Focus on the latest fund information

1.The latest news from well-known fund managers

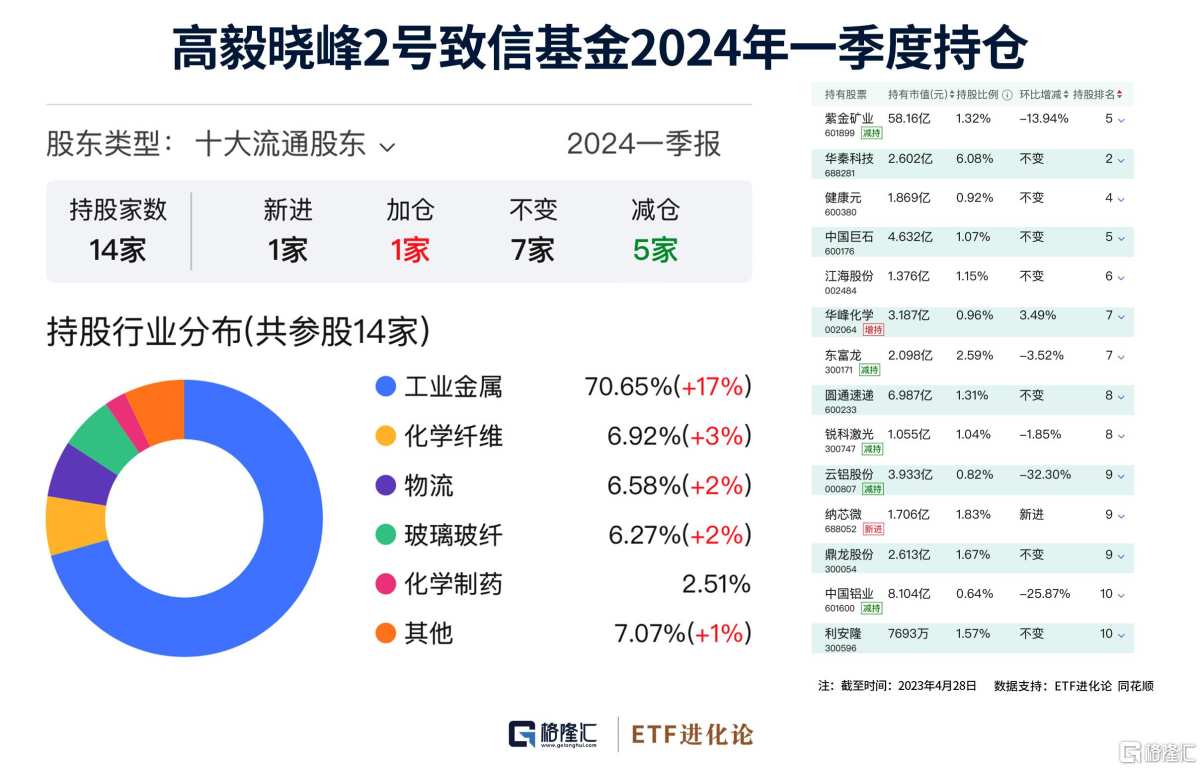

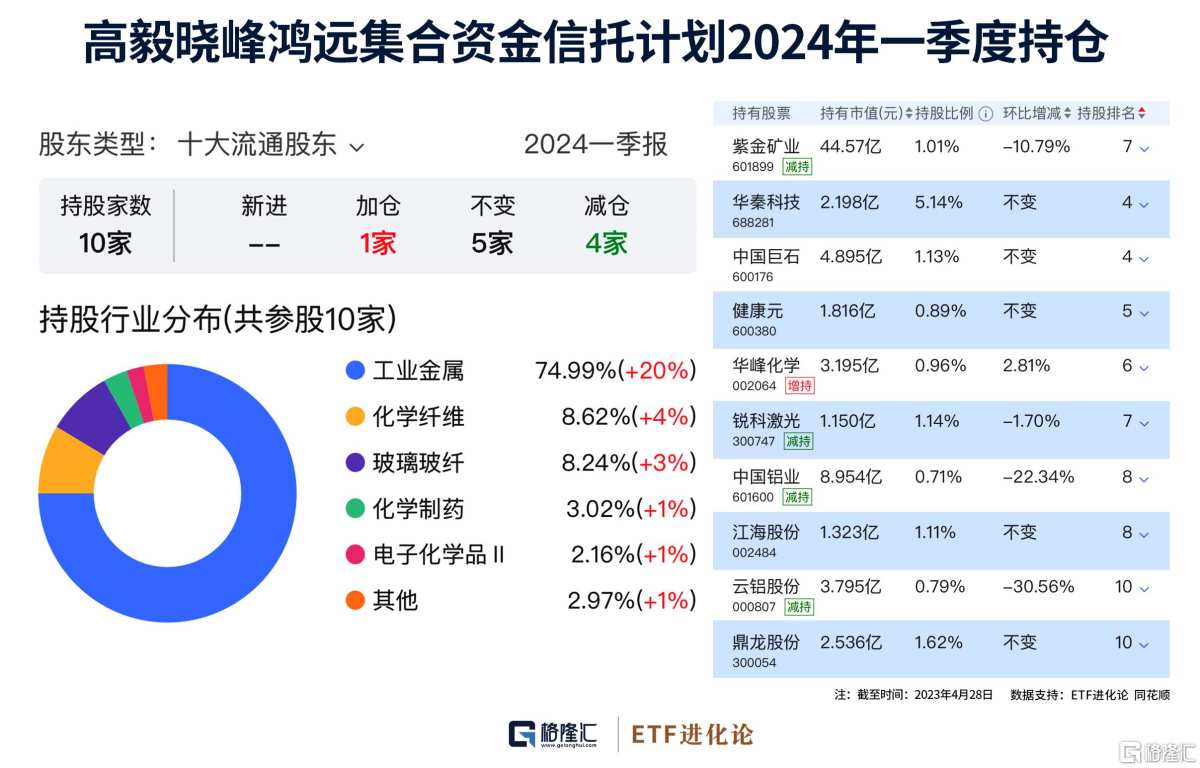

Deng Xiaofeng: Drastic reduction in Zijin Mining holdings, new entry into Xinmicro

Gao Yi Xiaofeng's 2nd Letter Fund and Gao Yi Xiaofeng Hongyuan Pooled Fund Trust Plan, managed by Deng Xiaofeng, reduced their holdings of Zijin Mining by 56 million shares and 320,565 million shares respectively, with a total reduction of more than 88 million shares. The two products still hold 610 million shares of Zijin Mining, and the market value of their holdings at the end of the first quarter still exceeds 10 billion yuan. The two products managed by Deng Xiaofeng also reduced the holdings of China Aluminum by 73.013,800 shares and Yunlu shares by 25.5998 million shares, respectively.

In the first quarter, Deng Xiaofeng became interested in the semiconductor theme. He bought 1.699 million new shares of Naxin, and the market value of his holdings at the end of the period was 171 million yuan.

Feng Liu: Reduced positions at Hikvision and added Ruifeng New Materials

Feng Liu was moderate in reducing his holdings of “Love Stock” Hikvision. Gao Yi Linshan No. 1 Yuanwang Fund, which he heads, reduced its position by 16 million shares in the first quarter. The latest holdings reached 411 million shares, with a total market value of over 13 billion yuan at the end of the period. Furthermore, Feng Liu reduced his holdings of Baofeng Energy by 40 million shares and Zhongju Hi-Tech by 21 million shares in the first quarter.

In terms of purchases, Feng Liu added 10.03 million shares of Ruifeng New Materials in the first quarter, and also made small increases in positions with Longbai Group, Kanghua Biotech, Dongcheng Pharmaceutical, and Angel Yeast.

II. Today's Fund News Fast Facts

Heavy resource stocks and some active equity funds rose more than 20%

Most of the active equity funds with the highest returns during the year have held upstream resource stocks in the past two years, and some urgently switched to the resource cycle theme in the first quarter. The Invesco Great Wall Cycle Preferred, managed by Zou Lihu, ranked first, with a yield of 30.02% during the year. The Invesco Great Wall Cycle Preferred Quarterly Report shows heavy stocks of ferrous and coal.

Wanjia Twin Engine, managed by Wanjia Fund, rose 29.13% this year, ranking second among active equity funds. According to Wanjia Dual Engine's quarterly report, half of the top ten major stocks are non-ferrous stocks, including Zijin Mining and Shandong Gold. They also have heavy holdings in petroleum, oil transportation, and coal stocks.

Second fund raising failure in the year

On April 27, the Agricultural Bank Huili Fund announced that its agricultural bank Huili MSCI China A-share climate change index fund failed to raise funds. The fund tracking index was released by MSCI in August 2020. Since then, Huabao Fund and Agricultural Bank Huili Fund submitted relevant product issuance data in 2021 to be accepted. Currently, only the Agricultural Bank Huili MSCI China A-share Climate Change Index Fund has been issued, and fundraising has failed.

Bullish debt came to a standstill, and the debt base declined significantly

On April 26, treasury bond futures continued to decline. By the close of the day, the main 30-year treasury bond futures contract fell 0.46%, the main 10-year treasury bond futures contract fell 0.26%, the main 5-year treasury bond futures contract fell 0.22%, and the main 2-year treasury bond futures contract fell 0.12%. The data shows that on April 25, the daily net worth of more than 2,000 debt bases retracted, and even many debt bases fell by more than 0.3%. On April 26, the net worth of only 1,300 debt bases increased on the same day, less than one-third of the total.

Prosperous short- and medium-term bonds surged 129 times

Driven by debt bulls, pure debt products, represented by short- and medium-term debt funds, were popular among investors and attracted a lot of money in the first quarter. According to Wind data, out of all short- and medium-term debt funds that have published a quarterly report, 28 funds doubled in size in the first quarter. Huitianfu Wealth Short Term Debt, a mini fund that was once on the verge of liquidation, had a size of only 0.61 billion yuan at the end of last year, but by the end of the first quarter of this year, the size of the fund had skyrocketed to 7.994 billion yuan, drawing about 7.932 billion yuan in a single quarter, an increase of 12900%.

Public funding actively lays out green bond funds

According to public information, on April 3, Morgan Asset Management reported the Morgan Common Classification Green Bond Fund. Immediately after that, Baoying Fund submitted the application materials for the Baoying Green Inclusive Finance Bond Fund on April 8. Penghua Fund also took action and reported to Penghua Green Bond Fund on April 15. All three funds are active products. Among them, the Morgan Common Classification Green Bond Fund was accepted on April 10.

Fund companies centrally declared a number of green bond index funds in the second half of last year. On July 10 of last year, three companies, Bosch, Oriental, and Manulife, respectively reported the China Bond Green Inclusion Themed Financial Bond Preferred Index Fund. In August, Harvest declared a bond fund that tracks the same index. In September, Guohai Franklin Fund also reported a CCC Green Inclusion Themed Financial Bond Preferred Index Fund. The industry said that issuing green investment products is in line with the basic national policy on clean energy and has long-term economic benefits.

Two major private equity fundsvoluminousReduced holdings in Kweichow Moutai

Recently, Kweichow Moutai released a quarterly report announcing the top ten shareholders. Ruifeng Huibang and Jinhui Rongsheng both withdrew from the top ten tradable shareholders. Meanwhile, Ruifeng Huibang and Jinhui Rongsheng once attracted investors' attention by holding more than 10 billion dollars in Kweichow Moutai in a single product. Both major private equity firms have held Kweichow Moutai for more than 4 years.

Based on the estimated number of shares held by the tenth largest tradable shareholder of Kweichow Moutai, Jinhui Rongsheng and Ruifeng Huibang reduced their holdings of Kweichow Moutai by at least 3,212,400 shares and 2.040,900 shares in the first quarter, not even ruling out the possibility of clearing the inventory. During the fourth quarter of last year, Jinhui Rongsheng and Ruifeng Huibang have reduced their holdings by 1,114,300 shares and 2.182,100 shares respectively.

III. Recent developments in fund products