Procter & Gamble's Options: A Look at What the Big Money Is Thinking

Procter & Gamble's Options: A Look at What the Big Money Is Thinking

Benzinga's options scanner has just identified more than 9 option transactions on Procter & Gamble (NYSE:PG), with a cumulative value of $272,582. Concurrently, our algorithms picked up 3 puts, worth a total of 103,622.

Benzinga的期權掃描儀剛剛在寶潔(紐約證券交易所代碼:PG)上發現了超過9筆期權交易,累計價值爲272,582美元。同時,我們的算法獲得了 3 個看跌期權,總價值爲 103,622。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $140.0 to $170.0 for Procter & Gamble over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚的目標價格似乎在140.0美元至170.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

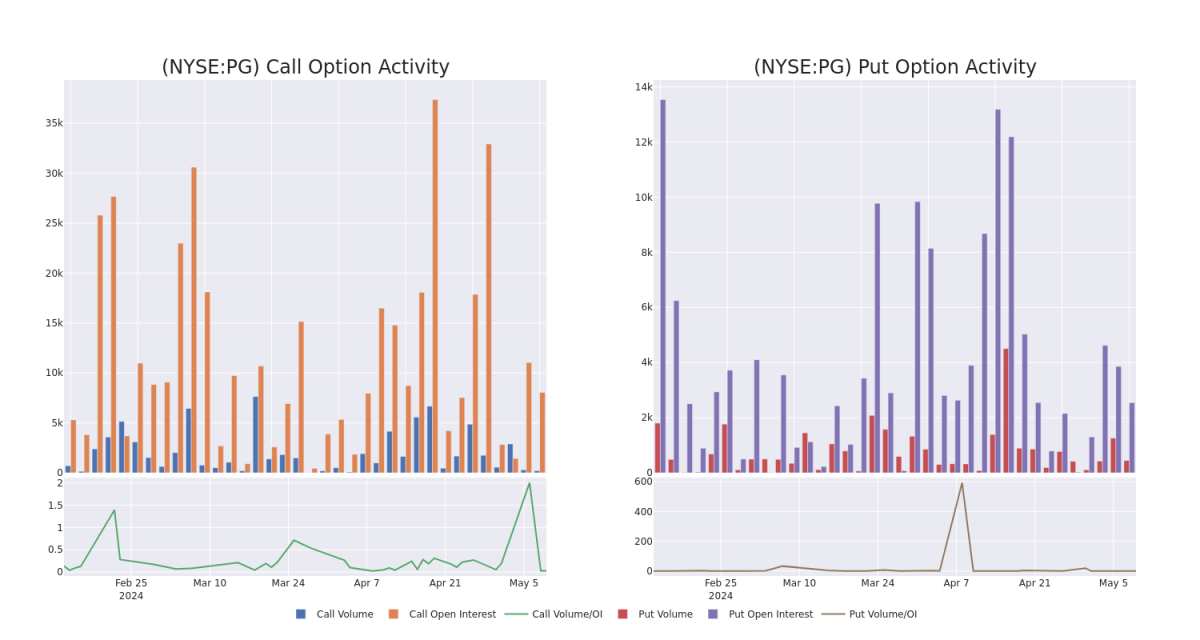

In terms of liquidity and interest, the mean open interest for Procter & Gamble options trades today is 1765.83 with a total volume of 658.00.

就流動性和利息而言,寶潔期權交易的平均未平倉合約爲1765.83,總交易量爲658.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Procter & Gamble's big money trades within a strike price range of $140.0 to $170.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天寶潔公司在140.0美元至170.0美元行使價區間內的看漲期權和看跌期權交易的交易量和未平倉合約的變化。

Procter & Gamble Option Activity Analysis: Last 30 Days

寶潔期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | CALL | SWEEP | BULLISH | 09/20/24 | $10.5 | $10.35 | $10.42 | $160.00 | $52.1K | 2.6K | 50 |

| PG | CALL | SWEEP | BEARISH | 09/20/24 | $4.4 | $4.3 | $4.33 | $170.00 | $40.2K | 4.2K | 152 |

| PG | PUT | SWEEP | BULLISH | 06/21/24 | $4.85 | $4.65 | $4.7 | $170.00 | $37.6K | 30 | 0 |

| PG | PUT | SWEEP | BULLISH | 01/17/25 | $1.82 | $1.71 | $1.7 | $145.00 | $34.2K | 2.5K | 211 |

| PG | PUT | TRADE | BULLISH | 01/17/25 | $1.76 | $1.67 | $1.69 | $145.00 | $31.7K | 2.5K | 235 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | 打電話 | 掃 | 看漲 | 09/20/24 | 10.5 美元 | 10.35 美元 | 10.42 美元 | 160.00 美元 | 52.1 萬美元 | 2.6K | 50 |

| PG | 打電話 | 掃 | 粗魯的 | 09/20/24 | 4.4 美元 | 4.3 美元 | 4.33 美元 | 170.00 美元 | 40.2 萬美元 | 4.2K | 152 |

| PG | 放 | 掃 | 看漲 | 06/21/24 | 4.85 美元 | 4.65 美元 | 4.7 美元 | 170.00 美元 | 37.6 萬美元 | 30 | 0 |

| PG | 放 | 掃 | 看漲 | 01/17/25 | 1.82 | 1.71 美元 | 1.7 美元 | 145.00 美元 | 34.2 萬美元 | 2.5K | 211 |

| PG | 放 | 貿易 | 看漲 | 01/17/25 | 1.76 美元 | 1.67 美元 | 1.69 美元 | 145.00 美元 | 31.7 萬美元 | 2.5K | 235 |

About Procter & Gamble

關於寶潔

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. P&G sold its last remaining food brand, Pringles, to Kellogg in calendar 2012. Sales outside its home turf represent around 53% of the firm's consolidated total.

自1837年成立以來,寶潔公司已成爲全球最大的消費品製造商之一,年銷售額超過800億美元。它與一系列領先品牌合作,其中包括20多個品牌,這些品牌的全球年銷售額均超過10億美元,例如Tide洗衣液、Charmin廁紙、潘婷洗髮水和幫寶適尿布。寶潔在2012年將其剩下的最後一個食品品牌品客薯片出售給了凱洛格。其本土以外的銷售額約佔該公司合併總額的53%。

After a thorough review of the options trading surrounding Procter & Gamble, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對寶潔公司的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Procter & Gamble's Current Market Status

寶潔當前的市場狀況

- Trading volume stands at 4,243,101, with PG's price up by 0.59%, positioned at $166.04.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 78 days.

- 交易量爲4,243,101美元,其中PG的價格上漲了0.59%,爲166.04美元。

- RSI指標顯示該股可能已超買。

- 預計將在78天后公佈業績。

What Analysts Are Saying About Procter & Gamble

分析師對寶潔公司的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $175.2.

5位市場專家最近發佈了該股的評級,共識目標價爲175.2美元。

- An analyst from Barclays has decided to maintain their Overweight rating on Procter & Gamble, which currently sits at a price target of $168.

- Maintaining their stance, an analyst from Deutsche Bank continues to hold a Buy rating for Procter & Gamble, targeting a price of $171.

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Procter & Gamble with a target price of $170.

- Maintaining their stance, an analyst from Jefferies continues to hold a Buy rating for Procter & Gamble, targeting a price of $182.

- An analyst from Argus Research persists with their Buy rating on Procter & Gamble, maintaining a target price of $185.

- 巴克萊銀行的一位分析師已決定維持對寶潔公司的增持評級,目前的目標股價爲168美元。

- 德意志銀行的一位分析師保持立場,繼續維持寶潔公司的買入評級,目標價爲171美元。

- 巴克萊銀行的一位分析師在評估中保持了對寶潔公司的增持評級,目標價爲170美元。

- 傑富瑞的一位分析師堅持其立場,繼續維持寶潔公司的買入評級,目標價格爲182美元。

- 阿格斯研究的一位分析師堅持對寶潔公司的買入評級,將目標價維持在185美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Procter & Gamble options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時提醒,隨時了解寶潔公司最新的期權交易。