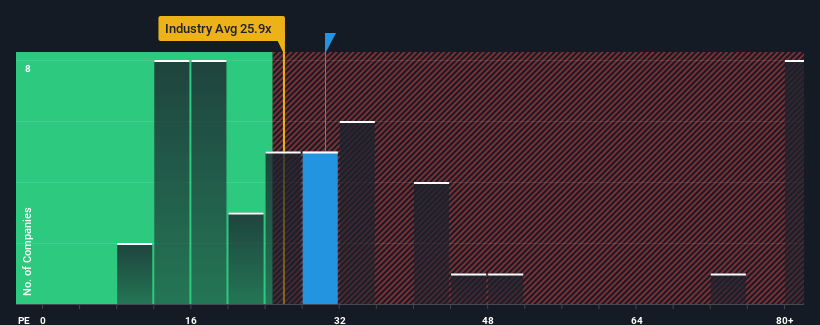

There wouldn't be many who think Shanxi Securities Co., Ltd.'s (SZSE:002500) price-to-earnings (or "P/E") ratio of 30.4x is worth a mention when the median P/E in China is similar at about 32x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Earnings have risen at a steady rate over the last year for Shanxi Securities, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to only match most other companies over the coming period, which has kept the P/E from rising. If not, then at least existing shareholders probably aren't too pessimistic about the future direction of the share price.

Is There Some Growth For Shanxi Securities?

There's an inherent assumption that a company should be matching the market for P/E ratios like Shanxi Securities' to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 6.2% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with EPS shrinking 26% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 38% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Shanxi Securities is trading at a fairly similar P/E to the market. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Shanxi Securities currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shanxi Securities you should be aware of.

If these risks are making you reconsider your opinion on Shanxi Securities, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.