Ningbo Marine Company Limited's (SHSE:600798) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

How Do Unusual Items Influence Profit?

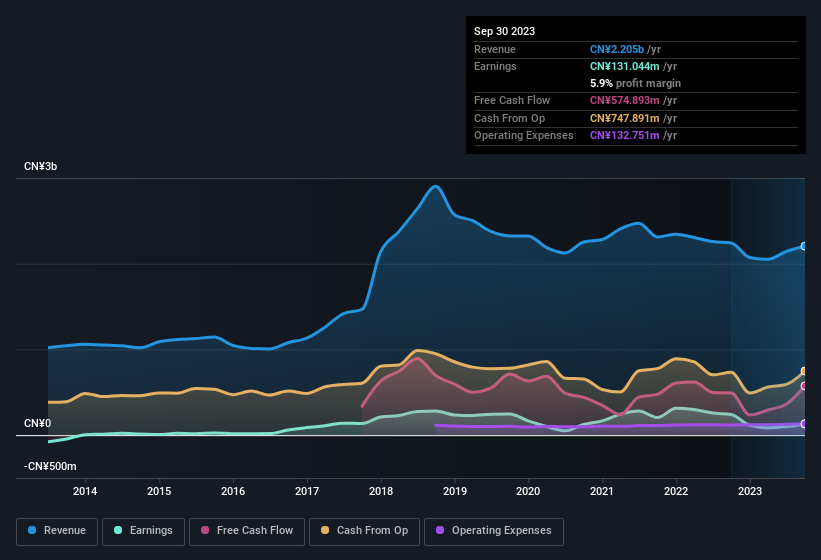

To properly understand Ningbo Marine's profit results, we need to consider the CN¥93m gain attributed to unusual items. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. Ningbo Marine had a rather significant contribution from unusual items relative to its profit to September 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Ningbo Marine.

Our Take On Ningbo Marine's Profit Performance

As previously mentioned, Ningbo Marine's large boost from unusual items won't be there indefinitely, so its statutory earnings are probably a poor guide to its underlying profitability. For this reason, we think that Ningbo Marine's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. In further bad news, its earnings per share decreased in the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. So while earnings quality is important, it's equally important to consider the risks facing Ningbo Marine at this point in time. Be aware that Ningbo Marine is showing 4 warning signs in our investment analysis and 1 of those is a bit concerning...

Today we've zoomed in on a single data point to better understand the nature of Ningbo Marine's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.