The rise in technology stocks driven by risk appetite last week was not missed by hedge funds, and their buying rate reached its highest rate in more than a year.

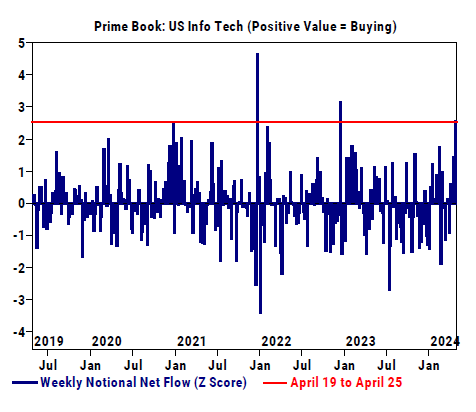

According to data from Goldman Sachs's brokerage business division, net purchases of technology stocks last week reached their highest level since December 2022, due to an increase in long positions and short compensation.

Hedge funds were net buyers in the sector for the fourth week in a row, while the S&P 500 information technology index fell for most of April due to concerns about high interest rates. Hedge fund buying seemed prescient, as the results of Google's parent company Alphabet and Microsoft last week boosted investors' optimism about the fundamentals of the tech industry.

“The long-term potential of technology stocks is very obvious and almost undisputed,” said Seema Shah, chief global strategist at Xin'an Asset Management. “Yet with valuations so high, many investors have recently been reluctant to increase their exposure. Recently, the valuation has been slightly adjusted, providing an opportunity to enter the market.”

While almost all technology subsectors received capital inflows, the largest flows to semiconductor and semiconductor equipment companies. According to Goldman Sachs data, the allocation of hedge funds in this sub-sector jumped from 1.1% at the beginning of this year to 4.4%, the highest level in more than five years.

Last week, hedge funds made net purchases of US stocks at the fastest speed in about five months. The S&P 500 index recorded its biggest weekly gain since 2024, and is only a stone's throw from 5,100 points.