Financial giants have made a conspicuous bearish move on HubSpot. Our analysis of options history for HubSpot (NYSE:HUBS) revealed 34 unusual trades.

Delving into the details, we found 23% of traders were bullish, while 52% showed bearish tendencies. Out of all the trades we spotted, 20 were puts, with a value of $1,140,552, and 14 were calls, valued at $563,292.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $300.0 to $700.0 for HubSpot over the last 3 months.

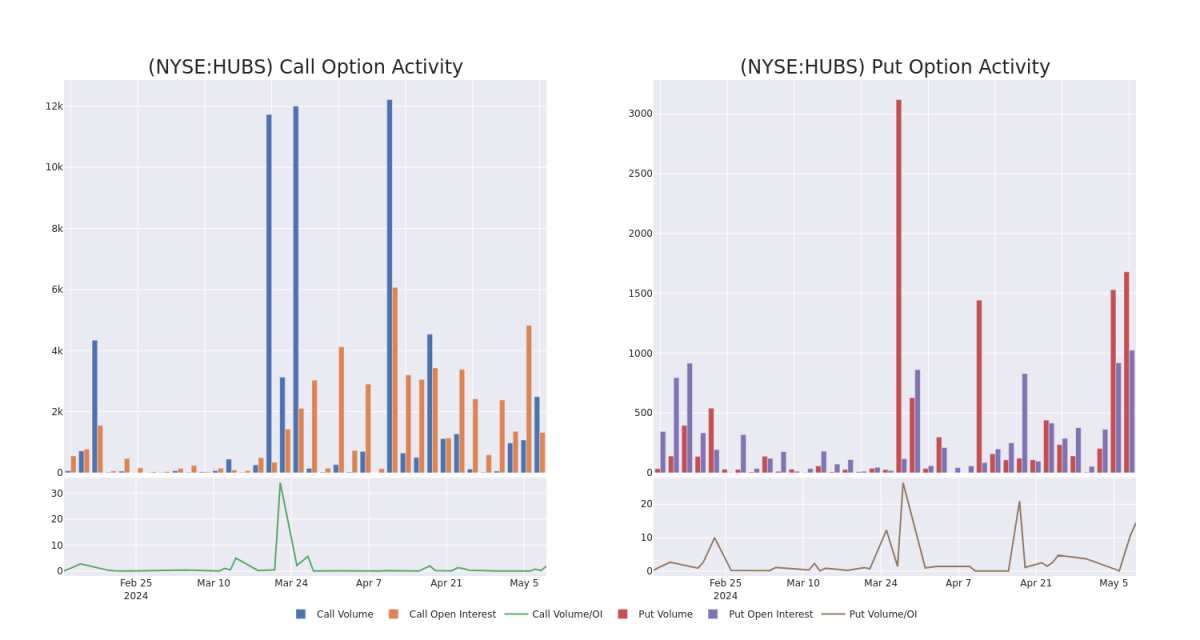

Volume & Open Interest Trends

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in HubSpot's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to HubSpot's substantial trades, within a strike price spectrum from $300.0 to $700.0 over the preceding 30 days.

HubSpot Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUBS | PUT | SWEEP | BEARISH | 06/21/24 | $35.0 | $29.0 | $35.0 | $620.00 | $199.5K | 144 | 18 |

| HUBS | PUT | SWEEP | NEUTRAL | 06/21/24 | $46.8 | $44.0 | $44.0 | $620.00 | $114.7K | 144 | 75 |

| HUBS | CALL | SWEEP | BULLISH | 06/21/24 | $19.6 | $18.6 | $18.6 | $650.00 | $90.4K | 615 | 501 |

| HUBS | PUT | SWEEP | NEUTRAL | 06/21/24 | $85.8 | $79.0 | $83.9 | $660.00 | $83.7K | 57 | 13 |

| HUBS | PUT | TRADE | BULLISH | 06/21/24 | $110.7 | $102.6 | $105.85 | $690.00 | $74.0K | 28 | 0 |

About HubSpot

HubSpot provides a cloud-based marketing, sales, and customer service software platform referred to as the growth platform. The applications are available ala carte or packaged together. HubSpot's mission is to help companies grow better and has expanded from its initial focus on inbound marketing to embrace marketing, sales, and service more broadly. The company was founded in 2006, completed its initial public offering in 2014, and is headquartered in Cambridge, Massachusetts.

Present Market Standing of HubSpot

- With a trading volume of 1,726,128, the price of HUBS is down by -0.49%, reaching $587.14.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 83 days from now.

Professional Analyst Ratings for HubSpot

In the last month, 5 experts released ratings on this stock with an average target price of $687.0.

- Maintaining their stance, an analyst from Stifel continues to hold a Buy rating for HubSpot, targeting a price of $700.

- Maintaining their stance, an analyst from Mizuho continues to hold a Buy rating for HubSpot, targeting a price of $650.

- Consistent in their evaluation, an analyst from Piper Sandler keeps a Overweight rating on HubSpot with a target price of $655.

- Maintaining their stance, an analyst from Canaccord Genuity continues to hold a Buy rating for HubSpot, targeting a price of $700.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $730.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for HubSpot with Benzinga Pro for real-time alerts.