Jinhua Chunguang Technology Co.,Ltd (SHSE:603657) shares have continued their recent momentum with a 35% gain in the last month alone. Notwithstanding the latest gain, the annual share price return of 9.4% isn't as impressive.

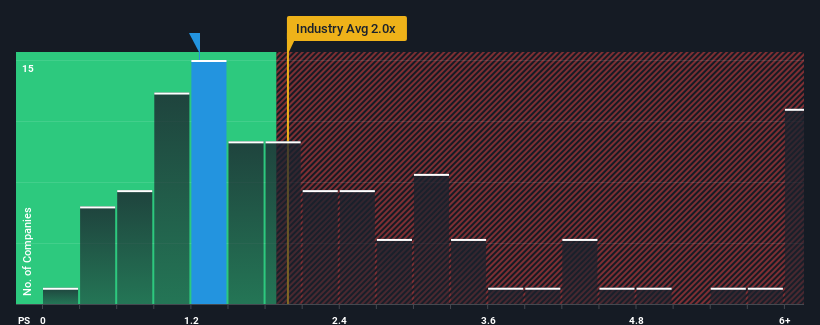

Although its price has surged higher, Jinhua Chunguang TechnologyLtd's price-to-sales (or "P/S") ratio of 1.3x might still make it look like a buy right now compared to the Consumer Durables industry in China, where around half of the companies have P/S ratios above 2x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

How Jinhua Chunguang TechnologyLtd Has Been Performing

While the industry has experienced revenue growth lately, Jinhua Chunguang TechnologyLtd's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Jinhua Chunguang TechnologyLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Jinhua Chunguang TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In order to justify its P/S ratio, Jinhua Chunguang TechnologyLtd would need to produce sluggish growth that's trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 21%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 78% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 16% during the coming year according to the lone analyst following the company. With the industry only predicted to deliver 11%, the company is positioned for a stronger revenue result.

With this information, we find it odd that Jinhua Chunguang TechnologyLtd is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

Despite Jinhua Chunguang TechnologyLtd's share price climbing recently, its P/S still lags most other companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Jinhua Chunguang TechnologyLtd currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You need to take note of risks, for example - Jinhua Chunguang TechnologyLtd has 3 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.