Guangzhou LBP Medicine Science & Technology's (SHSE:688393) Shareholders Have More To Worry About Than Only Soft Earnings

Guangzhou LBP Medicine Science & Technology's (SHSE:688393) Shareholders Have More To Worry About Than Only Soft Earnings

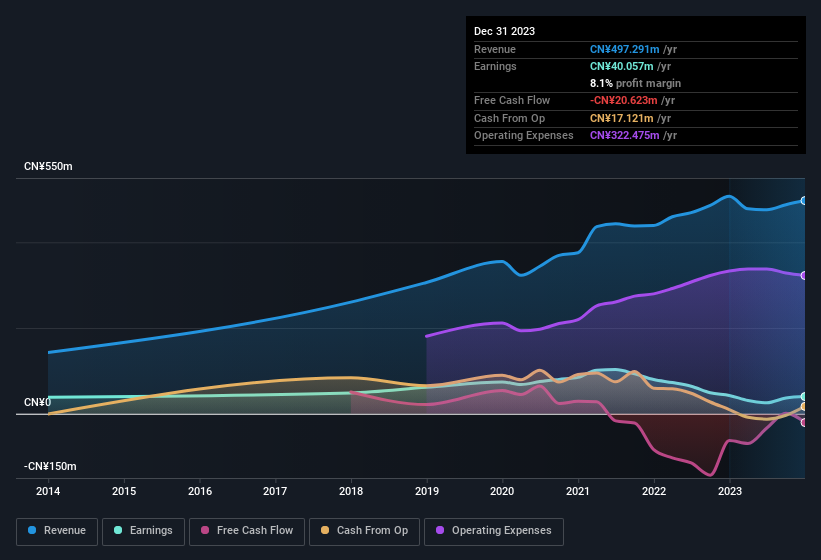

The market rallied behind Guangzhou LBP Medicine Science & Technology Co., Ltd.'s (SHSE:688393) stock, leading do a rise in the share price after its recent weak earnings report. We think that shareholders might be missing some concerning factors that our analysis found.

An Unusual Tax Situation

Guangzhou LBP Medicine Science & Technology reported a tax benefit of CN¥4.2m, which is well worth noting. This is meaningful because companies usually pay tax rather than receive tax benefits. Of course, prima facie it's great to receive a tax benefit. However, our data indicates that tax benefits can temporarily boost statutory profit in the year it is booked, but subsequently profit may fall back. In the likely event the tax benefit is not repeated, we'd expect to see its statutory profit levels drop, at least in the absence of strong growth.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Guangzhou LBP Medicine Science & Technology.

Our Take On Guangzhou LBP Medicine Science & Technology's Profit Performance

Guangzhou LBP Medicine Science & Technology reported that it received a tax benefit, rather than paid tax, in its last report. Given that sort of benefit is not recurring, a focus on the statutory profit might make the company seem better than it really is. Therefore, it seems possible to us that Guangzhou LBP Medicine Science & Technology's true underlying earnings power is actually less than its statutory profit. Sadly, its EPS was down over the last twelve months. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. For instance, we've identified 3 warning signs for Guangzhou LBP Medicine Science & Technology (1 is potentially serious) you should be familiar with.

This note has only looked at a single factor that sheds light on the nature of Guangzhou LBP Medicine Science & Technology's profit. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.