Spot gold weakened slightly during the Asian session on Monday (May 6) and is currently trading around US$2293.76 per ounce. Although US employment data was weaker than expected, gold fell to a one-month low last Friday, continuing the corrective trend entered after last month's sharp rise, as investors' profits settled and geopolitical risks mitigated.

According to the survey, the bullish sentiment for gold has cooled down. Most analysts believe that the price of gold will tend to fluctuate and consolidate in the coming week. However, most retail investors still tend to be bullish on the gold market in the future.

The price of gold rose to 2320.78 US dollars after the release of data showing that the number of non-farm payrolls in the US increased by 175,000 last month, lower than the 243,000 forecast by economists, but it quickly returned to the increase.

Tai Wong, an independent metals trader in New York, said, “Gold surged in response to the release of a balanced and favorable employment report, which attracted a significant amount of profit backlash. This shows that bulls are becoming more cautious after experiencing a significant rebound in April, and the reaction after Powell's friendly remarks on Wednesday was quite average.”

Although employment data reinforces expectations that the Federal Reserve will start cutting interest rates this year, which should support non-yielding gold, this has instead prompted investors to switch to riskier assets.

Driven by the outbreak of the situation in the Middle East and strong buying by the central bank, the price of gold reached a record high of 2431.41 US dollars in April. Since then, safe-haven gold has fallen 5.7%, or about 140 US dollars.

US employment and wage growth both slowed in April, which may give the Federal Reserve a sigh of relief

US Federal Reserve (Fed/FED) officials, who have been worried that the economy may overheat again in recent months, breathed a sigh of relief on Friday. The April employment report released earlier showed that wage growth had cooled down markedly, and the pace of recruitment was close to pre-COVID-19 levels.

The US added 175,000 new jobs in April, the lowest in more than a year. The average hourly wage rose 3.9% year on year, the smallest increase since May 2021, and continued to fall towards a range of around 3.5%. This is a level that policymakers believe is in line with their 2% inflation target.

Chicago Federal Reserve Chairman Goulsby said that judging from the number of jobs created, this is still a “steady” report, but this is more like the level of employment growth before the COVID-19 pandemic, thus strengthening confidence that the economy will not overheat again.

Goulsby told Bloomberg TV: “The more employment data like today, the more you'll see an easing in inflation, and the more relieved I feel...”

However, he did not say whether he expected the Federal Reserve to cut interest rates this year. Inflation “experienced some twists and turns at the beginning of this year,” he said. “We have to be sure that this is not a sign of a renewed acceleration in inflation.”

Federal Reserve Governor Bowman, who has always advocated taking positive action to control inflation, said after the data was released that her forecast is still “with policy interest rates remaining stable, inflation will fall further.”

Bauman and other Federal Open Market Committee (FOMC) members responsible for policy formulation decided earlier this week to keep the policy interest rate target range unchanged at the current 5.25%-5.50% range.

After the employment data was released, traders increased their bets that the Federal Reserve would cut interest rates for the first time this year in September and possibly for the second time in December. Both of these possibilities have recently declined, as inflation data is higher than expected, and Federal Reserve officials pointed out at the April 30 to May 1 meeting that there has been a lack of progress recently in reducing inflation.

Other recent data, such as a slowdown in overall output, is thought to mask strong potential demand, while weak productivity data for the first three months of this year suggest that a key force helping to slow inflation may have little effect in the coming months.

However, Federal Reserve Chairman Powell listed a series of indicators at the post-meeting press conference last Wednesday. He believes that these indicators indicate that the labor market is trending towards a better balance between employers' recruitment needs and the number of job seekers.

Job vacancy data, worker resignation rates, and corporate recruitment rates all indicate a slowdown in the labor market.

Powell said that in a survey of workers and businesses, the number of respondents who thought it was easy to find jobs or fill job vacancies “has fallen back to pre-COVID-19 levels.”

The increase in jobs in April fell far short of the 243,000 jobs expected by economists. However, the April increase may also make Powell and his colleagues think it has boosted their hopes for a “soft landing.”

The unemployment rate rose 0.1 percentage points to 3.9% in April, but is still below 4.1%, which is the median level that Federal Reserve officials believe is in line with the 2% inflation target.

Employment growth in April was close to the monthly average of 183,000 in the ten years before the pandemic, and higher than the 100,000 that policymakers thought would be needed to keep up with population growth.

Thomas Simons, senior US economist at Jefferies, said, “The monthly growth rate of 175,000 units is still sufficient to absorb the new labor force and maintain a low unemployment rate.”

There is little hope for a cease-fire in Gaza, Hamas officials leave Cairo but will return on Tuesday

Hamas on Sunday reiterated its demand for an end to the war in exchange for the release of the hostages, and Israeli Prime Minister Binyamin Netanyahu flatly rejected the demand, and the prospects for a cease-fire in Gaza seem slim.

The two sides accuse each other of causing an impasse, and the Hamas delegation said it would leave the Cairo cease-fire negotiations site on Sunday night to discuss with its leadership. However, two Egyptian security sources said Hamas officials plan to return to Cairo on Tuesday.

Palestinian officials said that during talks with Egyptian and Qatari mediators the next day, Hamas negotiators insisted on their position that any armistice agreement must end the war.

Israeli officials did not go to Cairo to participate in indirect negotiations, but on Sunday Netanyahu reiterated Israel's goal in the nearly seven months since the war began: to permanently disarm and disband Hamas; otherwise, it would endanger Israel's future security. He said Israel is willing to suspend fighting in Gaza to ensure the release of the hostages still being held by Hamas. There are believed to be more than 130 hostages.

“Despite Israel's will, Hamas persists in its extreme position. The first is to demand that we withdraw all our forces from the Gaza Strip, end the war, and let Hamas take power,” Netanyahu said. “Israel cannot accept this demand.”

An official with knowledge of the talks told Reuters, “The latest round of mediation in Cairo almost collapsed.

On Sunday, the Hamas armed group claimed responsibility for the attack on the Kerem Shalom crossing into Gaza. Israel said the attack killed three Israeli soldiers.

According to the Israeli military, 10 rockets were fired from Rafah in southern Gaza into the crossing area and the crossing was closed. Other crossing points remain open.

The Hamas armed group said they fired rockets at an Israeli military base near the crossing point, but it was not confirmed where they were fired. Hamas media quoted a source close to the group as saying that the attack was not aimed at commercial transit

Palestinian medical workers said that soon after Hamas launched an attack, Israel launched an air attack on a house in Rafah, killing three people and injuring several others.

The Israeli military confirmed this counterattack, saying it hit a Hamas rocket launcher and a nearby “military building.”

Future market outlook: Most analysts are bearish on the future market

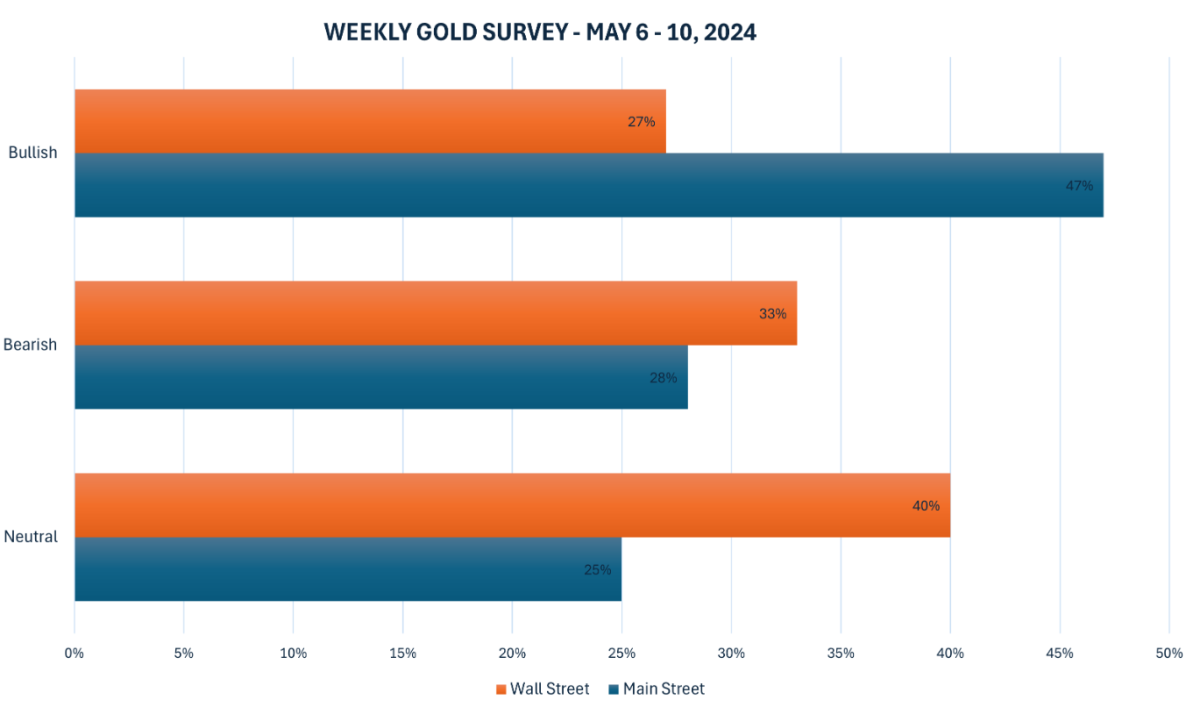

Last week, 15 Wall Street analysts participated in the Kitco News gold survey. After two weeks of downward consolidation, most people believe that the price of gold will decline further in the near future. onlyFour experts (or 27%) expect the price of gold to rise in the coming week, while five analysts (or 33%) predict that the price of gold will fall. Six experts (or 40% of respondents) believe that gold will move sideways.

Meanwhile, a total of 217 votes were cast in Kitco's online poll, and 102 retail traders (47%) expect gold prices to rise in the coming week. Another 61 respondents (or 28%) expect gold prices to fall, while 54 respondents (or 25%) expect precious metals to move sideways in the coming week.

This week will be the week with the fewest economic data releases this year. Key highlights include Wednesday's 10-year bond auction, the Bank of England's monetary policy decision and the US Treasury's 30-year bond auction on Thursday, and preliminary consumer confidence data from the University of Michigan released on Friday.

Marc Chandler, managing director of Bannockburn Global Forex, believes that the balance of recent transactions will tend to decline because he expects demand from Asia to fall. “Gold prices have been consolidating in recent days. The key question is whether to consolidate the pattern or bottoming out,” he said. “I doubt that gold may fall again to $2250-60.”

He added, “It should also be noted that the Hong Kong stock market and the mainland stock market traded in Hong Kong have risen sharply in the past week and a half, which may reduce the urgency for some investors to seek safe haven in gold. A recovery in the yen may also slow down local demand.”

Darin Newsom, senior market analyst at Barchart, pointed out that the bulls are a bit exhausted, and he thinks this is understandable given the recent rise in gold prices.

He believes that June gold futures were close to ending the short-term downtrend at noon last Friday, which means that a bullish technical reversal may occur on Monday. The market is technically oversold in the short term. “The short-term downside target for gold futures remains $2,268 per ounce.” (Note: Gold futures closed at around 2310 last Friday.) However, he stressed that there are still many medium- to long-term factors supporting gold demand.

Jim Wyckoff, senior analyst at Kitco, said that technical aspects will still support higher gold prices in the coming week. “Since the chart is generally bullish, it is moving steadily higher”.

At 08:09 Beijing time, the current price of spot gold was 2294.35 US dollars/ounce.