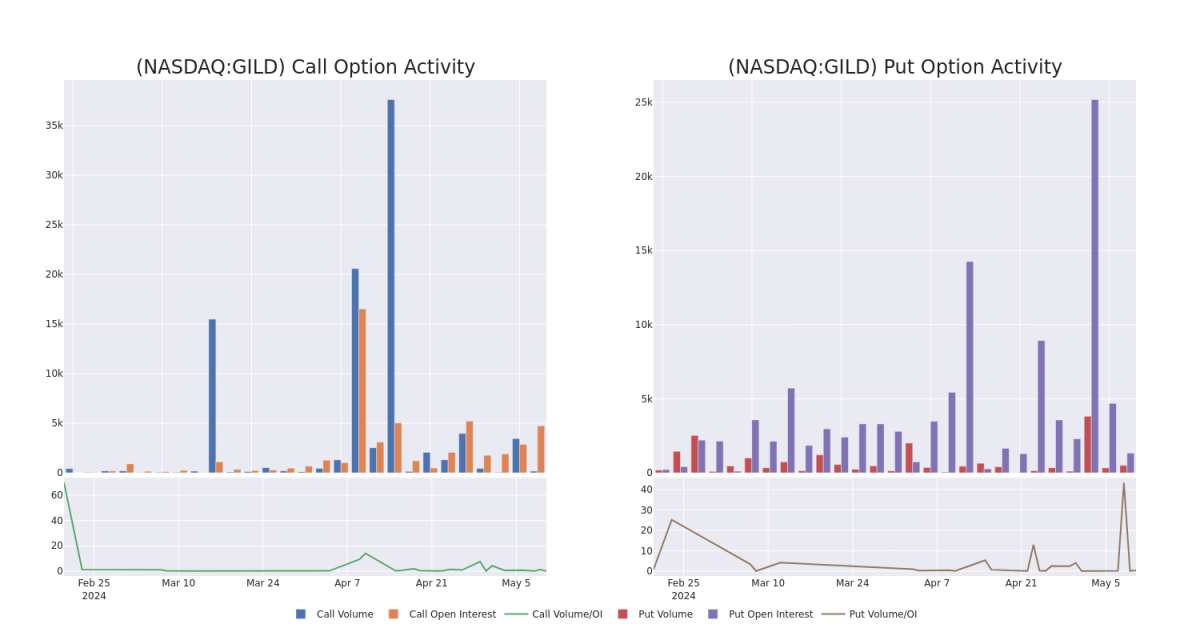

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Gilead Sciences's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Gilead Sciences's significant trades, within a strike price range of $60.0 to $70.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量吉利德科學期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月吉利德科學重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲60.0美元至70.0美元。

Gilead Sciences Call and Put Volume: 30-Day Overview

吉利德科學看漲和看跌交易量:30 天概述

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $4.35 | $4.25 | $4.35 | $67.50 | $93.5K | 534 | 0 |

| GILD | PUT | SWEEP | BEARISH | 11/15/24 | $3.7 | $3.65 | $3.7 | $65.00 | $37.0K | 1.3K | 200 |

| GILD | PUT | SWEEP | BULLISH | 11/15/24 | $3.75 | $3.65 | $3.65 | $65.00 | $35.0K | 1.3K | 305 |

| GILD | CALL | SWEEP | BULLISH | 01/17/25 | $5.3 | $5.2 | $5.3 | $65.00 | $33.9K | 2.0K | 50 |

| GILD | CALL | SWEEP | BULLISH | 05/17/24 | $6.2 | $6.0 | $6.18 | $60.00 | $30.9K | 89 | 50 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 金 | 打電話 | 掃 | 看漲 | 01/17/25 | 4.35 美元 | 4.25 美元 | 4.35 美元 | 67.50 美元 | 93.5 萬美元 | 534 | 0 |

| 金 | 放 | 掃 | 粗魯的 | 11/15/24 | 3.7 美元 | 3.65 美元 | 3.7 美元 | 65.00 美元 | 37.0 萬美元 | 1.3K | 200 |

| 金 | 放 | 掃 | 看漲 | 11/15/24 | 3.75 美元 | 3.65 美元 | 3.65 美元 | 65.00 美元 | 35.0 萬美元 | 1.3K | 305 |

| 金 | 打電話 | 掃 | 看漲 | 01/17/25 | 5.3 美元 | 5.2 美元 | 5.3 美元 | 65.00 美元 | 33.9 萬美元 | 2.0K | 50 |

| 金 | 打電話 | 掃 | 看漲 | 05/17/24 | 6.2 美元 | 6.0 美元 | 6.18 美元 | 60.00 美元 | 30.9 萬美元 | 89 | 50 |

About Gilead Sciences

關於吉利德科學

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead's exposure to cell therapy and noncell therapy in oncology.

吉利德科學開發和銷售治療危及生命的傳染病的療法,其產品組合的核心集中在艾滋病毒以及乙型和丙型肝炎上。對Corus Pharma、Myogen、CV Therapeutics、Arresto Biosciences和Calistoga的收購擴大了這一關注範圍,將肺部和心血管疾病以及癌症包括在內。吉利德對Pharmasset的收購帶來了丙型肝炎藥物Sovaldi的版權,該藥物也是複方藥物Harvoni的一部分,而對Kite、Forty Seven和Immunomedics的收購增加了吉利德在腫瘤學領域接受細胞療法和非細胞療法的機會。

After a thorough review of the options trading surrounding Gilead Sciences, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞吉利德科學的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Gilead Sciences's Current Market Status

吉利德科學的當前市場狀況

- Currently trading with a volume of 5,292,112, the GILD's price is up by 2.29%, now at $66.06.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 83 days.

- GILD目前的交易量爲5,292,112美元,價格上漲了2.29%,目前爲66.06美元。

- RSI讀數表明,該股目前在超買和超賣之間處於中立狀態。

- 預計業績將在83天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。