Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that BigBear.ai Holdings, Inc. (NYSE:BBAI) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

How Much Debt Does BigBear.ai Holdings Carry?

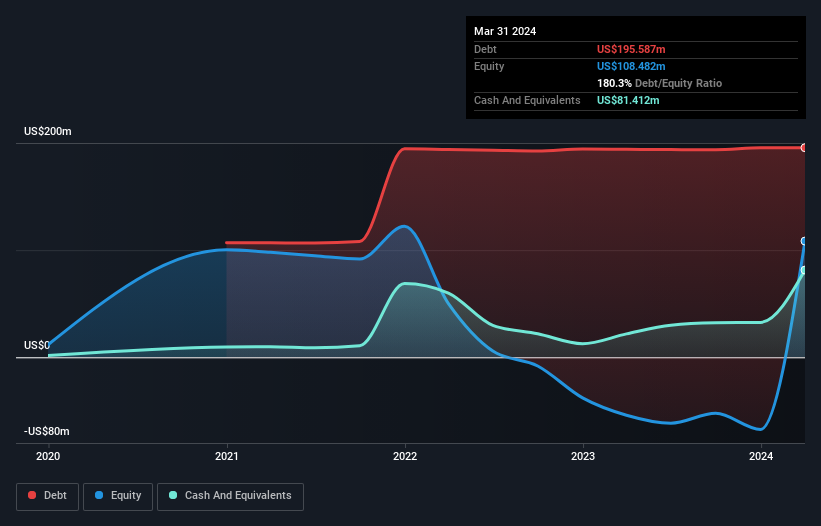

As you can see below, BigBear.ai Holdings had US$195.6m of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. On the flip side, it has US$81.4m in cash leading to net debt of about US$114.2m.

How Strong Is BigBear.ai Holdings' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that BigBear.ai Holdings had liabilities of US$63.1m due within 12 months and liabilities of US$206.1m due beyond that. On the other hand, it had cash of US$81.4m and US$39.0m worth of receivables due within a year. So its liabilities total US$148.8m more than the combination of its cash and short-term receivables.

While this might seem like a lot, it is not so bad since BigBear.ai Holdings has a market capitalization of US$425.7m, and so it could probably strengthen its balance sheet by raising capital if it needed to. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if BigBear.ai Holdings can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, BigBear.ai Holdings made a loss at the EBIT level, and saw its revenue drop to US$146m, which is a fall of 9.1%. We would much prefer see growth.

Caveat Emptor

Over the last twelve months BigBear.ai Holdings produced an earnings before interest and tax (EBIT) loss. Indeed, it lost US$35m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. Another cause for caution is that is bled US$26m in negative free cash flow over the last twelve months. So in short it's a really risky stock. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 4 warning signs we've spotted with BigBear.ai Holdings (including 2 which are significant) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.