The ZoomInfo Technologies Inc. (NASDAQ:ZI) share price has fared very poorly over the last month, falling by a substantial 25%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

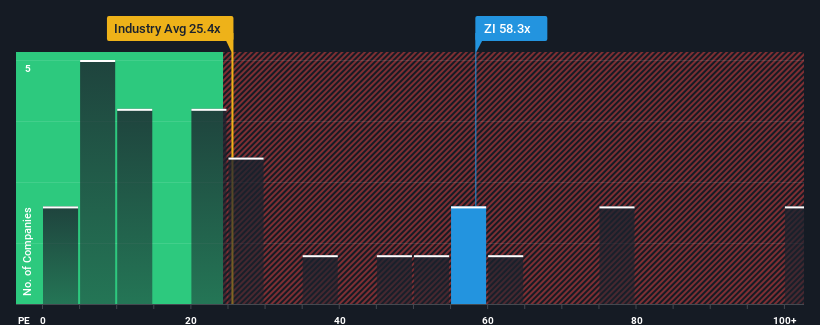

In spite of the heavy fall in price, ZoomInfo Technologies' price-to-earnings (or "P/E") ratio of 58.3x might still make it look like a strong sell right now compared to the market in the United States, where around half of the companies have P/E ratios below 17x and even P/E's below 9x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

ZoomInfo Technologies has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

How Is ZoomInfo Technologies' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as ZoomInfo Technologies' is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 21%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 46% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 10% per year, which is noticeably less attractive.

With this information, we can see why ZoomInfo Technologies is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On ZoomInfo Technologies' P/E

Even after such a strong price drop, ZoomInfo Technologies' P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that ZoomInfo Technologies maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for ZoomInfo Technologies with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than ZoomInfo Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.