There will be major policies in the future

As a representative of new quality productivity, the synthetic biology concept has recently caught fire.

However, the synthetic biology sector experienced a divergence of markets today, and the stock prices of many connected stocks fell.

Leading company Blue Biotech continues to rise and fall. Currently, the amount of orders closed is 569 million yuan, and the turnover is 68.41 million yuan.

The stock was flat for the past four trading days, with a cumulative increase of 61% over the five trading days. It can be seen that capital is looking for it.

Fujilai has 3 consecutive boards. The current order amount is 95.08 million yuan, and the turnover is 253 million yuan.

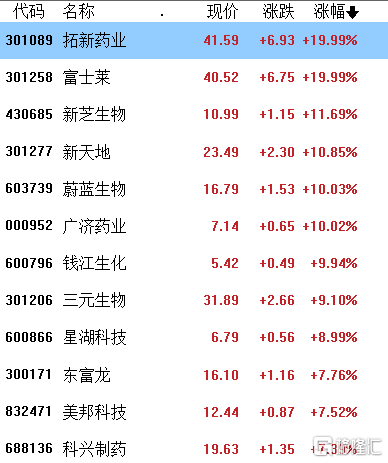

Tuoxin Pharmaceutical's 20CM first board went up and down. Qianjiang Biochemical's market was on the same page. Xinzhi Biotech and Xintiandi rose more than 10%, Sanyuan Biotech rose more than 9%, and Xinghu Technology rose nearly 9%.

On the other hand, yesterday, Shengda Biotech once fell by more than 6% in 4 days, but has now rebounded to an increase of 1.27% to 14.34 yuan/share, with a turnover of 316 million yuan.

The 2-game Bohn Group once fell nearly 4%, but now it has risen slightly by 0.13% to 15.05 yuan/share.

The stock price of Chuan Ning Biotech hit a new high of 17.05 yuan/share and then declined. Currently, it has risen 3.35%, with a turnover of 2,408 billion yuan.

Lukang Pharmaceutical hit a new high of 8.49 yuan/share, then declined and is now up 1.78%.

After hitting a new high yesterday, Jia Biyou fell more than 3% today.

Intensive announcements from listed companies

After the stock price soared, a number of companies issued intensive announcements warning of risks and indicated that the company's synthetic biology projects did not yet have the conditions for industrialization.

Among them,Blue creatureRisk warning notices were issued on May 1 and May 7, respectively, stating that the company's main business is R&D, production and sales of enzyme preparations, microecological preparations, and animal health products.

The synthetic biotechnology innovation laboratory disclosed in the previous periodic report is mainly used to develop functional proteins, sweeteners, etc., but there are few reserved R&D projects and the investment amount is small. Currently, it is still in the early stages of research and development, and the conditions for industrialization are not yet in place.

FujilaiThe announcement stated that bioenzymatic catalysis is a development trend in the preparation of R-lipoic acid. R-lipoic acid produced by the company's bioenzymatic catalysis method has been mass-produced, and is mainly used for external sales and preparation of R-lipoic acid sodium salt.

Currently, it is still in the marketing stage, and whether it can completely replace the original process depends on various factors such as market demand and customer acceptance. In 2023, the company's revenue from this type of business accounts for no more than 3% of the company's revenue, which is relatively small, and there are no clear plans to expand production.

Shengda CreaturesIt said that the synthetic biology platform disclosed earlier by the company currently has a platform for strain construction, high-throughput screening, testing and fermentation.

The “Full Biosynthesis Technology and Green Manufacturing Demonstration for Major Vitamin Products” project jointly developed by the company and Zhejiang University aims to solve the problems of using toxic chemicals and high risk levels in traditional D-biotin production processes. At present, it has passed small test verification and fermentation process optimization, and has obtained 1 invention patent, but the conditions for industrialization are not yet in place.

Lu Kang PharmaceuticalHe said that the company's current production and operation activities are normal, there have been no major changes in the daily business situation, no major adjustments have been made to the market environment or industry policies, and the internal production and operation order is normal.

The company's main business includes R&D, production and sales of pharmaceutical products. The products mainly involve human antibiotics, veterinary agricultural antibiotics, cardiovascular, digestive, endocrine and respiratory drugs, etc. Currently, there have been no major changes in the product structure and main business.

Boen Group, Xinghu Technology, Jia Biyou, Twining BiotechHowever, the relevant business was not mentioned in the announcement; it only indicates that the current business situation is normal, and there are no major changes in the internal or external business environment or are expected to occur.

Agency: There is still room

In the short term, after a period of recent rise, synthetic organisms have shown signs of differentiation.

Currently, institutions are generally optimistic about future policy catalysts for synthetic biology, and it is also a new kind of productivity. Relevant sectors are expected to replicate the trend of the low-altitude economy.

Earlier, Tan Tianwei, an Academician of the Chinese Academy of Engineering, revealed that under the leadership of the Development and Reform Commission, the Ministry of Industry and Information Technology and the Ministry of Science and Technology, and other national ministries and departments are jointly developing a national biotechnology and biomanting action plan, which is expected to be introduced in the near future. “Biomedicine +” is a key element of it.

In terms of fundamentals, CITIC Securities believes that in 2024, major synthetic biology companies are expected to launch new products and new production capacity. As the volume of new products and new production capacity climbs,The revenue and profits of related companies are expected to maintain a steady growth trend.

With the subsequent catalysis of major policies, the sector's valuation level is expected to continue to recover. Currently, the core competitiveness of biological manufacturing companies lies in product development and implementation capabilities, and they are optimistic about targets with successful cases, leading positions, high-quality product reserves, and a boom in downstream demand.

Western Securities believes thatSynthetic biology has plenty of room for imagination, policy expectations are not yet full, and there is still room for the market to ferment.Synthetic biology is still in the early stages of industrialization, and Chinese companies are expected to become globally competitive companies with synthetic biological products/cost advantages.

Western Securities suggests focusing on segments with leading costs or high added value/strong industrialization capabilities. The core targets include Kaisai Biotech (long-chain binary acid) and Huaheng Biotech(Alanine), Channing Biotech (active drug), Huada Intelligent Manufacturing (genetic sequencing), Jinsirui (gene synthesis), Huaxi Biotech (sodium hyaluronate), in addition, focus on Berry Gene (genetic testing), Blue Bio (enzyme preparation), Xinghu Technology (food additives, etc.), Lukang Pharmaceutical (plasticizer), and Giant Bio, Jinbo Bio (leading recombinant collagen), etc.