Investors with a lot of money to spend have taken a bullish stance on Shopify (NYSE:SHOP).

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with SHOP, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 12 options trades for Shopify.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 41%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $33,908, and 11, calls, for a total amount of $671,034.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $72.0 to $85.0 for Shopify over the recent three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Shopify's options for a given strike price.

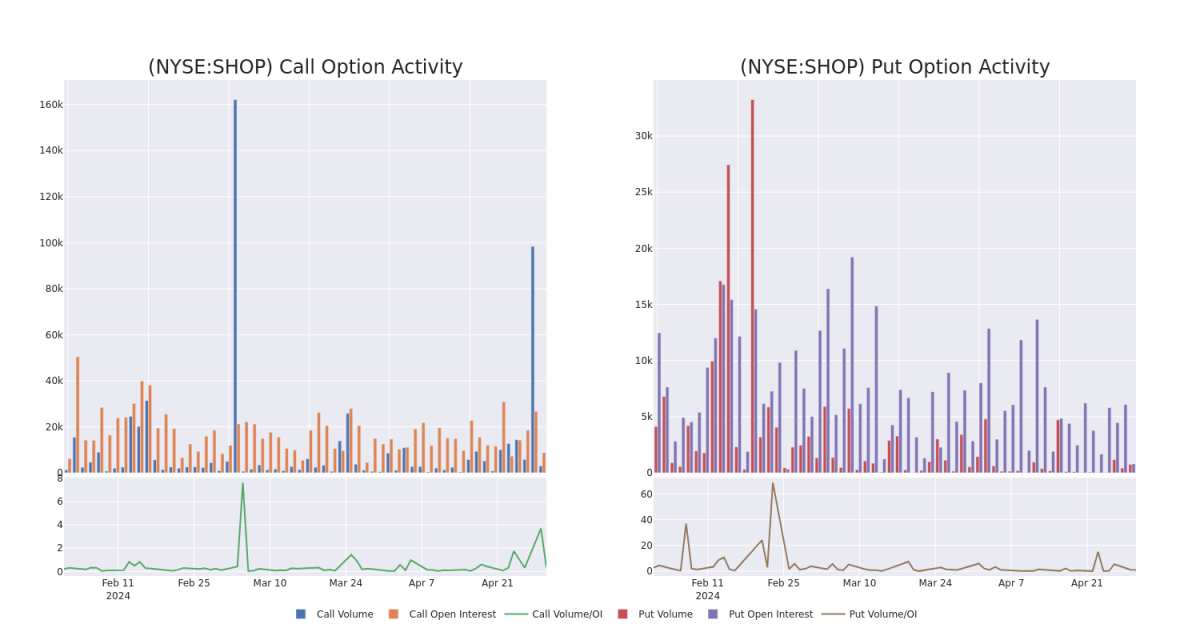

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify's whale activity within a strike price range from $72.0 to $85.0 in the last 30 days.

Shopify Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | BEARISH | 07/19/24 | $7.1 | $7.0 | $7.0 | $75.00 | $140.0K | 1.4K | 212 |

| SHOP | CALL | SWEEP | BEARISH | 07/19/24 | $7.0 | $6.9 | $6.9 | $75.00 | $75.2K | 1.4K | 1 |

| SHOP | CALL | TRADE | BULLISH | 07/19/24 | $7.15 | $7.05 | $7.15 | $75.00 | $71.5K | 1.4K | 210 |

| SHOP | CALL | TRADE | BULLISH | 07/19/24 | $7.0 | $6.9 | $6.96 | $75.00 | $69.6K | 1.4K | 515 |

| SHOP | CALL | TRADE | BULLISH | 07/19/24 | $6.2 | $6.15 | $6.2 | $75.00 | $62.0K | 1.4K | 721 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

In light of the recent options history for Shopify, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Shopify

- Trading volume stands at 4,330,799, with SHOP's price down by -1.3%, positioned at $71.54.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 8 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.