The Joint Corp. (NASDAQ:JYNT) shares have continued their recent momentum with a 26% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 13% is also fairly reasonable.

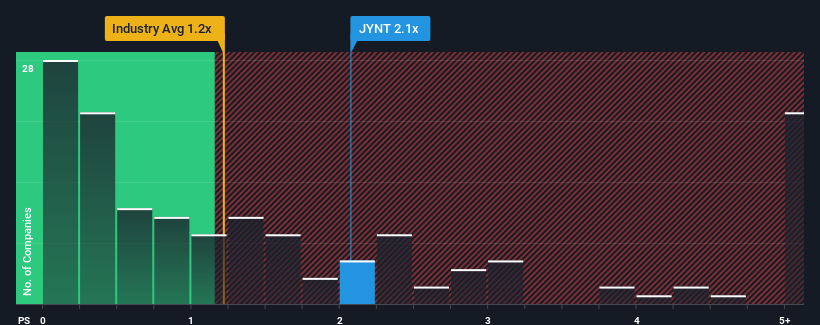

Since its price has surged higher, when almost half of the companies in the United States' Healthcare industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider Joint as a stock probably not worth researching with its 2.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Joint Has Been Performing

Joint's revenue growth of late has been pretty similar to most other companies. One possibility is that the P/S ratio is high because investors think this modest revenue performance will accelerate. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Joint's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Joint's to be considered reasonable.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 90% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 6.8% during the coming year according to the five analysts following the company. With the industry predicted to deliver 7.4% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that Joint's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in Joint's shares has lifted the company's P/S handsomely. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

For a company with revenues that are set to decline in the context of a growing industry, Joint's P/S is much higher than we would've anticipated. In cases like this where we see revenue decline on the horizon, we suspect the share price is at risk of following suit, bringing back the high P/S into the realms of suitability. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Joint, and understanding these should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.