Deep-pocketed investors have adopted a bullish approach towards Medtronic (NYSE:MDT), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in MDT usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 10 extraordinary options activities for Medtronic. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 40% bearish. Among these notable options, 8 are puts, totaling $329,168, and 2 are calls, amounting to $63,169.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $77.5 to $85.0 for Medtronic over the recent three months.

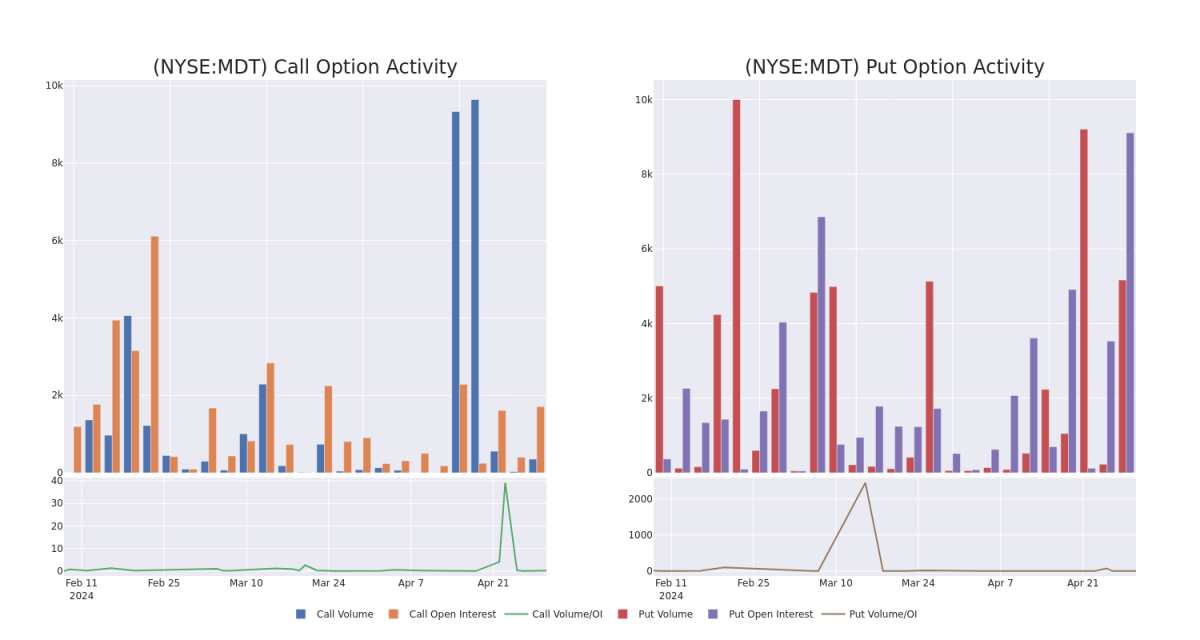

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Medtronic's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Medtronic's whale trades within a strike price range from $77.5 to $85.0 in the last 30 days.

Medtronic Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MDT | PUT | TRADE | BULLISH | 05/03/24 | $0.24 | $0.21 | $0.22 | $79.00 | $62.0K | 5.0K | 2.0K |

| MDT | PUT | SWEEP | BEARISH | 01/17/25 | $5.4 | $5.25 | $5.4 | $80.00 | $54.5K | 2.0K | 267 |

| MDT | PUT | SWEEP | BEARISH | 01/17/25 | $5.25 | $5.1 | $5.25 | $80.00 | $54.0K | 2.0K | 0 |

| MDT | PUT | SWEEP | BULLISH | 01/17/25 | $4.3 | $4.2 | $4.25 | $77.50 | $37.8K | 2.0K | 524 |

| MDT | CALL | TRADE | BEARISH | 07/19/24 | $1.25 | $1.17 | $1.18 | $85.00 | $35.1K | 1.6K | 354 |

About Medtronic

One of the largest medical-device companies, Medtronic develops and manufactures therapeutic medical devices for chronic diseases. Its portfolio includes pacemakers, defibrillators, heart valves, stents, insulin pumps, spinal fixation devices, neurovascular products, advanced energy, and surgical tools. The company markets its products to healthcare institutions and physicians in the United States and overseas. Foreign sales account for roughly 50% of the company's total sales.

Current Position of Medtronic

- Currently trading with a volume of 5,681,036, the MDT's price is down by -0.77%, now at $80.24.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 23 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Medtronic with Benzinga Pro for real-time alerts.