Check Out What Whales Are Doing With SMCI

Check Out What Whales Are Doing With SMCI

Financial giants have made a conspicuous bullish move on Super Micro Computer. Our analysis of options history for Super Micro Computer (NASDAQ:SMCI) revealed 15 unusual trades.

金融巨頭對超級微電腦採取了明顯的看漲舉動。我們對超級微型計算機(納斯達克股票代碼:SMCI)期權歷史的分析顯示了15筆不尋常的交易。

Delving into the details, we found 46% of traders were bullish, while 46% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $329,452, and 10 were calls, valued at $412,292.

深入研究細節,我們發現46%的交易者看漲,而46%的交易者表現出看跌趨勢。在我們發現的所有交易中,有5筆是看跌期權,價值329,452美元,10筆是看漲期權,價值412,292美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $720.0 to $1500.0 for Super Micro Computer over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將超級微電腦的價格定在720.0美元至1500.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

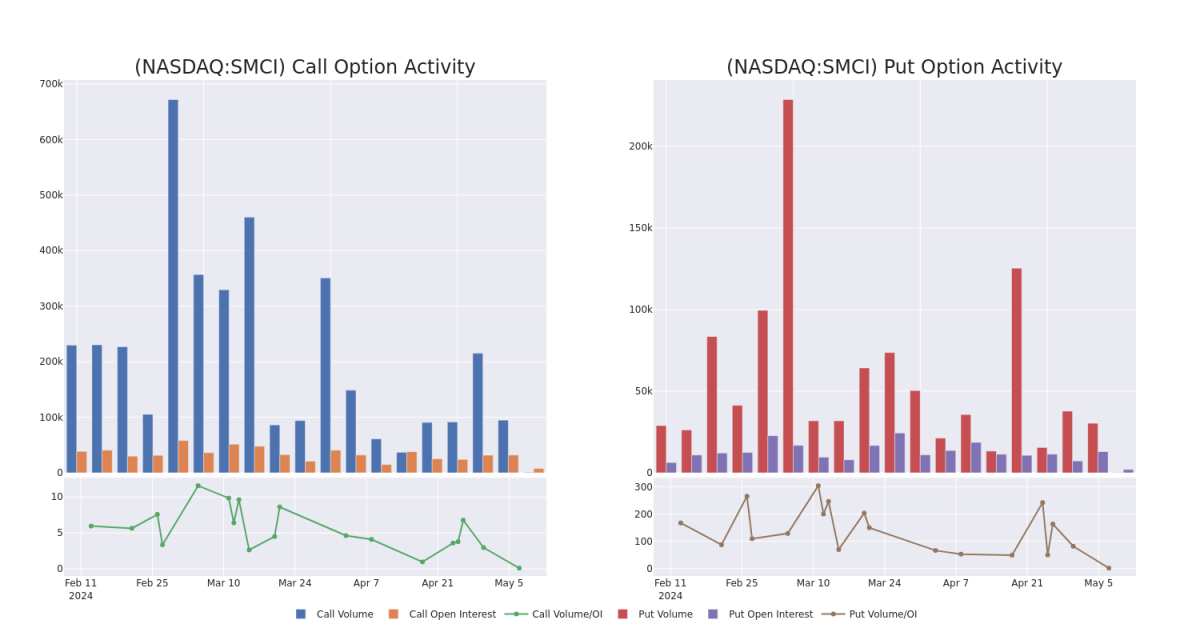

In terms of liquidity and interest, the mean open interest for Super Micro Computer options trades today is 700.64 with a total volume of 993.00.

就流動性和利息而言,今天超級微電腦期權交易的平均未平倉合約爲700.64,總交易量爲993.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Super Micro Computer's big money trades within a strike price range of $720.0 to $1500.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天在720.0美元至1500.0美元行使價區間內的Super Micro Computer大額資金交易的看漲期權和未平倉合約的發展情況。

Super Micro Computer Option Volume And Open Interest Over Last 30 Days

過去 30 天的超級微電腦期權交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | TRADE | BEARISH | 07/19/24 | $96.5 | $94.0 | $96.5 | $820.00 | $144.7K | 59 | 15 |

| SMCI | CALL | SWEEP | BEARISH | 05/17/24 | $30.5 | $29.0 | $29.0 | $850.00 | $116.0K | 1.8K | 61 |

| SMCI | PUT | TRADE | NEUTRAL | 05/17/24 | $685.7 | $672.2 | $677.82 | $1500.00 | $67.7K | 2 | 2 |

| SMCI | PUT | TRADE | BULLISH | 01/17/25 | $290.2 | $287.0 | $287.0 | $1000.00 | $57.4K | 79 | 0 |

| SMCI | CALL | TRADE | BULLISH | 05/10/24 | $11.8 | $11.0 | $11.48 | $850.00 | $47.0K | 2.4K | 106 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | 放 | 貿易 | 粗魯的 | 07/19/24 | 96.5 美元 | 94.0 美元 | 96.5 美元 | 820.00 美元 | 144.7 萬美元 | 59 | 15 |

| SMCI | 打電話 | 掃 | 粗魯的 | 05/17/24 | 30.5 美元 | 29.0 美元 | 29.0 美元 | 850.00 美元 | 116.0 萬美元 | 1.8K | 61 |

| SMCI | 放 | 貿易 | 中立 | 05/17/24 | 685.7 美元 | 672.2 美元 | 677.82 美元 | 1500.00 美元 | 67.7 萬美元 | 2 | 2 |

| SMCI | 放 | 貿易 | 看漲 | 01/17/25 | 290.2 美元 | 287.0 美元 | 287.0 美元 | 1000.00 美元 | 57.4 萬美元 | 79 | 0 |

| SMCI | 打電話 | 貿易 | 看漲 | 05/10/24 | 11.8 美元 | 11.0 美元 | 11.48 美元 | 850.00 美元 | 47.0 萬美元 | 2.4K | 106 |

About Super Micro Computer

關於超級微型計算機

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Super Micro Computer Inc爲雲計算、數據中心、大數據、高性能計算和 “物聯網” 嵌入式市場提供高性能的服務器技術服務。其解決方案包括服務器、存儲、刀片和工作站到完整機架、網絡設備和服務器管理軟件。該公司採用模塊化架構方法,爲交付定製解決方案提供了靈活性。該公司在一個運營領域開展業務,該業務部門基於創新、模塊化和開放標準架構開發和提供高性能服務器解決方案。該公司一半以上的收入來自美國,其餘來自歐洲、亞洲和其他地區。

In light of the recent options history for Super Micro Computer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Super Micro Computer最近的期權歷史,現在應該將重點放在公司本身上。我們的目標是探索其目前的表現。

Present Market Standing of Super Micro Computer

超級微型計算機目前的市場地位

- With a volume of 264,947, the price of SMCI is down -2.18% at $812.25.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 91 days.

- SMCI的交易量爲264,947美元,下跌了-2.18%,至812.25美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在91天后公佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Super Micro Computer with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用 Benzinga Pro 了解超級微電腦的最新期權交易,以獲得實時警報。