In recent years, in the clean appliance circuit, corporate performance has clearly divided, and Stone Technology (688169.SH), as a dark horse in the industry, bucked the trend and experienced high growth last year, which is obvious to all.

Entering 2024, Stone Technology released its latest quarterly earnings report, which is still pleasing to the market. In terms of core data performance, revenue and profit continued to grow at a high rate. The report shows that in Q1 2024, Stone Technology achieved revenue of 1,841 billion yuan, a year-on-year increase of 58.69%, and realized net profit to mother of 399 million yuan, an increase of 95.23% over the previous year.

You might as well use this latest report card to sort out the underlying logic of Stone Technology's development, and at the same time look forward to the latest incremental highlights of Stone Technology in line with the new product layout.

Q1 performance continues to grow, ranking first in the world in terms of sales of sweepers

Under the trend where the entire industry is getting cold, Stone Technology's profit index performance can continue to refresh the industry's height. This is also the external logic that it is “exclusively favored” by the capital market.

Judging from the 2024 Q1 financial report of Stone Technology, gross margin reached 59.49%, a further increase compared with 49.85% in the same period last year. The net interest rate also increased significantly, from 17.61% in the same period last year to 21.66%.

Looking back at the 2017-2023 performance, Stone Technology's profit indicators did not disappoint the market, and both gross margin and net margin showed a steady upward trend. In particular, the net interest rate, from 5.99% in 2017 to 23.70% in 2023, fully reflects the strong growth and certainty of Stone Technology in terms of profitability.

As an enterprise with both global consumer attributes and technological attributes, to be able to achieve both an increase in profit scale and efficiency, first of all, it is inseparable from continuous growth in product sales and continuous iterative innovation of products through technological advantages, freeing up profit space.

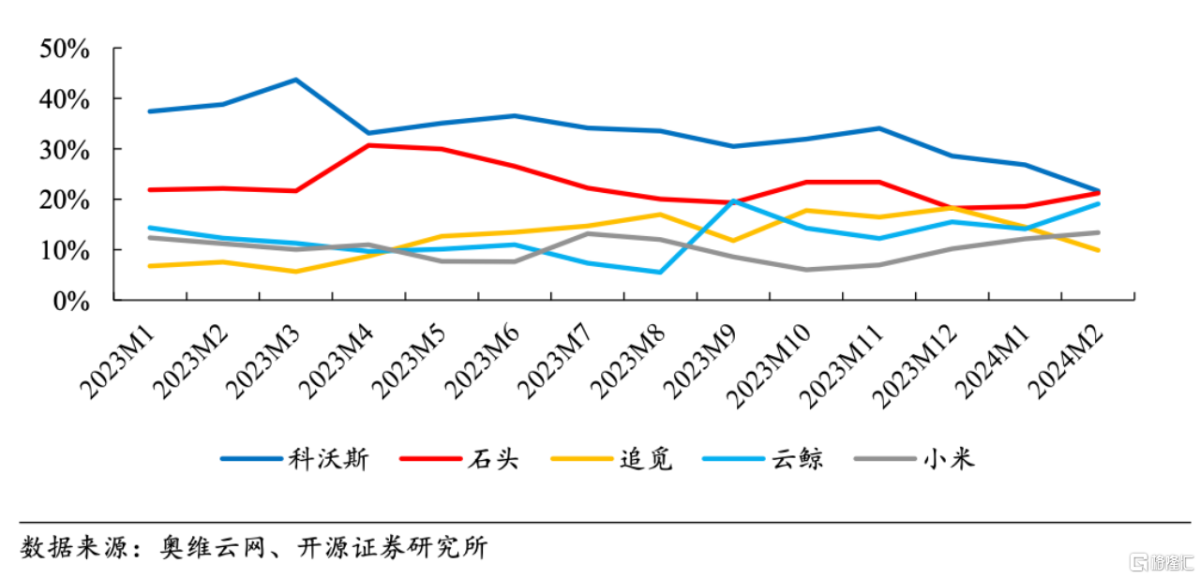

For the first quarter of this year, net cash flow from operating activities was 233 million yuan, an increase of 70.32% over the previous year. Also, according to data from Aowei Cloud Network, by the end of February 2024, Stone Technology's domestic online sales market share is already leading other mainstream competitors.

Looking at the global market, Stone Technology achieved far leading results last year. According to statistics from the global market research company Euromonitor, in the global vacuum robot market in the first three quarters of 2023, Stone Technology ranked first in the world in terms of sales of sweeping robots.

The survey collected public information including public data, policy documents, authoritative reports, and media reports, and conducted in-depth interviews with leading companies in the industry to confirm the sales ranking of Stone Technology's sweeping robots.

Therefore, it can be seen that with its product competitiveness in the middle and high-end markets around the world, Stone Technology continues to deliver high-quality performance. At the same time, users are willing to pay for such a high-end sweeper robot, which also brings better profit margin to Stone Technology, and has achieved high-quality growth in its performance.

However, on the basis of the above high growth, the author must also explain that the role of Q1 in 2024 is mainly to release new products. Often, the Q1 quarter did not have a high ratio of revenue and profit for the whole year. It was a stage of saving orders for new products and initial sales.

Not long ago, Stone Technology held a global new product launch conference, and it also followed this rhythm. Through the latest press conference, Stone Technology launched two new flagship products, Stone V20 and Stone G20S. As the G series and V series, which have always led the upgrading of the industry, it can help Stone Technology further gain a foothold in the high-end market and raise the ceiling for future revenue.

This means that with the iterative launch of Stone Technology's products and the gradual confirmation of revenue and profits, it is very certain that Q2 will produce better results this year. As a result, Stone Technology's high-quality performance in the first half of 2024 is also easier to predict.

A model for the globalization of Chinese hard technology enterprises, the value of stone technology has been upgraded

In the past, the structure of the best-selling products of overseas brands was biased towards the lower end, and technologies such as navigation and cleaning were also relatively primitive. Meanwhile, the Chinese brand represented by Stone Technology has brought higher quality products through scientific and technological innovation, promoted the upgrading of the global vacuum robot product structure, and made Chinese sweeping robot products favored by global users.

In this process, just as new energy vehicles, power battery companies, and e-commerce companies go overseas, Stone Technology has also become a model for Chinese hard-core technology companies to go overseas, and the corporate value positioning has been upgraded.

Specifically, it is possible to disassemble the underlying logic of stone technology development from the following three perspectives:

First, on the R&D side, a continued high proportion of R&D investment has enabled Stone Technology to maintain strong momentum in technology and product innovation.

Stone technology research and development expenses reached 195 million yuan in the first quarter of this year, a sharp increase of 47.66% over the previous year. Further looking at the annual reports of recent years, R&D expenses have remained above 7% of revenue in the last three years, and the cumulative R&D expenses in the past 5 years have reached 2,005 billion yuan. This has become the strongest guarantee that product strength continues to lead the industry.

In terms of patents, by the end of 2023, Stone Technology had obtained a total of 2,435 intellectual property rights worldwide, including 218 invention patents, 615 utility model patents, and 711 design patents. In addition, Stone Technology has established three research institutes: AI Research Institute, Mechatronics Research Institute, and Optoelectronics Research Institute to form a full-stack self-research system for core technologies.

Second, on the marketing side, Stone Technology has opened up “online+offline” channels and established a broad understanding of high-end products and all-round base stations for consumers through mature social media promotion experience.

Using online as an entry point, Stone Technology has opened brand stores on online platforms such as Amazon, Home Depot, Target, Bestbuy, and WalMart. Last year, Stone Technology's products were also recognized by the American retail giant Target (Target). Currently, the products have entered more than 180 offline Target stores in the US.

The author learned that Target has nearly 2,000 stores in the US, and its store network coverage is difficult for Amazon to reach. Entering Target has always been seen as a key step for suppliers or brands to accurately explore the US market, expand brand routes, and maximize brand profits. Stone Technology is expected to enter more than 1,000 Target stores in 2024.

As a result, Stone Technology raised brand awareness through “online+offline” channels, enhanced the brand's high-end image, and further consolidated the trend of continued growth in subsequent sales.

Finally, on the industry side, the AI algorithm era has arrived, and Stone Technology can achieve leading product experiences for the industry and global consumers based on accumulation on the R&D side.

In the past, Stone Technology led the entire industry into the era of laser navigation, and since then, it has continued to empower products through visual maps, binocular visual obstacle avoidance, integrated sweeping and mopping, and high-frequency vibration to wipe floors. It is worth mentioning that Shitou Technology's self-developed RR mason algorithm has been updated more than 10 times, greatly improving the level of intelligence of sweeping robots and being able to flexibly solve complex problems in various scenarios.

This also explains why at the recent press conference, Stone Technology's new products were once again able to refresh the industry ceiling in terms of cleaning power, omnipotence, and intelligence.

Therefore, looking back at the above three perspectives, the foundation of stone science and technology development actually revolves around adhering to long-term principles. Regardless of the investment in any area, it is aimed at achieving significant accumulation and development potential in the end.

Epilogue

Predictably, in the second half of smart cleaning, Stone Technology will bring broad room for imagination. In particular, the AI era has arrived, and the entire smart appliance circuit extending from cleaning appliances will present more new opportunities for Stone Technology. At present, the company has launched a new category of floor scrubbers and all-in-one washers and dryers. While the penetration rate still has huge room for improvement, the explosive power is expected to be strong in the future.

Looking at the present, with the advent of high dividends, the leading effect of the clean appliance industry has been highlighted. The concept of stable profitability and a continuous net inflow of operating cash flow is deeply rooted in the hearts of the people, and the confidence of the capital market in improving corporate finance has greatly increased.

Currently, as a model enterprise with high dividends, Stone Technology undoubtedly satisfies the capital market's general expectations for high-quality standards. Based on the above, Stone Technology may be worth watching for a long time.