According to the latest market data, spot gold experienced a significant decline in early European trading on Thursday. The price once fell below the 2,310 US dollars/ounce mark, and the intraday high fell back to 10 US dollars. As of press time, gold had rebounded slightly and traded around 2,312 US dollars/ounce. This price fluctuation is not unrelated to the short-term rebound of the US dollar index. The US dollar index is around 105.65, and the strengthening of the US dollar puts pressure on the price of gold denominated in US dollars.

Technical analysis: looking for support and resistance in gold prices

From a technical analysis perspective, the long-term outlook for gold remains positive. On the daily chart, the price of gold remains trading above the key 100-day exponential moving average (EMA), showing some resilience. Since mid-April, although the price of gold has been in a downward trend channel, the Relative Strength Index (RSI) hovered near the mid-50 level on the 14th, indicating that market sentiment has not shown extreme bias, and the consolidation trend may continue.

The first support level for the gold price is at the psychological mark of 2,300 US dollars/ounce. If it falls below, it may fall further to the lower limit of the downtrend channel of 2,260 US dollars/ounce. If the weakness continues, the price of gold may fall to the low of 2,228 US dollars/ounce on April 1, or even test the level of 2,200 US dollars/ounce. Conversely, if demand is strong, the price of gold is expected to rise back to the May 6 high of $2,332 per ounce, and may further rise to the upper edge of the downtrend channel of $2,345 per ounce. The integer mark of $2,400 per ounce and an all-time high near $2,432 per ounce will be the next major resistance levels.

Some analysts also believe thatGold is expected to continue its gains or break above $2,500 per ounce.

Gold hit an all-time high of $2,431 after showing overbought in April, then oversold in May after correction. Gold is consolidating and moving towards the peak of a large wave of gains — the situation is bullish. The price of gold has risen by more than $500 since October, more than $400 above the February low.

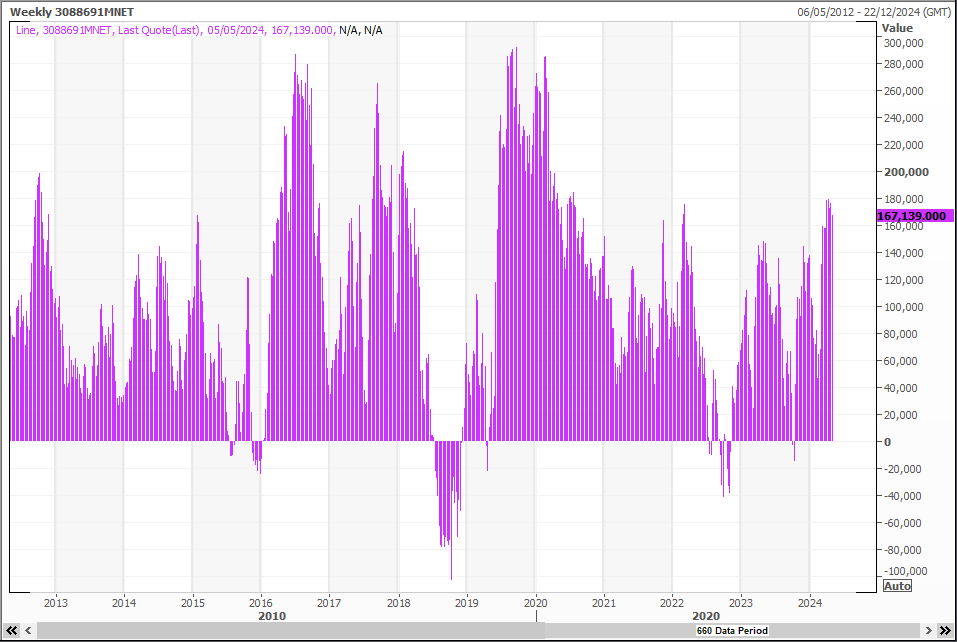

The closing of long positions has little impact on the price of gold. Bullish bets are likely to increase, and long positions are almost double the size of 2020 and 2016. The next target was $2,500, followed by $2,725 and $3,000.

Macro Perspectives: Global Economy and Policy Implications

Gold traders are watching closely for new catalysts that could affect the market. The announcement of the number of initial jobless claims in the US and San Francisco Federal Reserve Chairman Mary Daly's speech are all important factors that may affect the price of gold in the short term. As a dovish official within the Federal Reserve, Daly's remarks may limit the decline in gold prices.

Institutional Perspective: Long-term outlook for the gold market

According to an analysis by the World Gold Council, gold performed well in 2023, and was particularly unique in a high interest rate environment, outperforming most assets. Looking ahead to 2024, the global economy faces three possible scenarios, including a “soft landing” for the US economy, the risk of a recession, and an uncertain “no landing.” Under these circumstances, gold is likely to continue to be favored by investors as an effective hedging tool.

Investment Strategy: The Diverse Role of Gold

Not only is gold receiving attention as an investment asset, but its demand as a consumer product cannot be ignored. Increased demand for gold purchases by central banks and geopolitical risks have also provided additional support to the gold market. Under the dual influence of economic expansion and risk uncertainty, the investment value of gold and consumer demand will continue to coexist and interact.