Despite an already strong run, Envision Greenwise Holdings Limited (HKG:1783) shares have been powering on, with a gain of 30% in the last thirty days. The last 30 days were the cherry on top of the stock's 804% gain in the last year, which is nothing short of spectacular.

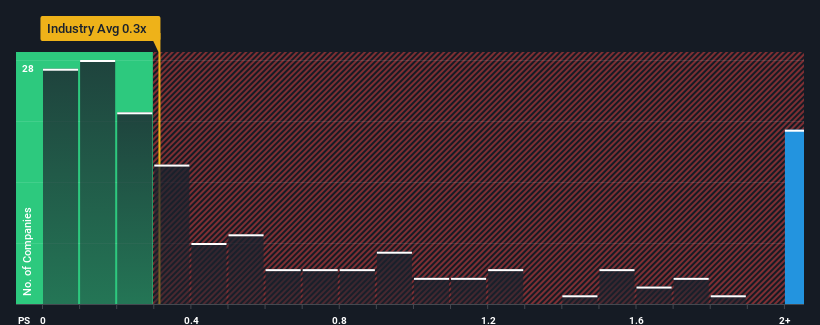

After such a large jump in price, given around half the companies in Hong Kong's Construction industry have price-to-sales ratios (or "P/S") below 0.3x, you may consider Envision Greenwise Holdings as a stock to avoid entirely with its 14.6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

What Does Envision Greenwise Holdings' P/S Mean For Shareholders?

For instance, Envision Greenwise Holdings' receding revenue in recent times would have to be some food for thought. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Envision Greenwise Holdings' earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Envision Greenwise Holdings?

In order to justify its P/S ratio, Envision Greenwise Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's top line. Still, the latest three year period has seen an excellent 60% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Envision Greenwise Holdings' P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Shares in Envision Greenwise Holdings have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It's no surprise that Envision Greenwise Holdings can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Having said that, be aware Envision Greenwise Holdings is showing 2 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

If these risks are making you reconsider your opinion on Envision Greenwise Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.