Smart Money Is Betting Big In UNH Options

Smart Money Is Betting Big In UNH Options

Financial giants have made a conspicuous bullish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 13 unusual trades.

金融巨頭對UnitedHealth Group採取了明顯的看漲舉動。我們對聯合健康集團(紐約證券交易所代碼:UNH)期權歷史的分析顯示了13筆不尋常的交易。

Delving into the details, we found 53% of traders were bullish, while 15% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $252,385, and 9 were calls, valued at $354,461.

深入研究細節,我們發現53%的交易者看漲,而15%的交易者表現出看跌趨勢。在我們發現的所有交易中,有4筆是看跌期權,價值爲252,385美元,9筆是看漲期權,價值354,461美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $490.0 to $550.0 for UnitedHealth Group over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將UnitedHealth Group的價格區間定在490.0美元至550.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

In terms of liquidity and interest, the mean open interest for UnitedHealth Group options trades today is 581.5 with a total volume of 938.00.

就流動性和利息而言,UnitedHealth Group期權交易的平均未平倉合約爲581.5,總交易量爲938.00。

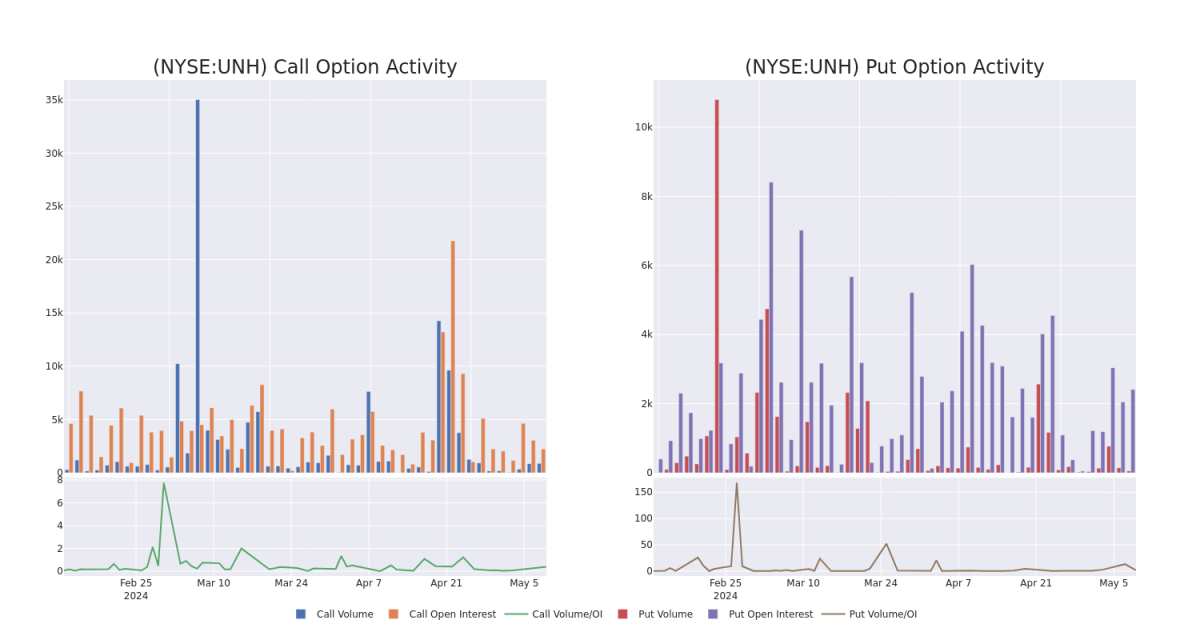

In the following chart, we are able to follow the development of volume and open interest of call and put options for UnitedHealth Group's big money trades within a strike price range of $490.0 to $550.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天UnitedHealth Group大額資金交易的看漲和看跌期權交易量和未平倉合約的變化,其行使價區間爲490.0美元至550.0美元。

UnitedHealth Group Option Activity Analysis: Last 30 Days

UnitedHealth 集團期權活動分析:過去 30 天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | PUT | TRADE | NEUTRAL | 06/21/24 | $15.15 | $14.95 | $15.05 | $510.00 | $82.7K | 980 | 16 |

| UNH | PUT | TRADE | NEUTRAL | 01/17/25 | $49.35 | $48.4 | $48.84 | $540.00 | $78.1K | 496 | 20 |

| UNH | PUT | TRADE | BEARISH | 03/21/25 | $32.35 | $31.8 | $32.35 | $500.00 | $58.2K | 12 | 18 |

| UNH | CALL | SWEEP | BULLISH | 05/17/24 | $2.86 | $2.85 | $2.85 | $510.00 | $47.5K | 1.1K | 315 |

| UNH | CALL | TRADE | BULLISH | 12/19/25 | $50.75 | $49.35 | $50.75 | $550.00 | $45.6K | 638 | 8 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | 放 | 貿易 | 中立 | 06/21/24 | 15.15 美元 | 14.95 美元 | 15.05 美元 | 510.00 美元 | 82.7 萬美元 | 980 | 16 |

| UNH | 放 | 貿易 | 中立 | 01/17/25 | 49.35 美元 | 48.4 美元 | 48.84 美元 | 540.00 美元 | 78.1 萬美元 | 496 | 20 |

| UNH | 放 | 貿易 | 粗魯的 | 03/21/25 | 32.35 美元 | 31.8 美元 | 32.35 美元 | 500.00 美元 | 58.2 萬美元 | 12 | 18 |

| UNH | 打電話 | 掃 | 看漲 | 05/17/24 | 2.86 美元 | 2.85 美元 | 2.85 美元 | 510.00 美元 | 47.5 萬美元 | 1.1K | 315 |

| UNH | 打電話 | 貿易 | 看漲 | 12/19/25 | 50.75 美元 | 49.35 美元 | 50.75 美元 | 550.00 美元 | 45.6 萬美元 | 638 | 8 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 53 million members globally, including 5 million outside the U.S. as of mid-2023. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

UnitedHealth Group是最大的私人健康保險公司之一,截至2023年年中,爲全球約5300萬會員提供醫療福利,其中包括美國以外的500萬會員。作爲僱主贊助、自管和政府支持的保險計劃的領導者,UnitedHealth在管理式醫療領域取得了巨大的規模。除了其保險資產外,UnitedHealth對其Optum特許經營權的持續投資還創造了一個醫療保健服務巨頭,涵蓋了從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析的所有領域。

Following our analysis of the options activities associated with UnitedHealth Group, we pivot to a closer look at the company's own performance.

在分析了與UnitedHealth Group相關的期權活動之後,我們將轉向仔細研究公司自身的業績。

Present Market Standing of UnitedHealth Group

聯合健康集團目前的市場地位

- Currently trading with a volume of 486,998, the UNH's price is up by 0.13%, now at $503.86.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 64 days.

- UNH目前的交易量爲486,998美元,價格上漲了0.13%,目前爲503.86美元。

- RSI讀數表明該股目前可能處於超買狀態。

- 預計業績將在64天后發佈。

Professional Analyst Ratings for UnitedHealth Group

聯合健康集團的專業分析師評級

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $564.6.

在過去的一個月中,5位行業分析師分享了他們對該股的見解,提出平均目標價爲564.6美元。

- An analyst from Barclays has decided to maintain their Overweight rating on UnitedHealth Group, which currently sits at a price target of $560.

- An analyst from Piper Sandler persists with their Overweight rating on UnitedHealth Group, maintaining a target price of $571.

- An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $591.

- An analyst from RBC Capital persists with their Outperform rating on UnitedHealth Group, maintaining a target price of $555.

- An analyst from TD Cowen persists with their Buy rating on UnitedHealth Group, maintaining a target price of $546.

- 巴克萊銀行的一位分析師已決定維持對UnitedHealth Group的增持評級,該集團目前的目標股價爲560美元。

- 派珀·桑德勒的一位分析師堅持對UnitedHealth Group的增持評級,維持571美元的目標價格。

- 坎託·菲茨傑拉德的一位分析師已將其評級下調至增持,將目標股價調整爲591美元。

- 加拿大皇家銀行資本的一位分析師堅持對UnitedHealth Group的跑贏大盤評級,維持555美元的目標價。

- 道明考恩的一位分析師堅持對UnitedHealth Group的買入評級,維持546美元的目標價。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest UnitedHealth Group options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時提醒,隨時了解UnitedHealth Group期權的最新交易。