Check Out What Whales Are Doing With Energy Transfer

Check Out What Whales Are Doing With Energy Transfer

Benzinga's options scanner just detected over 8 options trades for Energy Transfer (NYSE:ET) summing a total amount of $349,095.

Benzinga的期權掃描儀剛剛發現了超過8筆Energy Transfer(紐約證券交易所代碼:ET)的期權交易,總金額爲349,095美元。

At the same time, our algo caught 2 for a total amount of 125,880.

同時,我們的算法捕獲了2個,總金額爲125,880個。

What's The Price Target?

目標價格是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $12.0 to $30.0 for Energy Transfer during the past quarter.

分析這些合約的交易量和未平倉合約,看來大型企業一直在考慮將能源轉移的價格範圍從12.0美元到30.0美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

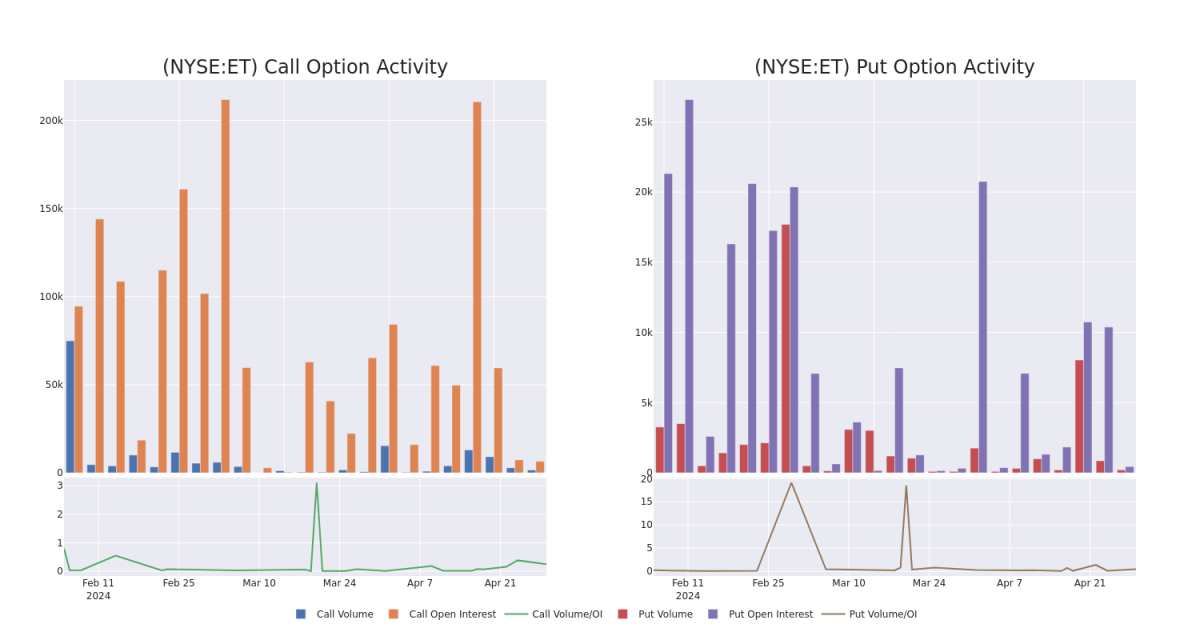

In terms of liquidity and interest, the mean open interest for Energy Transfer options trades today is 18709.67 with a total volume of 5,350.00.

就流動性和利息而言,當今能源轉移期權交易的平均未平倉合約爲18709.67,總交易量爲5,350.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Energy Transfer's big money trades within a strike price range of $12.0 to $30.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內Energy Transfer在12.0美元至30.0美元行使價區間內的看漲期權和看跌期權的交易量和未平倉合約的變化。

Energy Transfer Option Volume And Open Interest Over Last 30 Days

過去 30 天的能源轉移期權交易量和未平倉合約

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ET | PUT | SWEEP | BULLISH | 05/17/24 | $9.65 | $9.6 | $9.6 | $25.00 | $72.9K | 0 | 6 |

| ET | PUT | SWEEP | BULLISH | 05/17/24 | $16.5 | $14.7 | $14.7 | $30.00 | $52.9K | 0 | 0 |

| ET | CALL | SWEEP | BULLISH | 01/17/25 | $0.35 | $0.32 | $0.35 | $17.00 | $40.2K | 50.4K | 1.1K |

| ET | CALL | TRADE | BULLISH | 06/20/25 | $3.8 | $3.75 | $3.8 | $12.00 | $38.0K | 5.6K | 600 |

| ET | CALL | TRADE | BULLISH | 06/20/25 | $3.7 | $3.65 | $3.7 | $12.00 | $37.0K | 5.6K | 500 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 等 | 放 | 掃 | 看漲 | 05/17/24 | 9.65 美元 | 9.6 美元 | 9.6 美元 | 25.00 美元 | 72.9 萬美元 | 0 | 6 |

| 等 | 放 | 掃 | 看漲 | 05/17/24 | 16.5 美元 | 14.7 美元 | 14.7 美元 | 30.00 美元 | 52.9 萬美元 | 0 | 0 |

| 等 | 打電話 | 掃 | 看漲 | 01/17/25 | 0.35 美元 | 0.32 美元 | 0.35 美元 | 17.00 美元 | 40.2 萬美元 | 50.4K | 1.1K |

| 等 | 打電話 | 貿易 | 看漲 | 06/20/25 | 3.8 美元 | 3.75 美元 | 3.8 美元 | 12.00 美元 | 38.0 萬美元 | 5.6K | 600 |

| 等 | 打電話 | 貿易 | 看漲 | 06/20/25 | 3.7 美元 | 3.65 美元 | 3.7 美元 | 12.00 美元 | 37.0 萬美元 | 5.6K | 500 |

About Energy Transfer

關於能量傳輸

Energy Transfer owns a large platform of crude oil, natural gas, and natural gas liquid assets primarily in Texas and the U.S. midcontinent region. It also has gathering and processing facilities, one of the largest fractionation facilities in the U.S., and fuel distribution. Energy Transfer also owns the Lake Charles gas liquefaction facility. It combined its publicly traded limited and general partnerships in October 2018.

Energy Transfer擁有大型原油、天然氣和液態天然氣資產平台,主要位於德克薩斯州和美國中部大陸地區。它還擁有收集和處理設施,這是美國最大的分餾設施之一,以及燃料分配。Energy Transfer還擁有查爾斯湖的天然氣液化設施。它於2018年10月合併了其公開交易的有限合夥企業和普通合夥企業。

Present Market Standing of Energy Transfer

能量轉移的當前市場地位

- With a volume of 8,094,437, the price of ET is up 2.03% at $15.79.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 6 days.

- 美國東部時間的成交量爲8,094,437美元,上漲2.03%,至15.79美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在6天后公佈。

What The Experts Say On Energy Transfer

專家對能量轉移的看法

Over the past month, 1 industry analysts have shared their insights on this stock, proposing an average target price of $19.0.

在過去的一個月中,1位行業分析師分享了他們對該股的見解,提出平均目標價爲19.0美元。

- An analyst from Mizuho downgraded its action to Buy with a price target of $19.

- 瑞穗的一位分析師將其評級下調至買入,目標股價爲19美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Energy Transfer options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的能量轉移期權交易。