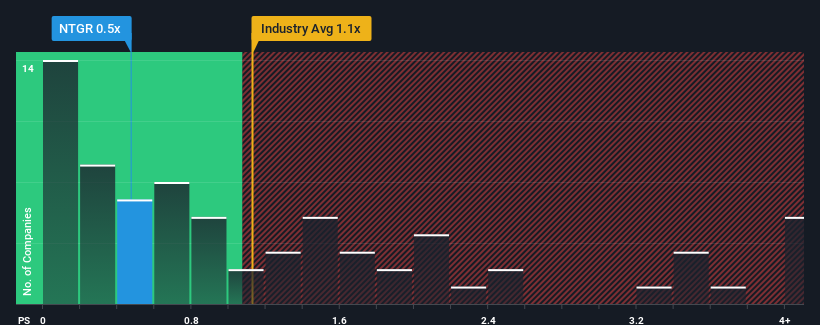

When you see that almost half of the companies in the Communications industry in the United States have price-to-sales ratios (or "P/S") above 1.1x, NETGEAR, Inc. (NASDAQ:NTGR) looks to be giving off some buy signals with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

What Does NETGEAR's P/S Mean For Shareholders?

While the industry has experienced revenue growth lately, NETGEAR's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think NETGEAR's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For NETGEAR?

In order to justify its P/S ratio, NETGEAR would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 20%. As a result, revenue from three years ago have also fallen 46% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 5.1% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.7%, which is noticeably less attractive.

With this information, we find it odd that NETGEAR is trading at a P/S lower than the industry. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What Does NETGEAR's P/S Mean For Investors?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

NETGEAR's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Before you take the next step, you should know about the 1 warning sign for NETGEAR that we have uncovered.

If you're unsure about the strength of NETGEAR's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.