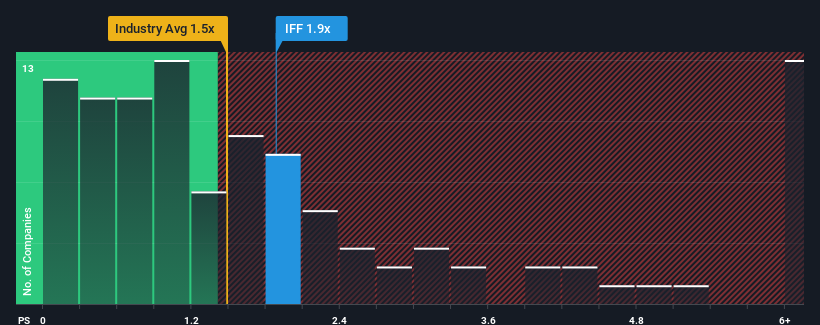

With a median price-to-sales (or "P/S") ratio of close to 1.5x in the Chemicals industry in the United States, you could be forgiven for feeling indifferent about International Flavors & Fragrances Inc.'s (NYSE:IFF) P/S ratio of 1.9x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

What Does International Flavors & Fragrances' P/S Mean For Shareholders?

International Flavors & Fragrances has been struggling lately as its revenue has declined faster than most other companies. One possibility is that the P/S is moderate because investors think the company's revenue trend will eventually fall in line with most others in the industry. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think International Flavors & Fragrances' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For International Flavors & Fragrances?

There's an inherent assumption that a company should be matching the industry for P/S ratios like International Flavors & Fragrances' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 7.7%. Even so, admirably revenue has lifted 126% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth is heading into negative territory, declining 0.07% per annum over the next three years. Meanwhile, the broader industry is forecast to expand by 8.2% per annum, which paints a poor picture.

With this information, we find it concerning that International Flavors & Fragrances is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It appears that International Flavors & Fragrances currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

There are also other vital risk factors to consider and we've discovered 2 warning signs for International Flavors & Fragrances (1 shouldn't be ignored!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on International Flavors & Fragrances, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.