About Japanese stocks, Apple, oil stocks...

From May 3 to 5, local time, the “Investment Community Spring Festival Gala” and the annual Berkshire Hathaway Shareholders' Meeting will be held.

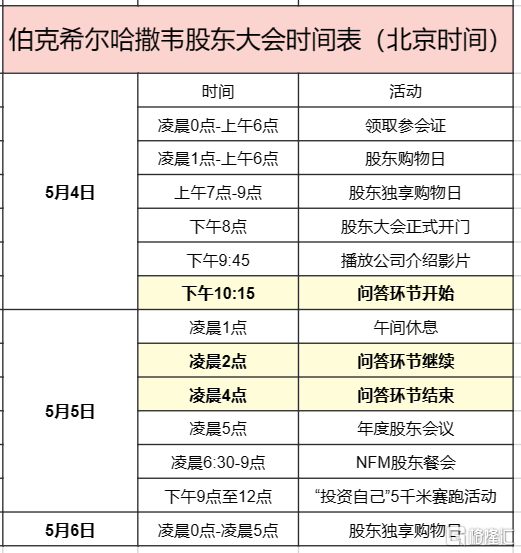

The shareholders' meeting will still last for three days. The first day, May 3, is an investors' shopping event.

May 4 was Buffett's Q&A session and shareholders' dinner. It was also a top priority of this event.It is reported that the session will be webcast in English and Mandarin Chinese on CNBC.com.

May 5 is the “Invest in Yourself” 5-kilometer jogging event. Previously, Buffett would be there to fire the gun.

At the same time,Berkshire will also release earnings for the first quarter.

Shareholders' meetings without Munger

For investors, Buffett's annual Q&A session is something everyone must pay attention to.

Beginning at 10:15 p.m. Beijing time on the 4th, Buffett will join the company's CEO's successor Greg Abel (Greg Abel), head of Berkshire's non-insurance business, and Ajit Jain (Ajit Jain), head of the insurance business, to answer questions from shareholders.

As is customary, Buffett's question-and-answer session will be at least 5 hours long, involving 40 to 60 questions.

In the past, Buffett and Munger attended this session together every year. However, since Munger has passed away, images of the two answering questions together have become a thing of the past, and Buffett is now almost 94 years old.

Buffett revealed that both Abel and Jain will attend the morning half of this year's Q&A session; only he and Abel will answer questions in the afternoon.

Previously, Buffett not only shared his investment experience, but also often talked about his thoughts on life.

A few highlights

In this year's Q&A session, outsiders speculated that Buffett's answers included the following highlights.

About huge amounts of cash

According to Berkshire's earnings report, as of the fourth quarter of last year, the company's cash reserves rose to a record high of 167.6 billion US dollars, equivalent to about 1.2 trillion yuan.

How this huge amount of cash flow will be used will be the focus of investors' attention.

About Japanese stocks

Previously, Buffett operated frequently in Japan, first raising the shareholding ratio of Japan's top five trading companies to 9%, and recentlyNew yen bonds were issued to raise 263.3 billion yen.

Since last year, with Buffett's support, Japanese stocks have frequently reached new highs before, but have recently declined somewhat. Buffett's next movements may continue to affect the trend of Japanese stocks.

Therefore, the market is very concerned about Buffett's next move in Japan.

About Apple

To the surprise of the market, Berkshire unusually reduced its Apple stock holdings by 10 million shares in the fourth quarter of last year. However, Apple is still Berkshire's biggest stock.

At last year's shareholders' meeting, Buffett reflected that it was “very foolish” to reduce his Apple holdings in 2020.

After a few months, he reduced his holdings again. I don't know if his opinion on Apple has changed. The reason behind this operation is also thought-provoking.

About oil stocks

Berkshire continues to increase its holdings in oil stocks such as Chevrolet and Occidental Petroleum. Currently, Buffett's shareholding ratio in Occidental Petroleum has risen to 34%, and in the fourth quarter of last year, it also increased its position by 15.845 million Chevrolet shares.

About the Federal Reserve's monetary policy

At the May meeting,The Federal Reserve kept the benchmark interest rate unchanged in the 5.25%-5.50% range for the 6th time in a rowAt the same time, the scale of treasury debt contraction will slow down starting in June, from 60 billion US dollars per month to 25 billion US dollars. The downturn has slightly exceeded expectations.

Meanwhile, Powell denied the possibility of interest rate hikes and said that if inflation persists and the labor market remains strong, then it may be appropriate to delay interest rate cuts, but there are other paths that may point to interest rate cuts.

Buffett's outlook on the Federal Reserve's monetary policy and the US economy will be the focus of investors' attention.

About the Chinese market

Recently, many foreign investment banks have taken advantage of the Chinese market, and Hong Kong stocks and A shares all experienced sharp increases before the May 1st holiday.

During the May Day holiday, US stocks surged, RMB appreciated, and Hong Kong stocks surged.

Overnight, the Nasdaq China Golden Dragon Index rose more than 6%, closing high since the end of November last year, and the biggest one-day increase since the end of July last year.

This morning, the offshore renminbi rose above the 7.19 mark against the US dollar.

I don't know how Buffett will take a stand on the future development of Chinese assets.

About AI

At last year's shareholders' meeting, Buffett once expressed his concerns about AI, saying that AI reminded him of the invention of the atomic bomb. “AI can do almost anything, which makes me a little worried.”

In the first quarter of this year, tech giants such as Amazon, Microsoft, Google, and Meta have all indicated that they will increase their annual capital expenditure and mainly invest in AI.

I don't know if Buffett's views on AI have changed after a year of development.