Some Hudson Technologies, Inc. (NASDAQ:HDSN) Analysts Just Made A Major Cut To Next Year's Estimates

Some Hudson Technologies, Inc. (NASDAQ:HDSN) Analysts Just Made A Major Cut To Next Year's Estimates

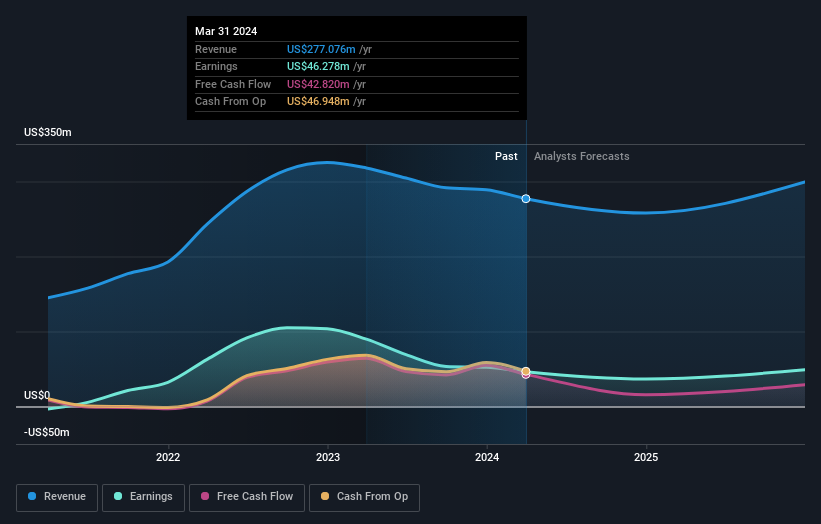

The latest analyst coverage could presage a bad day for Hudson Technologies, Inc. (NASDAQ:HDSN), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting the analysts have soured majorly on the business.

分析師的最新報道可能預示着哈德遜科技公司(納斯達克股票代碼:HDSN)將迎來糟糕的一天,分析師全面下調了法定估計,這可能會讓股東感到震驚。收入和每股收益(EPS)的預測都出現了偏差,這表明分析師對該業務的表現主要不佳。

Following the downgrade, the consensus from four analysts covering Hudson Technologies is for revenues of US$258m in 2024, implying a perceptible 6.9% decline in sales compared to the last 12 months. Statutory earnings per share are supposed to dive 21% to US$0.80 in the same period. Previously, the analysts had been modelling revenues of US$288m and earnings per share (EPS) of US$0.97 in 2024. Indeed, we can see that the analysts are a lot more bearish about Hudson Technologies' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

評級下調後,四位涵蓋哈德森科技的分析師一致認爲,2024年的收入爲2.58億美元,這意味着與過去12個月相比,銷售額將明顯下降6.9%。同期,法定每股收益預計將下降21%,至0.80美元。此前,分析師一直在模擬2024年的收入爲2.88億美元,每股收益(EPS)爲0.97美元。事實上,我們可以看出,分析師對哈德森科技的前景更加悲觀,他們認爲收入預期大幅下降,並下調了每股收益預期。

The consensus price target fell 21% to US$11.67, with the weaker earnings outlook clearly leading analyst valuation estimates.

共識目標股價下跌21%,至11.67美元,盈利前景疲軟顯然領先於分析師的估值預期。

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 9.1% by the end of 2024. This indicates a significant reduction from annual growth of 18% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 5.7% annually for the foreseeable future. So although its revenues are forecast to shrink, this cloud does not come with a silver lining - Hudson Technologies is expected to lag the wider industry.

我們可以從大局的角度看待這些估計值的另一種方式,例如預測如何與過去的表現相提並論,以及預測相對於業內其他公司是否或多或少看漲。這些估計表明,預計銷售將放緩,預計到2024年底,年化收入將下降9.1%。這表明與過去五年的18%的年增長率相比大幅下降。相比之下,我們的數據表明,在可預見的將來,預計同一行業的其他公司(有分析師報道)的收入每年將增長5.7%。因此,儘管預計其收入將萎縮,但這種雲並沒有帶來一線希望——預計哈德森科技將落後於整個行業。

The Bottom Line

底線

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After such a stark change in sentiment from analysts, we'd understand if readers now felt a bit wary of Hudson Technologies.

要了解的最重要的一點是,分析師下調了每股收益預期,預計業務狀況將明顯下降。遺憾的是,他們還下調了收入預期,最新的預測表明該業務的銷售增長將慢於整個市場。在分析師的情緒發生瞭如此明顯的變化之後,我們可以理解讀者現在是否對哈德森科技有些警惕。

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. At Simply Wall St, we have a full range of analyst estimates for Hudson Technologies going out to 2025, and you can see them free on our platform here.

即便如此,業務的長期發展軌跡對於股東的價值創造更爲重要。在Simply Wall St,我們有分析師對哈德遜科技到2025年的全方位估計,你可以在我們的平台上免費看到這些估計。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

當然,看到公司管理層將大量資金投資於股票與了解分析師是否在下調預期一樣有用。因此,您可能還希望搜索這份內部人士正在購買的免費股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?對內容感到擔憂?直接聯繫我們。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St的這篇文章本質上是籠統的。我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。它不構成買入或賣出任何股票的建議,也沒有考慮到您的目標或財務狀況。我們的目標是爲您提供由基本數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感型公司公告或定性材料。簡而言之,華爾街沒有持有任何上述股票的頭寸。