American Express Unusual Options Activity For May 09

American Express Unusual Options Activity For May 09

Benzinga's options scanner has just identified more than 11 option transactions on American Express (NYSE:AXP), with a cumulative value of $1,053,955. Concurrently, our algorithms picked up 3 puts, worth a total of 266,435.

Benzinga的期權掃描儀剛剛在美國運通(紐約證券交易所代碼:AXP)上發現了超過11筆期權交易,累計價值爲1,053,955美元。同時,我們的算法獲得了 3 個看跌期權,總價值爲 266,435。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $260.0 for American Express over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將美國運通的價格區間從200.0美元擴大到260.0美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

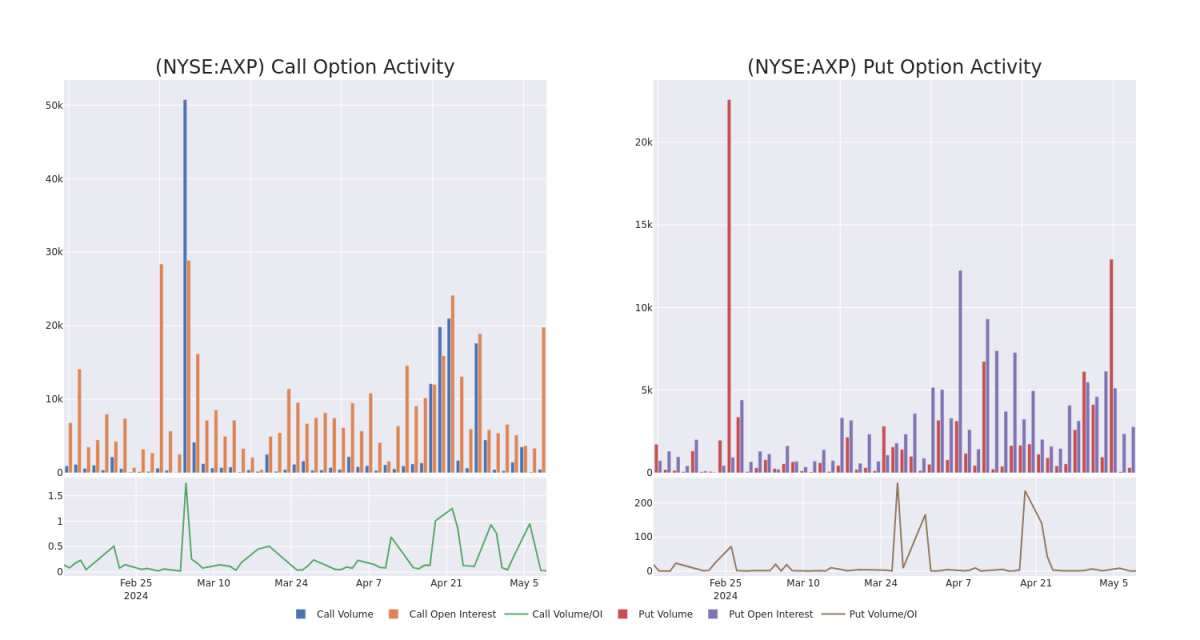

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for American Express's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across American Express's significant trades, within a strike price range of $200.0 to $260.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量美國運通期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月美國運通重大交易的看漲期權和未平倉合約的趨勢,行使價區間爲200.0美元至260.0美元。

American Express Option Activity Analysis: Last 30 Days

美國運通期權活動分析:過去 30 天

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | CALL | TRADE | BULLISH | 06/20/25 | $20.8 | $19.8 | $20.75 | $260.00 | $622.5K | 5.7K | 340 |

| AXP | PUT | TRADE | BULLISH | 01/17/25 | $13.05 | $13.0 | $13.0 | $230.00 | $130.0K | 1.4K | 100 |

| AXP | PUT | SWEEP | BULLISH | 07/19/24 | $5.15 | $5.05 | $5.05 | $230.00 | $102.5K | 720 | 220 |

| AXP | CALL | TRADE | BULLISH | 01/16/26 | $39.2 | $38.45 | $38.9 | $240.00 | $38.9K | 7.9K | 12 |

| AXP | CALL | TRADE | BULLISH | 01/16/26 | $34.2 | $33.75 | $34.2 | $250.00 | $34.2K | 246 | 20 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | 打電話 | 貿易 | 看漲 | 06/20/25 | 20.8 美元 | 19.8 美元 | 20.75 美元 | 260.00 美元 | 622.5 萬美元 | 5.7K | 340 |

| AXP | 放 | 貿易 | 看漲 | 01/17/25 | 13.05 美元 | 13.0 美元 | 13.0 美元 | 230.00 美元 | 130.0K | 1.4K | 100 |

| AXP | 放 | 掃 | 看漲 | 07/19/24 | 5.15 美元 | 5.05 美元 | 5.05 美元 | 230.00 美元 | 102.5 萬美元 | 720 | 220 |

| AXP | 打電話 | 貿易 | 看漲 | 01/16/26 | 39.2 美元 | 38.45 美元 | 38.9 美元 | 240.00 美元 | 38.9 萬美元 | 7.9K | 12 |

| AXP | 打電話 | 貿易 | 看漲 | 01/16/26 | 34.2 美元 | 33.75 美元 | 34.2 美元 | 250.00 美元 | 34.2 萬美元 | 246 | 20 |

About American Express

關於美國運通

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

美國運通是一家全球金融機構,在約130個國家開展業務,爲消費者和企業提供收費和信用卡支付產品。該公司還運營着一個利潤豐厚的商戶支付網絡。自2018年以來,它已在三個領域開展業務:全球消費者服務、全球商業服務以及全球商業和網絡服務。除了支付產品外,該公司的商業業務還提供費用管理工具、諮詢服務和商業貸款。

Following our analysis of the options activities associated with American Express, we pivot to a closer look at the company's own performance.

在分析了與美國運通相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Present Market Standing of American Express

美國運通目前的市場地位

- Currently trading with a volume of 2,320,276, the AXP's price is up by 0.97%, now at $238.53.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 71 days.

- AXP目前的交易量爲2320,276美元,價格上漲了0.97%,目前爲238.53美元。

- RSI讀數表明該股目前可能處於超買狀態。

- 預計收益將在71天后發佈。

What Analysts Are Saying About American Express

分析師對美國運通的看法

5 market experts have recently issued ratings for this stock, with a consensus target price of $240.4.

5位市場專家最近發佈了該股的評級,共識目標價爲240.4美元。

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on American Express with a target price of $263.

- An analyst from Baird has decided to maintain their Underperform rating on American Express, which currently sits at a price target of $205.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for American Express, targeting a price of $255.

- An analyst from RBC Capital has decided to maintain their Outperform rating on American Express, which currently sits at a price target of $253.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on American Express, which currently sits at a price target of $226.

- 加拿大皇家銀行資本的一位分析師在評估中保持了美國運通跑贏大盤的評級,目標價爲263美元。

- 貝爾德的一位分析師已決定維持其對美國運通的表現不佳的評級,目前的目標股價爲205美元。

- Evercore ISI集團的一位分析師堅持自己的立場,繼續維持美國運通的在線評級,目標價格爲255美元。

- 加拿大皇家銀行資本的一位分析師已決定維持其對美國運通的跑贏大盤評級,目前的目標股價爲253美元。

- 摩根士丹利的一位分析師已決定維持其對美國運通的等權評級,目前的目標股價爲226美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Express with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解美國運通的最新期權交易,獲取實時提醒。