Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX) shareholders might be concerned after seeing the share price drop 11% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 127% return, over that period. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Of course, that doesn't necessarily mean it's cheap now.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

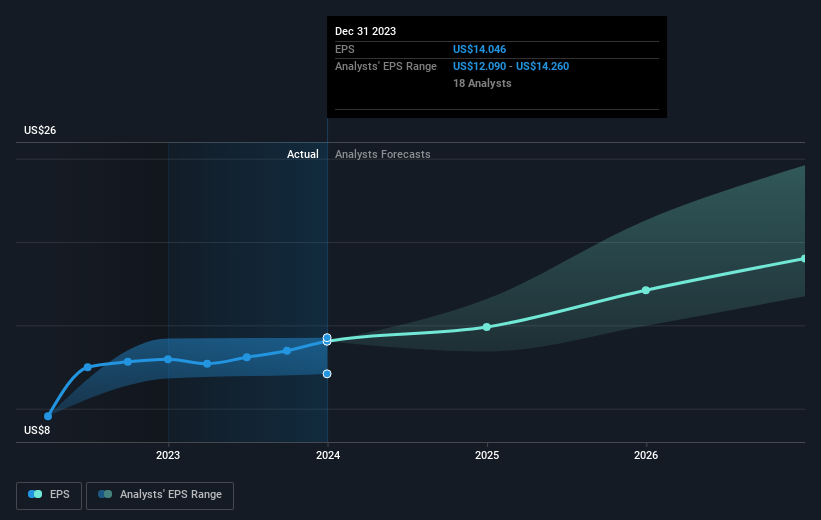

Over half a decade, Vertex Pharmaceuticals managed to grow its earnings per share at 11% a year. This EPS growth is slower than the share price growth of 18% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Vertex Pharmaceuticals' earnings, revenue and cash flow.

A Different Perspective

Vertex Pharmaceuticals shareholders are up 15% for the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 18% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Is Vertex Pharmaceuticals cheap compared to other companies? These 3 valuation measures might help you decide.

But note: Vertex Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.