Financial giants have made a conspicuous bearish move on Gilead Sciences. Our analysis of options history for Gilead Sciences (NASDAQ:GILD) revealed 13 unusual trades.

Delving into the details, we found 38% of traders were bullish, while 61% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $274,737, and 7 were calls, valued at $398,087.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $55.0 to $77.5 for Gilead Sciences over the last 3 months.

Volume & Open Interest Development

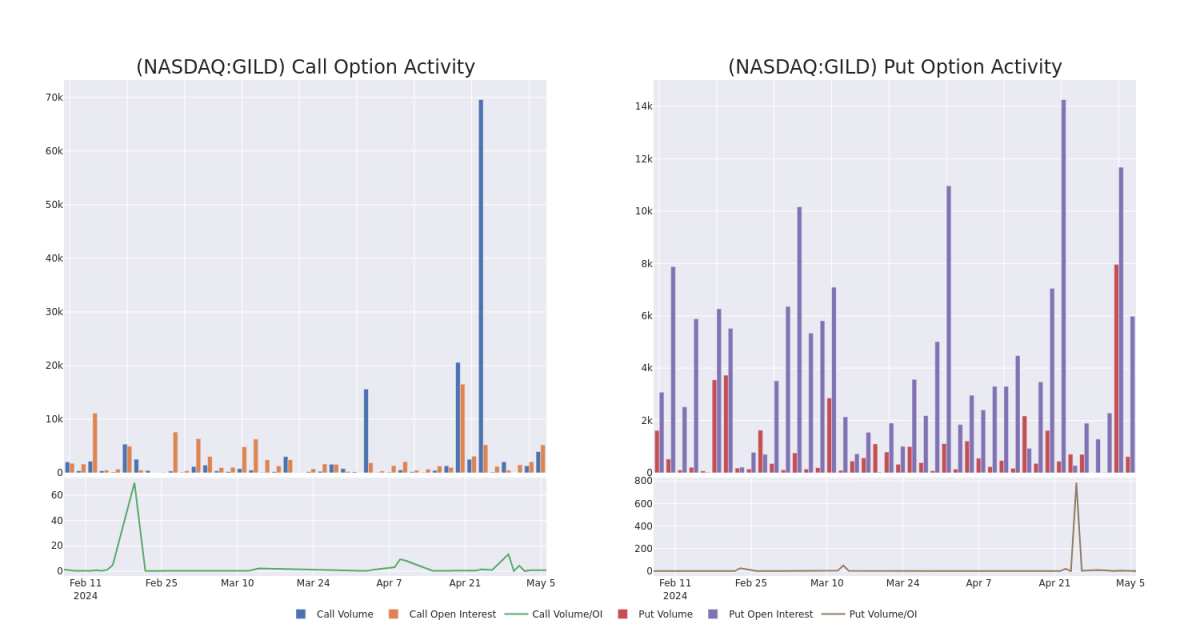

In today's trading context, the average open interest for options of Gilead Sciences stands at 860.38, with a total volume reaching 4,585.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Gilead Sciences, situated within the strike price corridor from $55.0 to $77.5, throughout the last 30 days.

Gilead Sciences Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GILD | CALL | SWEEP | BULLISH | 07/19/24 | $2.27 | $2.13 | $2.26 | $65.00 | $129.1K | 579 | 572 |

| GILD | CALL | TRADE | BEARISH | 06/21/24 | $5.55 | $5.45 | $5.47 | $60.00 | $109.4K | 172 | 200 |

| GILD | PUT | SWEEP | BEARISH | 06/20/25 | $2.8 | $2.42 | $2.8 | $55.00 | $74.4K | 768 | 173 |

| GILD | PUT | SWEEP | BEARISH | 08/16/24 | $4.85 | $4.75 | $4.85 | $67.50 | $51.8K | 1.4K | 108 |

| GILD | PUT | SWEEP | BEARISH | 08/16/24 | $2.17 | $2.16 | $2.17 | $62.50 | $41.6K | 2.0K | 232 |

About Gilead Sciences

Gilead Sciences develops and markets therapies to treat life-threatening infectious diseases, with the core of its portfolio focused on HIV and hepatitis B and C. The acquisitions of Corus Pharma, Myogen, CV Therapeutics, Arresto Biosciences, and Calistoga have broadened this focus to include pulmonary and cardiovascular diseases and cancer. Gilead's acquisition of Pharmasset brought rights to hepatitis C drug Sovaldi, which is also part of combination drug Harvoni, and the Kite, Forty Seven, and Immunomedics acquisitions boost Gilead's exposure to cell therapy and noncell therapy in oncology.

Gilead Sciences's Current Market Status

- Trading volume stands at 3,631,936, with GILD's price up by 0.63%, positioned at $65.19.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 87 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.