Recently, the Hong Kong stock market has continuously introduced a number of major benefits to solve the shortage of liquidity, and capital attention has increased markedly.

Currently, the valuation of the Hong Kong stock market is at a historically low level. Combined with expectations of improved liquidity, it is expected to usher in a medium- to long-term allocation window.

Against this backdrop, the Hong Kong stock higher education group “China Chunlai” once again delivered impressive results. The 2024 fiscal year report achieved revenue of 814 million yuan, an increase of 8.7% over the previous year. Due to further savings in sales expenses and financing costs, the company's adjusted net profit reached 386 million yuan, a growth rate of 16.3%, and the increase in revenue was even more profitable. Meanwhile, following dividends in 2022 and 2023, the company continued to introduce dividends of $0.0907 (approximately HK$0.1) per share, totaling RMB 108.84 million.

Looking at it over a long period of time, the company has continued to hand over the performance of outstanding students in recent years, and has paid dividends for three consecutive years. In an environment full of uncertainty, it has shown its ability to overcome market cycles and resilience to market risks.

High-quality growth continues to be realized, and dividends have been paid back to investors for 3 consecutive years

In recent years, vocational higher education has successively received national policy support. This includes encouraging higher education institutions to strengthen the integration of industry and education and cultivate applied talents.

As policy dividends continue to be released, China's strategy for high-quality growth since spring has also continued to be implemented.

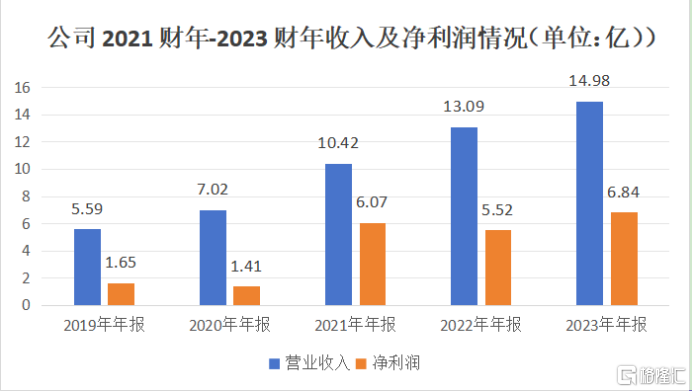

In the past fiscal year 2019 to fiscal year 2023, China's overall performance in Chunlai was strong: revenue grew steadily at a compound annual growth rate of 28%, and the compound annual growth rate on the profit side reached 43%.

Source: Compiling from the company's financial report

In the first half of the 2024 fiscal year, China continued to maintain a trend of increasing revenue and profit: operating income of 814 million yuan, up 8.7% year on year; on the cost side, due to the reduction in admissions advertising fees and reduction in bank loan expenses, the company's sales expenses and financing costs were reduced by 34.3% and 23%, respectively, compared to the same period last year, and eventually achieved net profit of 386 million yuan, an increase of 16.3% over the previous year.

Continued outstanding fundamental performance not only highlights China's strong momentum in expanding the education market in recent years since spring, but also reflects the company's refined management level and excellent operation.

And this high-quality development strategy is clearly reflected in the company's endogenous growth and epitaxial mergers and acquisitions.

In recent years, the company has achieved endogenous growth by establishing new campuses and expanding the size of existing campuses, such as establishing Hubei Health University, expanding the Yuanyang Campus of Anyang University, etc., and by participating in the operation of Jingzhou University and Tianping University to gradually incorporate high-quality campuses into the body.

Up to now, China's Chunlai Henan Province has operated four colleges (namely Shangqiu University, Shangqiu University School of Applied Science and Technology, Anyang University, and Yuanyang Campus of Anyang University), and has operated two colleges in Hubei Province (i.e. Health College and Jingzhou University), and has also participated in the operation of Tianping University in Jiangsu.

During the reporting period, the company's mature campuses, Shangqiu University, and Shangqiu University's School of Applied Science and Technology achieved a total revenue of 531 million yuan, a decrease of 1.5% over the previous year, mainly due to a reduction in enrollment.

The company's newly established and expanded campuses — “Health College” and “Anyang University Yuanyang Campus” — are growing rapidly.

Among them, the School of Health achieved revenue of 0.48 million, an increase of 84.0% over the previous year, mainly because the number of students enrolled was expanded from 3,714 in the 2022/2023 school year to 6,831; the Yuanyang Campus of Anyang University achieved revenue of 89 million, an increase of 34.1% over the previous year, mainly due to the increase in the number of students and the increase in average tuition fees;

Furthermore, Jingzhou University, which the company acquired through mergers and acquisitions, continues to maintain high-quality growth.

As early as the 2018/2019 academic year, the company participated in the operation of Jingzhou University (formerly known as the School of Engineering and Technology of Yangtze University) and Tianping College. Until May 2021 (2021 annual report period), the company completed the acquisition of Jingzhou University.

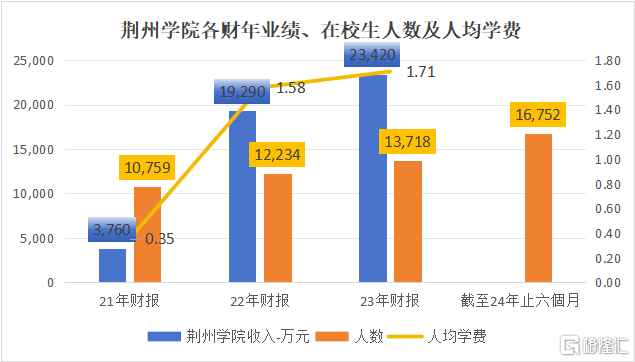

After the merger and acquisition was completed, Jingzhou University brought in revenue contributions of 37 million, 193 million, and 234 million respectively from fiscal year 2021 to fiscal year 2023, achieving significant growth.

Behind the increase in income is an increase in both the number of students enrolled and tuition fees per capita: the number of students enrolled in each fiscal year of Jingzhou University was 10,759, 12,234, and 13,718, respectively. The per capita tuition fee increased from 15,800 per capita in the 2021/2022 academic year to 171,000 per capita in the 2022/2023 academic year, a sharp increase of 8%.

During the reporting period, Jingzhou University expanded enrollment from 13,718 students in the previous academic year to 16,752, achieving revenue of 146 million, an increase of 24.4% over the previous year.

Source: Compiling from the company's financial report

It is worth mentioning that among the six universities under the company, Jingzhou University has the highest tuition fee per capita. The increase in the number of students enrolled and tuition fees per person in recent fiscal years not only indicates greater potential for future growth, but also fully reflects China's strategic vision to select high-quality targets and excellent mergers and acquisitions integration capabilities in spring.

Meanwhile, the company's continued excellent performance has also received positive feedback from the capital market.

Five years have passed, and the company's current stock price is still 132% higher than the initial price. From 2022 to 2023, when the stock price performance of education peers was sluggish, China came out of an independent market in spring, outperforming its peers by 86% and 80% in stock price increases during the year.

Source: WIND

In order to express the feedback to investors, during the reporting period, the company introduced cash dividends totaling RMB 108.84 million. This is 3 consecutive years of dividends since 2022, continuing to give back real money to investors. While further enhancing the investors' rights experience, it also strengthened the company's long-term allocation value.

Overseas layout injects new momentum, AI education+industry-education integration enables high-quality development

For the Chinese spring season, it is not easy to continue to achieve outstanding results; maintaining this outstanding performance is even more challenging.

Looking ahead, the company's growth momentum is still sufficient.

Tianping College, which the company has participated in operation, has been in operation for many years and is currently in the preparation period for transformation. Once incorporated into the group system in the future, in addition to directly increasing the company's profits once, it will also continue to contribute to the company's growth momentum for the next few fiscal years.

Furthermore, in addition to continuously improving the campus network in the mainland, China is also exploring overseas education opportunities in spring.

Recently, China Chunlai said it is planning to build a new university in Hong Kong, and is also planning to launch related businesses such as academic promotion (study) services and career planning to meet students' needs for high-quality international education.

The new school is expected to be completed and enrollment will begin within five years. After completion, the total number of students enrolled in the group is expected to grow from the current 104,400 to 150,000, injecting new growth momentum into the Group's development.

Furthermore, in the current situation of informatization and intelligence in education, China Chunlai is also continuously strengthening its strategic layout in the field of AI and deepening the integration of industry and education to enable high-quality development of corporate education.

In 2024, the company not only carried out strategic cooperation in the field of AI with Beijing Gravitational Connectivity Technology Co., Ltd., but also simultaneously inaugurated AI academies at its two core colleges, Shangqiu University and Anyang University. It highlights the Group's strategic determination to innovate education and cultivate applied talents.

Furthermore, the company's progress in deepening the integration of obstetrics and education is also worthy of attention. Since establishing cooperative relationships with 200 companies at the beginning of its listing, the company has expanded to establish close school-enterprise cooperation with more than 900 enterprises, covering various levels such as internship training, transformation of R&D results, order-based talent training, and professional and laboratory co-construction.

This deep integration of industry and education and close school-enterprise cooperation has effectively increased the employment rate of its colleges. As of December 31, 2023, the average employment rate of the company's higher education course graduates was about 93.52%, reflecting the remarkable results of the Group's employment guidance courses in promoting student employment.

epilogue

Finally, focusing on the valuation level, many brokerage firms agree that the current education policy has basically bottomed out, and that vocational education and higher education are clear investment directions.

As China Chunlai was officially included in the Hong Kong Stock Exchange Standard for the Shanghai and Shenzhen markets in March of this year, and in addition to expectations of recent improvements in Hong Kong stock liquidity, it is expected that the valuation level of China Spring will rise significantly.

Currently, China's Chunlai valuation is significantly lower than mainland education stocks, and it is extremely cost-effective.

Source: WIND

Looking forward to the future, under the policy trend, with the continuous expansion and upgrading of mainland colleges and the further expansion of the overseas education landscape since spring in China, future growth momentum can still be expected, and the company's in-depth exploration of AI education and the integration of industry and education will continue to protect the company's high-quality development.

As a leader in private higher education in central China, China's fundamental performance has continued to be excellent since spring, and new growth momentum is expected, and valuations are more cost-effective than those in the mainland. It is a reliable investment choice for investors seeking value investments.