The Federal Reserve is expected to keep the target overnight interest rate unchanged in the 5.25%-5.50% range after the two-day meeting on Wednesday (May 1). The Federal Reserve will issue a policy statement at 2:00 a.m. on Thursday, Beijing time. Half an hour later, Federal Reserve Chairman Powell will hold a press conference.

Since Federal Reserve policymakers will not release new economic forecasts until after the June 11-12 meeting, this policy statement and Powell's remarks will be the only guide for judging whether officials are still planning to cut interest rates this year and the extent of interest rate cuts.

Federal Reserve officials began spreading fervent expectations for interest rate cuts at the end of last year. At the time, the US economy seemed to be clearly on the path of returning to low inflation. Officials expected a steady decline in borrowing costs this year, but since then, the process of formulating interest rate cut decisions has basically stagnated.

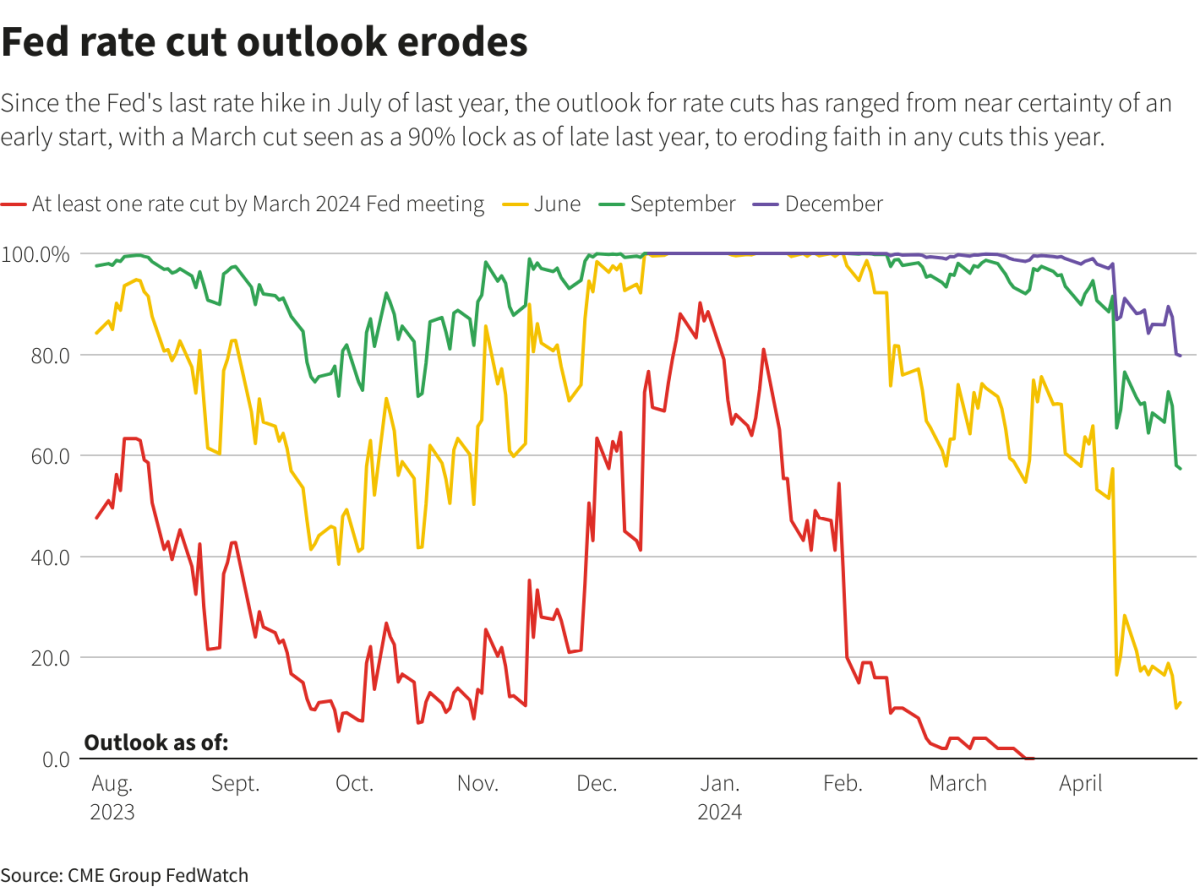

Prospects for the Fed to cut interest rates weaken

The target range of the Federal Reserve's indicator overnight interest rate has remained at 5.25%-5.50% since July last year, and the market is not expected to change during the two-day policy meeting that ends on Wednesday. Now it seems likely that it won't change for a while.

Inflation has been hovering since the end of last year. Some policymakers believe that there is a risk that progress in inflation will stagnate, and the prospects for interest rate cuts are gradually shifting backwards. Currently, there are some questions about whether interest rates will be cut this year.

How would you describe the Federal Reserve's current position? Earlier this year, the Federal Reserve seemed to be clearly moving in the direction of cutting interest rates. Just six weeks ago, officials expected interest rates to be cut three times by 25 basis points each in 2024, but recent remarks from senior Federal Reserve observers tell people that the outlook is very vague.

Figure: Prospects for the Fed to cut interest rates are weakening

Tim Duy, chief US economist at SGH Macro Advisors, believes that the Federal Reserve is like an athlete waiting for the right time to play, and the upcoming housing inflation data will be the key to whether policymakers can enter the market with interest rate cuts.

Will housing inflation slow down?

Housing costs have recently been driving inflation, and Federal Reserve officials still expect housing costs to fall and drive overall inflation down. But strong data continues to weaken confidence that inflation will quickly return to the Federal Reserve's 2% target. Some alternative housing cost indicators that policymakers are concerned about have yet to show significant improvements.

As a result,Federal Reserve Chairman Powell is expected to “reaffirm recent information that although (FOMC) participants still expect to cut interest rates when they are confident that inflation is on the path to price stability, they do not expect such confidence in the short term,” Duy wrote. Policymakers “believe housing inflation will fall later this year. According to this view, slowing inflation is still coming; it has only been postponed.”

Has there been a shift in the trend of “falling inflation”

Diane Swonk, chief economist at KPMG (KPMG), believes that Federal Reserve officials are in a deeper predicament. What she calls “monetary policy purgatory” is not that they have to pay for their past sins, but because they are no longer sure where they are headed.

Swonk wrote that since inflation in the first few months of this year was faster than expected, the Federal Reserve “is uncertain whether it has taken sufficient measures to curb inflation and lower interest rates; if inflation accelerates further, it will force the Federal Reserve to consider additional interest rate increases.”

“The key is the extent to which the upcoming statement from the Federal Reserve will change the tone of the debate,” Swonk wrote.He emphasized how the March 20 statement explained under what conditions it would be appropriate to lower the target interest rate.

Removing the word “reduce” or moving to a more balanced view of the next policy measures would send a particularly strong signal that recent inflation data has been digested.

Figure: Has the trend of “falling inflation” changed

Evercore ISI Vice Chairman Krishna Guha said, for example, that the Federal Reserve is at a fork in the road and stalled on the way to the final destination, and the final destination itself may have become less certain.

Currently, he believes that Powell and other Federal Reserve officials will try to maintain their current basic views on future interest rate cuts, while admitting that recent data is not helpful in this regard.

Guha stated that heIt is expected that “the policy wording in the statement will not change,” Powell will repeat at the press conference that the central bank “can” keep interest rates unchanged when necessary to lower the inflation rate, and cut interest rates when the decline in inflation is clear.

However, this conference “may also end up being just a halfway point in a more far-reaching hawkish policy reset process,” depending on newly announced salaries and other data.

Maintaining higher interest rates for a longer period of time?

Figure: Maintaining higher interest rates for a longer period of time?

Chicago Federal Reserve Chairman Austin Goolsbee (Austan Goolsbee), famous for his vivid wording, has captured this shift in sentiment, and the Federal Reserve needs to deal with a more complicated path.

At the end of last year, he believed that the Federal Reserve had already embarked on the “golden path” and that the inflation rate had declined, while the unemployment rate had not risen as before, and economic growth had not slowed down.

In his comments earlier this month, he still insisted that the result was such an outcome, but the surrounding circumstances had changed.

The 2023 economy suggests “we may be able to lower the inflation rate without a severe recession,” Goulsby said, “Can this continue in 2024? I hope so. But the situation isn't that extreme... it's a 'golden turnover' rather than a 'golden road'”.

Whether the Federal Reserve is slowing down its downsizing plan may be the focus of this week's meeting

Some economists say that the Federal Reserve may announce the end of the balance-sheet reduction plan as early as this week's policy meeting. However, the interest rate outlook is uncertain due to high inflation, which may delay the “downsizing” statement until June.

Revising quantitative austerity policies means that the Federal Reserve will slow down the pace of austerity.Under the plan, the Federal Reserve allows up to $95 billion of US bonds and mortgage bonds to expire each month from the central bank's portfolio without reinvesting them. Federal Reserve officials have been hinting that they will slow down quantitative austerity in the near future, and have indicated that by slowing the pace of quantitative austerity, they can reduce the risk of the market facing pressure and possibly reduce their holdings to a greater extent.

The Federal Reserve doubled the size of its balance sheet to $9 trillion after the COVID-19 outbreak to stabilize the market and stimulate the economy, then continued to reduce the balance sheet size since June 2022. While the Federal Reserve raised interest rates sharply to bring the inflation rate back to the target level of 2%, it initiated quantitative austerity policies.

The Federal Reserve's bond holdings have dropped to about 7.5 trillion US dollars. Although the Federal Reserve has yet to indicate the amount it ultimately hopes to hold, it is seeking to achieve a level of market liquidity that can both reduce interest rate fluctuations and strictly control federal funds interest rates; the federal funds rate is the main policy tool for the Federal Reserve to carry out its duties. According to a recent report released by the New York Federal Reserve, the quantitative austerity process is likely to continue until 2025, after which holdings will stabilize.

The minutes of the March meeting of the Federal Reserve show that officials are inclined to revise quantitative austerity policies.The focus is only on slowing down the reduction in US public debt, as the maturity amount of mortgage bonds is far below the target of $35 billion per month, and in the end, they tend to hold only government bonds.

Economists at J.P. Morgan Chase said in a research report: “The next step in the Federal Reserve's balance-sheet reduction plan is very clear: reduce the maximum monthly bond holdings reduction limit from $60 billion to $30 billion. The only real question is when: will it be raised at the May meeting or the June meeting.”

They stated:“We prefer the (May) meeting” because interest rate policies are not expected to change at this meeting, and decision makers will not update economic data estimates.”

The Federal Reserve has spared no effort in treating its balance sheet and interest rate policy separately, although both are working in the same direction, making the Federal Reserve's policy more restrictive overall.

Wrightson ICAP analysts believe that the Federal Reserve will announce a reduction in quantitative austerity policies at the end of the two-day policy meeting on Wednesday because “there is no obvious reason to wait.”

Bank of America economists believe that the Federal Reserve will announce a slowdown in contraction this week, as this will help it manage the liquidity needs generated by banks and the Treasury to control cash flow.

Figure: Changes in the size of the Federal Reserve's balance sheet

Others, however, think the issue might have to be delayed for a month.

A Deutsche Bank economist said, “In a situation where it is difficult to make a decision, we currently expect the announcement to lower the quantitative austerity cap to be postponed until the June meeting. Although officials seem to generally agree to adjust the downsizing parameters, we think they want to avoid any dovish misunderstandings caused by the slowdown in quantitative austerity, which may inadvertently ease financial conditions.”

The Federal Reserve will announce a new round of interest rate and key economic data estimates at the June meeting.Deutsche Bank said, “They may be inclined to combine this statement with the more hawkish signals on the June meeting bitmap.”To avoid mixed policy messages.

LH Meyer's analysts also believe that balance sheet issues will be addressed in June, and stated that “the Federal Open Market Committee (FOMC) can decide on the general framework (“principles and plans”) and announce it after the May meeting so that the market can confirm the general appearance of the entire process, and at the same time not prejudge when this step will be taken.”

Ipek Ozkardeskaya, a senior analyst at Swissquote Bank, said he will die. Investors are not optimistic when the Federal Reserve's resolution day arrives. She wrote in a report that the Federal Reserve must respond to three consecutive months of surging inflation and may cut back on the easing program. The Federal Reserve may even lower expectations of interest rate cuts in 2024. Given the latest economic data, this is the most dovish statement one can reasonably expect. The employment cost index rose more than expected in the first quarter. And while consumer confidence has declined, it has yet to slow down spending. Investors will focus on ADP, PMI, and other data later, but that won't change the fact that employment data was strong in the first quarter and inflation rose significantly.