Shareholders didn't seem to be thrilled with Nacity Property Service Group Co.,Ltd.'s (SHSE:603506) recent earnings report, despite healthy profit numbers. Our analysis has found some concerning factors which weaken the profit's foundation.

Zooming In On Nacity Property Service GroupLtd's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. Notably, there is some academic evidence that suggests that a high accrual ratio is a bad sign for near-term profits, generally speaking.

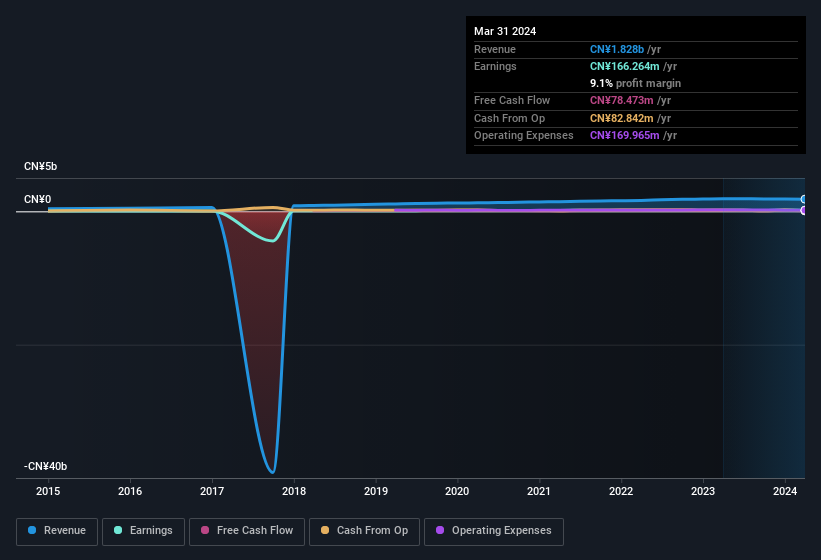

For the year to March 2024, Nacity Property Service GroupLtd had an accrual ratio of 0.29. Unfortunately, that means its free cash flow was a lot less than its statutory profit, which makes us doubt the utility of profit as a guide. In fact, it had free cash flow of CN¥78m in the last year, which was a lot less than its statutory profit of CN¥166.3m. Nacity Property Service GroupLtd shareholders will no doubt be hoping that its free cash flow bounces back next year, since it was down over the last twelve months. However, that's not all there is to consider. We can see that unusual items have impacted its statutory profit, and therefore the accrual ratio. The good news for shareholders is that Nacity Property Service GroupLtd's accrual ratio was much better last year, so this year's poor reading might simply be a case of a short term mismatch between profit and FCF. Shareholders should look for improved cashflow relative to profit in the current year, if that is indeed the case.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Nacity Property Service GroupLtd.

How Do Unusual Items Influence Profit?

Given the accrual ratio, it's not overly surprising that Nacity Property Service GroupLtd's profit was boosted by unusual items worth CN¥109m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we crunched the numbers on thousands of publicly listed companies, we found that a boost from unusual items in a given year is often not repeated the next year. And that's as you'd expect, given these boosts are described as 'unusual'. Nacity Property Service GroupLtd had a rather significant contribution from unusual items relative to its profit to March 2024. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On Nacity Property Service GroupLtd's Profit Performance

Summing up, Nacity Property Service GroupLtd received a nice boost to profit from unusual items, but could not match its paper profit with free cash flow. For the reasons mentioned above, we think that a perfunctory glance at Nacity Property Service GroupLtd's statutory profits might make it look better than it really is on an underlying level. With this in mind, we wouldn't consider investing in a stock unless we had a thorough understanding of the risks. Case in point: We've spotted 2 warning signs for Nacity Property Service GroupLtd you should be mindful of and 1 of these bad boys shouldn't be ignored.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.