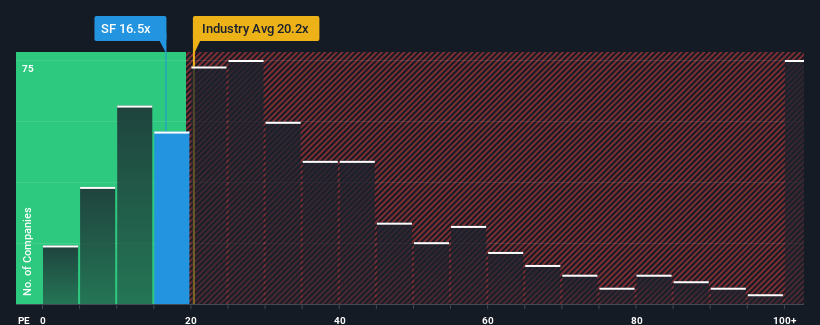

There wouldn't be many who think Stifel Financial Corp.'s (NYSE:SF) price-to-earnings (or "P/E") ratio of 16.5x is worth a mention when the median P/E in the United States is similar at about 17x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Stifel Financial has been struggling lately as its earnings have declined faster than most other companies. It might be that many expect the dismal earnings performance to revert back to market averages soon, which has kept the P/E from falling. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

How Is Stifel Financial's Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Stifel Financial's to be considered reasonable.

Retrospectively, the last year delivered a frustrating 17% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 8.9% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 18% each year during the coming three years according to the six analysts following the company. That's shaping up to be materially higher than the 11% each year growth forecast for the broader market.

In light of this, it's curious that Stifel Financial's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Stifel Financial's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Stifel Financial's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 2 warning signs we've spotted with Stifel Financial.

If you're unsure about the strength of Stifel Financial's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.