Hong Kong stocks soared and fell

Today, Hong Kong and A-share markets continued to rise, while treasury bond yields continued to decline.

According to the analysis, various cities have closely introduced real estate relaxation policies, and support policies for the trade-in of automobiles and home appliances have been implemented one after another, and the economy is basically oriented towards good development.

On the other hand, foreign investment banks have recently taken the lead in China, increasing their holdings of Hong Kong, A, and China securities.

Furthermore, the yen exchange rate once fell below 160 in early trading and has now rebounded to around 156. The market doubts that the Japanese government has interfered with the exchange rate.

Kitakami continues to increase its A-share positions

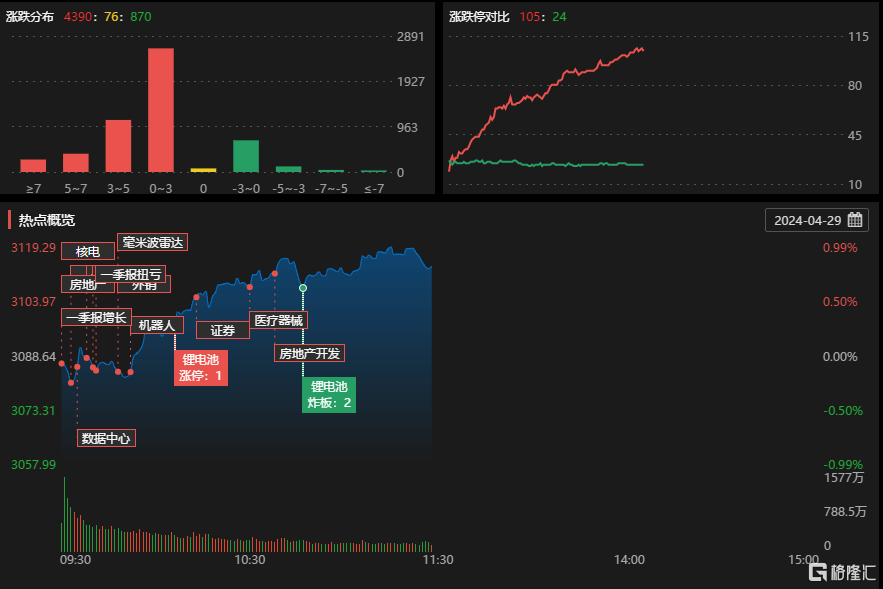

As of press release, the Shanghai Index had risen more than 0.9%, returning to the previous year's level at 3,100 points. The GEM Index had pulled up more than 3.55%, and the Shenzhen Index had risen more than 2.22%.

More than 4,300 stocks rose in the market, 870 stocks fell, 105 stocks rose or stopped, and 24 stocks fell.

On the market, sectors such as real estate, car dismantling, Sora concept, HJT batteries, and humanoid robots showed active performance, while precious metals, oil and gas bucked the trend.

The net purchase of A-shares by Beijing Capital surpassed 12.6 billion yuan. The net purchase of foreign capital was 22.4 billion yuan last Friday, setting a record.

The policy is expected to be further relaxedThere have been significant adjustments in the early stages. A total of 22 individual stocks in the real estate development sector have risen and stopped, while Huaxia Happiness, Rongsheng Development, Dalong Real Estate, Vanke, Jindi Group, and Tianbao Infrastructure have risen and stopped.

The car dismantling concept had the highest increase. DeZhong Auto rose more than 16%, surpassed technology by more than 11%, and Huahong Technology, Tianqi shares, and Grimmie rose and stopped. Last Friday,Car trade-in policy rules released, make specific implementation of the sources of subsidy funds, etc.

Hong Kong stocks soared and fell

After rising in the previous few trading days, Hong Kong stocks showed signs of surging and falling today.

At one point, the Hang Seng Index rose 1.6% to nearly 18,000 points, rebounding 20% cumulatively from its January low and entering a technical bull market.

The Hang Seng Technology Index once rose more than 2%; now it is up 0.25%, and the National Index is up 0.32%.

On the market, online healthcare, domestic housing stocks, domestic insurance stocks, gaming stocks, etc. collectively surged, while gold, non-ferrous metals, oil and gas declined.

In terms of technology stocks, NetEase rose more than 2%, while JD rose nearly 2%.

Baidu rose 7% to HK$108. Tesla is reported to be collaborating with Baidu on maps and navigation functions in China.

Xuhui Holding Group once surged 25%. The company announced that it had reached an agreement in principle with the bondholders' group on a comprehensive solution to the overseas liquidity situation.

Regarding the surge in the market, Union Bancaire Prive Managing Director Vey—Sern Ling said:”Some positive factors have already emerged. The macroeconomic situation improved in the first quarter. So far, corporate profits have been steady, the stock market has received government support, and relations with the US have improved slightly. The volume is very high. If the rise continues and more capital enters the market for fear of missing out on the rise, the upward trend is likely to continue.”

The CICC Research Report also analyzed that after experiencing a recent sharp rise, Hong Kong stocks may have been overbought in the short term. Rotating capital is still cooperating with external pressure in the short term, and improving fundamentals still requires policy efforts.

1) At the transaction level, the current level of overbuying has reached a new high since January 23, and the share of short sales has declined rapidly. The Hang Seng Index around 18,000 is also a key resistance level and is emotionally overdrawn.

3) Fundamentally, the reallocation of long-term capital requires fundamental improvements and coordination. In particular, fiscal policies are strengthened to deal with the current problems of declining inflation and credit contraction.

2) In terms of capital rotation, if capital is rotated to the Hong Kong stock market to temporarily avoid overseas risks, momentum will also decline after external pressure is released. In the short term, it may take some time for external environmental pressure to ease.

In terms of allocation, without significant improvements in fundamentals, the market may have formed a clear seesaw between high dividends and technological growth. Balanced allocation is an effective strategy.

Treasury bond yields continue to decline

Meanwhile, treasury bond futures closed down in early trading. The 30-year main contract fell 1.19%, the 10-year main contract fell 0.61%, the 5-year main contract fell 0.45%, and the 2-year main contract fell 0.2%.

In response, Goldman Sachs Group expectsTreasury yields will remain relatively low for a longer period of time.

Goldman Sachs analyst Chen Xinquan and others said, “With the issuance of ultra-long-term special treasury bonds and the further recovery of economic growth, the central bank may guide bond yields to gradually increase, but it is still unlikely that the policy stance will shift to an austerity model.”

They said, “In the long run, we expect interest rates to remain low given the weak demand for credit due to the long-term downturn in real estate and the fact that addressing local government debt risks may take years.”

Jason Pang, investment manager at J.P. Morgan Chase, said, “Given the extent of US Treasury adjustments, it is becoming less and less attractive to further increase positions on Chinese government bonds. We are considering reallocating capital to US Treasury bonds or other Asian bond markets.”