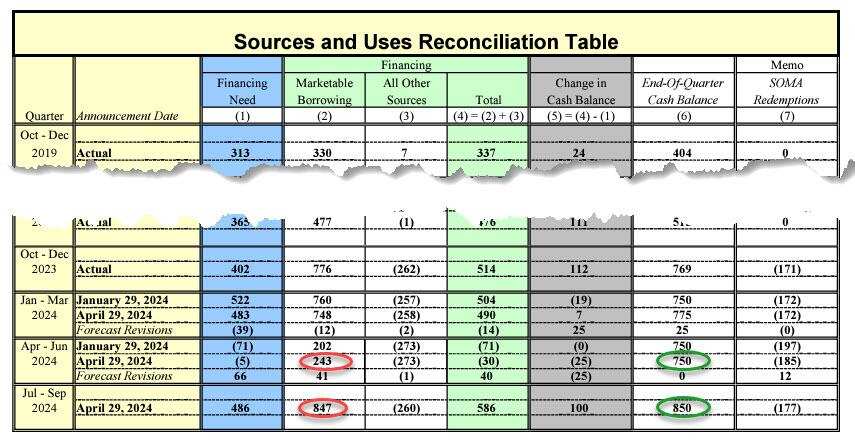

The Ministry of Finance raised the expected size of net borrowing for the second quarter by 20% to US$243 billion, and is expected to triple to US$847 billion in the third quarter; the Treasury account TAG cash balance is expected to remain unchanged at US$750 billion at the end of the second quarter, rising to US$850 billion at the end of the third quarter, suggesting that actual capital requirements for the third quarter were lower than Wall Street expectations.

To Wall Street's surprise, the US Treasury not only did not cut, but instead sharply raised the expected size of loans this quarter.

On Monday, April 29, EST, the US Treasury Department announced that the estimated net marketable private debt loan amount for April to June 2024 is US$243 billion, up US$41 billion from the previous estimate of US$2020 billion released in January this year, an increase of about 20.30%. At the same time, the net loan amount from July to September 2024 is estimated to be US$847 billion, about 3.5 times that of the current quarter.

The Ministry of Finance said that the increase in loan expectations for the second quarter was “mainly due to a decrease in cash income,” but the increase in cash balances at the beginning of the quarter partially offset this decline in revenue. Wall Street News has mentioned that April 15 is the deadline for US personal tax and corporate tax payments for the previous year. Due to the intensity of tax revenue, the US Treasury's TGA account balance will rise significantly around tax day.

This time, the Ministry of Finance's forecast net loan size for the second quarter was higher than the expected level of most brokers. Even J.P. Morgan Chase, which had previously anticipated that the Ministry of Finance would adjust net borrowing expectations, only expected a slight increase of 5 billion US dollars to 227 billion US dollars.

Regarding the current increase in borrowing expectations for the second quarter, some commentators believe that Treasury officials have not taken into account that the Federal Reserve will slow down its balance sheet (downsizing). Currently, Wall Street generally expects that the Federal Reserve will announce a slowdown in the downsizing, or so-called quantitative austerity (QT) plan, after the monetary policy meeting on Wednesday. However, traders have different predictions about when to start slowing down.

The Federal Reserve began downsizing in June 2022, and is currently maintaining the pace of contraction of US Treasury bonds and institutional mortgage-backed securities (MBS), totaling up to $95 billion per month. The minutes of the meeting released earlier this month show that at last month's monetary policy meeting, most Federal Reserve policymakers preferred to start slowing down the downsizing soon. Policymakers generally agreed to reduce the overall monthly bond downsizing scale by about half. Instead of adjusting the institutional MBS downsizing limit, the size of US Treasury bonds could be lowered to 30 billion US dollars per month.

However, some commentators pointed out that the estimated loan size of 847 billion US dollars for the third quarter was lower than the high end of the expected range. Furthermore, on Monday, the Ministry of Finance reiterated that it is expected that by the end of June, the general account TGA opened by the Treasury with the Federal Reserve will still have a cash balance of about 750 billion US dollars. Meanwhile, by the end of September, the cash balance is expected to increase to about 850 billion US dollars.

According to the review, since Wall Street generally expects the cash balance at the end of the third quarter to be 750 billion US dollars, the current treasury's expected scale means that the actual capital requirement for the third quarter is 747 billion US dollars, which is also lower than the median Wall Street forecast. This anticipated scale is probably not determined by financial data; it may stem from political factors related to the general election. The real question is what will happen in the fourth quarter after the election is over, when the whitewash is removed.

On Wednesday, the US Treasury will announce the “quarterly refinancing” (quarterly refinancing) treasury bond issuance plan for the next quarter. After the Ministry of Finance increased the scale of financing for three consecutive quarters, the market generally expects that the size of treasury bonds issued under this tender plan will remain unchanged.

However, considering the recent growth in TGA cash balances that exceeded expectations, the Ministry of Finance has no urgent need to issue short-term treasury notes or empty reverse repurchase instruments in the context of “having surplus in hand”. Nomura strategist Charlie McEligott believes that theoretically speaking, in the current context, the US Treasury can lower debt issuance expectations.

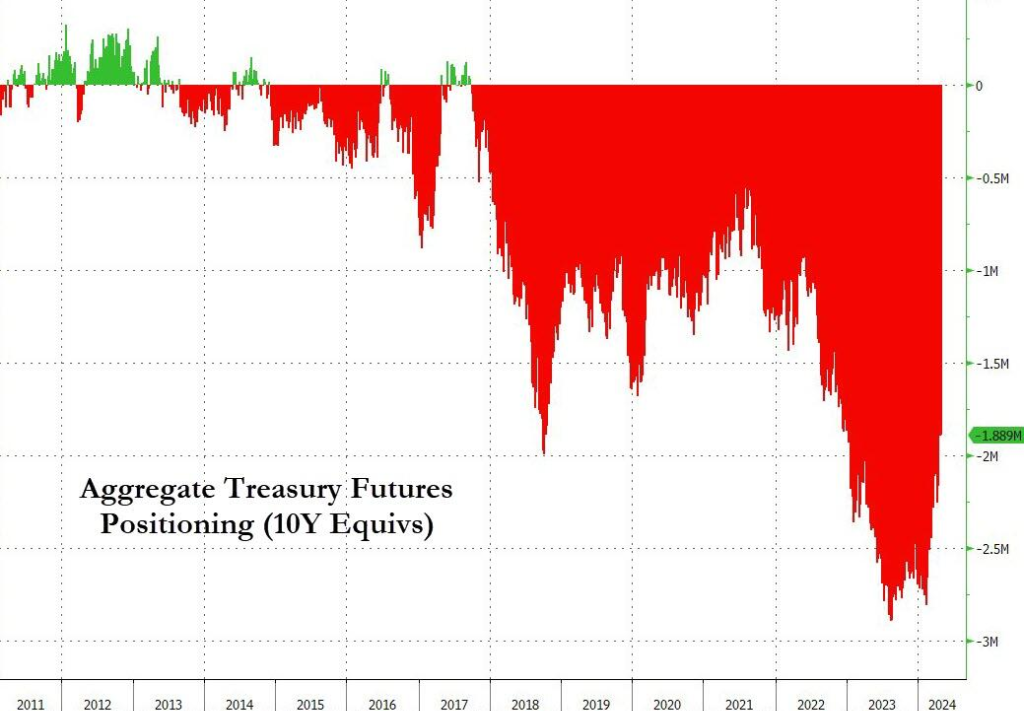

And once the Treasury cuts the scale of financing, at a time when short positions on US Treasury bonds are close to record levels, it will help push bond shortages once again and boost risk sentiment. In other words, although the Federal Reserve may cut interest rates later than expected, US Treasury Secretary Yellen may step forward to squeeze the bears in the bond market and push US stocks higher.