Marssenger Kitchenware Co., Ltd. (SZSE:300894) shares have continued their recent momentum with a 28% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 34% in the last twelve months.

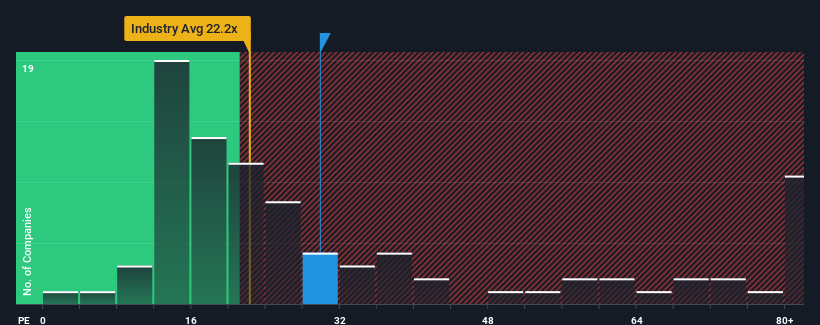

Although its price has surged higher, there still wouldn't be many who think Marssenger Kitchenware's price-to-earnings (or "P/E") ratio of 29.8x is worth a mention when the median P/E in China is similar at about 32x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Marssenger Kitchenware could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Does Growth Match The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Marssenger Kitchenware's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 39% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Shifting to the future, estimates from the nine analysts covering the company suggest earnings should grow by 17% each year over the next three years. That's shaping up to be materially lower than the 25% per annum growth forecast for the broader market.

In light of this, it's curious that Marssenger Kitchenware's P/E sits in line with the majority of other companies. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Marssenger Kitchenware appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Marssenger Kitchenware currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Marssenger Kitchenware (including 1 which doesn't sit too well with us).

If you're unsure about the strength of Marssenger Kitchenware's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.