A Closer Look at Newmont's Options Market Dynamics

A Closer Look at Newmont's Options Market Dynamics

Financial giants have made a conspicuous bullish move on Newmont. Our analysis of options history for Newmont (NYSE:NEM) revealed 33 unusual trades.

金融巨頭對紐蒙特採取了明顯的看漲舉動。我們對紐蒙特(紐約證券交易所代碼:NEM)期權歷史的分析顯示了33筆不尋常的交易。

Delving into the details, we found 63% of traders were bullish, while 33% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $178,973, and 28 were calls, valued at $2,388,993.

深入研究細節,我們發現63%的交易者看漲,而33%的交易者表現出看跌傾向。在我們發現的所有交易中,有5筆是看跌期權,價值爲178,973美元,28筆是看漲期權,價值2,388,993美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $25.0 to $47.5 for Newmont over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將紐蒙特的價格區間從25.0美元擴大到47.5美元。

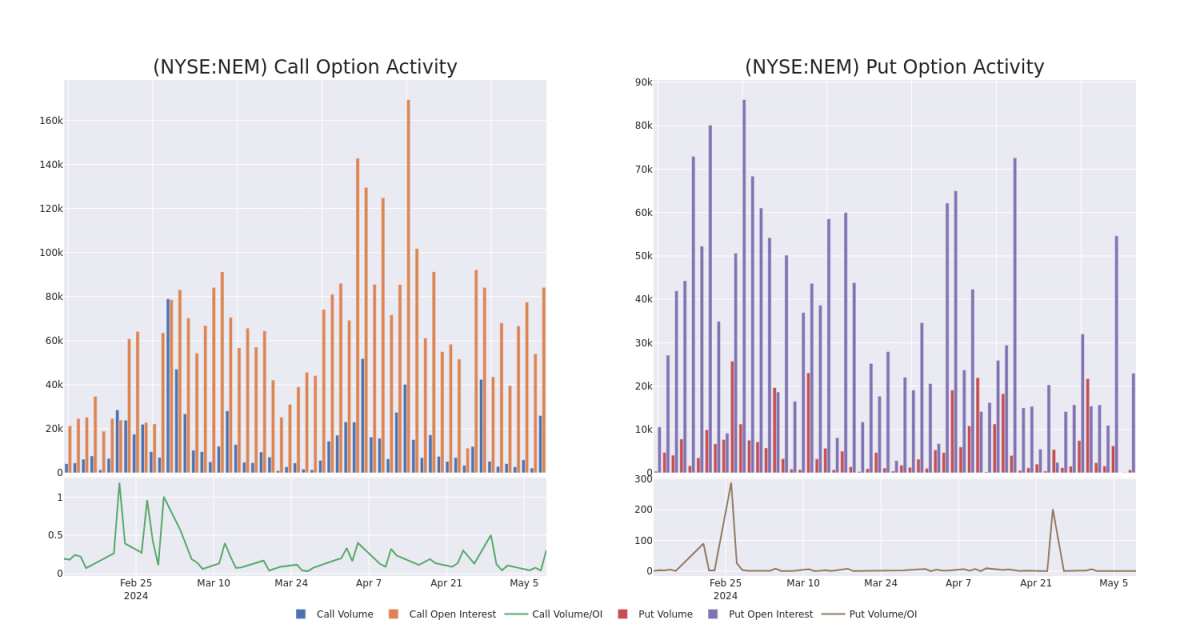

Analyzing Volume & Open Interest

分析交易量和未平倉合約

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Newmont's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Newmont's substantial trades, within a strike price spectrum from $25.0 to $47.5 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了紐蒙特期權在指定行使價下的流動性和投資者對紐蒙特期權的興趣。即將發佈的數據可視化了與紐蒙特的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從25.0美元到47.5美元不等。

Newmont 30-Day Option Volume & Interest Snapshot

紐蒙特30天期權交易量和利息快照

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | TRADE | BULLISH | 01/17/25 | $3.8 | $3.65 | $3.75 | $45.00 | $699.3K | 26.6K | 635 |

| NEM | CALL | SWEEP | BEARISH | 01/16/26 | $9.2 | $9.1 | $9.1 | $40.00 | $285.7K | 3.2K | 314 |

| NEM | CALL | SWEEP | BEARISH | 01/17/25 | $3.8 | $3.75 | $3.75 | $45.00 | $238.1K | 26.6K | 0 |

| NEM | CALL | SWEEP | BEARISH | 07/19/24 | $5.25 | $4.65 | $5.15 | $37.50 | $139.0K | 755 | 271 |

| NEM | CALL | SWEEP | BEARISH | 01/17/25 | $3.75 | $3.7 | $3.7 | $45.00 | $96.2K | 26.6K | 2.5K |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | 打電話 | 貿易 | 看漲 | 01/17/25 | 3.8 美元 | 3.65 美元 | 3.75 美元 | 45.00 美元 | 699.3 萬美元 | 26.6 K | 635 |

| NEM | 打電話 | 掃 | 粗魯的 | 01/16/26 | 9.2 美元 | 9.1 美元 | 9.1 美元 | 40.00 美元 | 285.7 萬美元 | 3.2K | 314 |

| NEM | 打電話 | 掃 | 粗魯的 | 01/17/25 | 3.8 美元 | 3.75 美元 | 3.75 美元 | 45.00 美元 | 238.1 萬美元 | 26.6 K | 0 |

| NEM | 打電話 | 掃 | 粗魯的 | 07/19/24 | 5.25 美元 | 4.65 美元 | 5.15 美元 | 37.50 | 139.0 萬美元 | 755 | 271 |

| NEM | 打電話 | 掃 | 粗魯的 | 01/17/25 | 3.75 美元 | 3.7 美元 | 3.7 美元 | 45.00 美元 | 96.2 萬美元 | 26.6 K | 2.5K |

About Newmont

關於紐蒙特

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at end December 2023.

紐蒙特是世界上最大的金礦開採商。它於2019年收購了Goldcorp,同年晚些時候與競爭對手巴里克合資合併了其內華達州的礦山,並於2023年11月收購了競爭對手紐克雷斯特。其投資組合包括在美洲、非洲、澳大利亞和巴布亞新幾內亞擁有的17個全資或多數股權礦山以及兩家合資企業的權益。預計該公司將在2024年生產約690萬盎司黃金。但是,在收購紐克雷斯特之後,紐蒙特可能會出售其一些成本較高的礦山,這些礦山佔2024年預測銷售額的20%。紐蒙特還生產大量的銅、銀、鋅和鉛作爲副產品。截至2023年12月底,它擁有大約二十年的黃金儲備和大量的副產品儲備。

Present Market Standing of Newmont

紐蒙特目前的市場地位

- Currently trading with a volume of 4,364,045, the NEM's price is up by 0.14%, now at $41.6.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 70 days.

- NEM目前的交易量爲4,364,045美元,價格上漲了0.14%,目前爲41.6美元。

- RSI讀數表明,該股目前可能接近超買。

- 預計收益將在70天后發佈。

What The Experts Say On Newmont

專家對紐蒙特的看法

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $50.0.

在過去的一個月中,3位行業分析師分享了他們對該股的見解,提出的平均目標價格爲50.0美元。

- Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Newmont with a target price of $54.

- An analyst from TD Securities persists with their Hold rating on Newmont, maintaining a target price of $48.

- Maintaining their stance, an analyst from TD Securities continues to hold a Hold rating for Newmont, targeting a price of $48.

- BMO Capital的一位分析師在評估中保持對紐蒙特的跑贏大盤評級,目標價爲54美元。

- 道明證券的一位分析師堅持對紐蒙特的持有評級,維持48美元的目標價格。

- 道明證券的一位分析師維持其立場,繼續對紐蒙特維持持有評級,目標股價爲48美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Newmont options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時警報,隨時了解最新的紐蒙特期權交易。