Nanjing Business & Tourism Corp.,Ltd. (SHSE:600250) shares have retraced a considerable 25% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 44%, which is great even in a bull market.

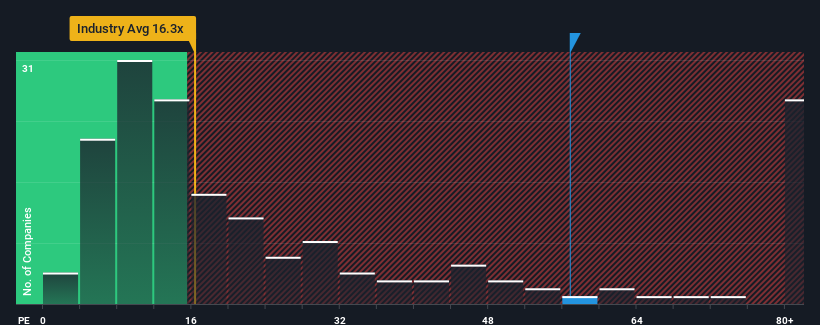

In spite of the heavy fall in price, given close to half the companies in China have price-to-earnings ratios (or "P/E's") below 32x, you may still consider Nanjing Business & TourismLtd as a stock to avoid entirely with its 56.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

For instance, Nanjing Business & TourismLtd's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as steep as Nanjing Business & TourismLtd's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 47%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 2,773% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

This is in contrast to the rest of the market, which is expected to grow by 38% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Nanjing Business & TourismLtd's P/E sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

The Final Word

Even after such a strong price drop, Nanjing Business & TourismLtd's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Nanjing Business & TourismLtd revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 3 warning signs for Nanjing Business & TourismLtd (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Nanjing Business & TourismLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.